Will there ever be another correction?

An absurd question to be sure, but one I’m fielding with increasing frequency these days.

Why?

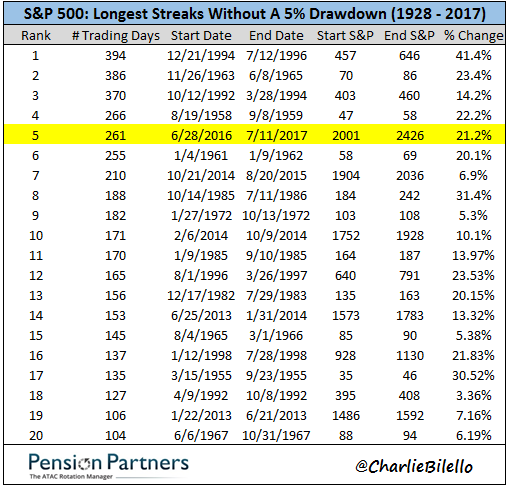

It’s been more than a year since the S&P 500 declined as much as 5% from a prior high. That’s quite a long time, now the 5th longest period without a correction in history. With recency bias in hand, investors are starting to forget that corrections are a normal occurrence in markets.

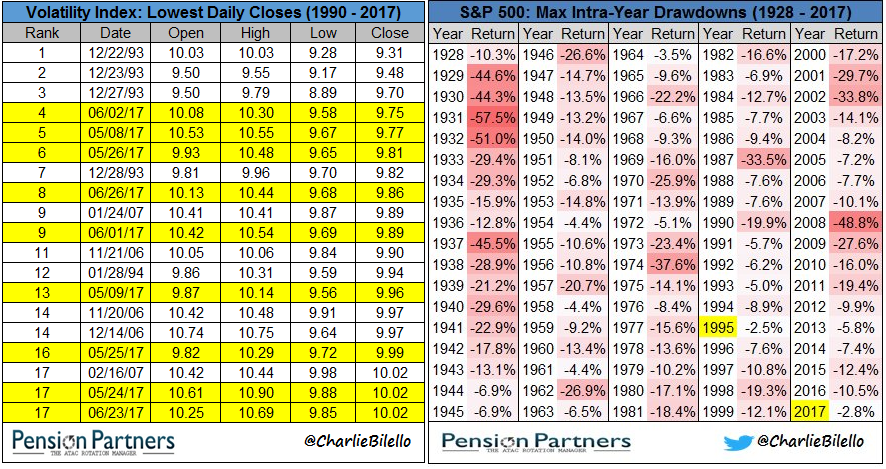

We haven’t seen such a prolonged stretch of calm in U.S. equities in over 20 years. One could argue that 2017 thus far has been the most peaceful market in history, as measured by record-low volatility and unfathomably low drawdowns.

So will there ever be another correction?

I think it’s a safe bet that there will be, unless the laws of risk and return have been repealed. We just don’t know when, we don’t know why, and we don’t know how deep it will be.

That uncertainty can drive one crazy, but it is that uncertainty which is necessary for the risk premium to exist. For without the prospect of risk in equities there would be no reward. It is not another correction that we should fear, then, but instead the widespread belief that there may never be another one.

Leave A Comment