So many things to talk about today.

None of it really matters as it’s the last day of the month and windows have to be dressed and already yesterday’s losses are more than reversed with 1% pre-market (low-volume) gains that are taking us back to our weak bounce lines, which remain:

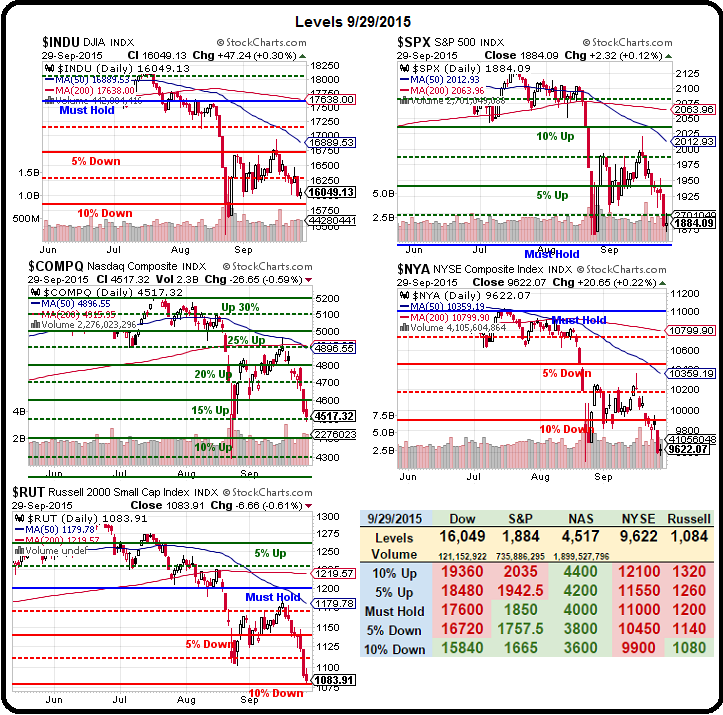

Click on picture to enlarge

All red is, obviously, not a good sign but we’ll be bouncing up to test some of the weak bounces again so we’ll reserve judgment until we see what sticks. I already warned our Members not to try to jump in bullish as it’s not likely we go much higher than 1.25% and I think we’ll be rejected around there (16,200, 1,900, 4,125 (on the 100), 10,100 and 1,090). Those are the bounce levels our 5% Rule™ tells us to expect intra-day. In the bigger picture, the S&P looks like this:

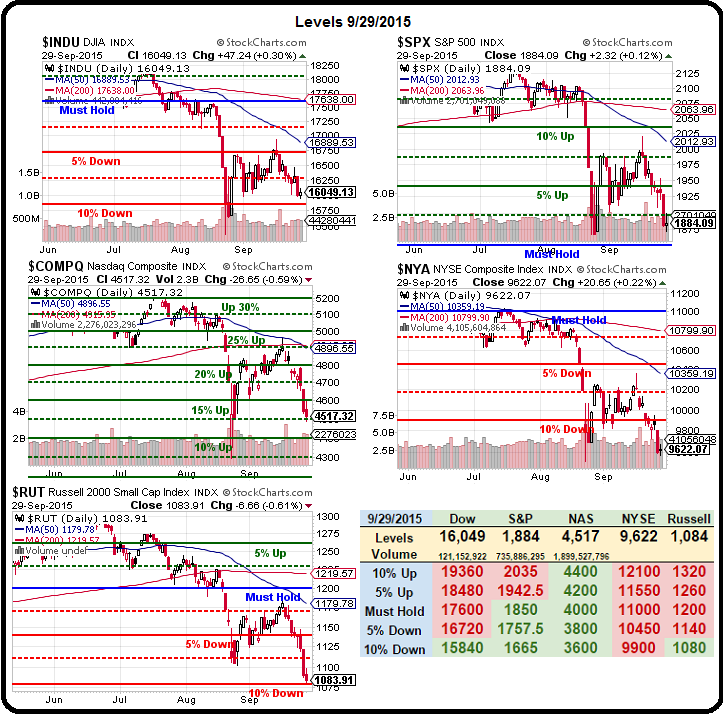

Click on picture to enlarge

I did a full 2-part rundown on the S&P back on August 13th, so I won’t rehash it here but I will reprint my closing statement from that very thorough evaluations post:

So, upon further examination, there is no change to our stance of being short the markets at these levels which, on the Futures this morning, are 17,400 on the Dow (/YM), 2,095 on the S&P (/ES), 4,550 on the Nasdaq (/NQ) and 1,212.50 on the Russell (/TF) and, as usual, we look to short the laggard of the set with tight stops above. We also took on a more aggressive SDS (ultra-short S&P) position yesterday afternoon – as we felt the run-up was nonsense anyway – this post just confirms our gut reaction.

As noted on Monday, our Futures shorts made over $40,000 by that day and well over $50,000 by Monday’s close, when we flipped a bit more bullish expecting the bounce we have right now(into the end of the month). Unfortunately, it’s too dangerous to flip around and go short again this morning because Yellen is speaking at 2pm but we’ll be very happy to short a run-up into the close spurred by nothing more than more Fed BS.

Leave A Comment