Ignoring the surge in junk bond risk and collapse of the yield curve, stock investors were overheard saying…

Video length: 00:00:02

Gold remains the post-Saudi-purge winner…

Stocks rebounded today. The Dow has now been up 7 days in a row thanks to today’s last second ramp…

But despite small caps bounce, they remain red on the week… as Dow, S&P, and Nasdaq scramble green

VIX was once again driven back below 10 to ensure a green close for The Dow etc…

The Media complex was busy today with rumors and headlines surrounding the AT&T, Time-Warner deal and the removal of CNN…

FANG Futures began trading today and FANG stocks ended lower but dip-buyers were evident…

Credit Markets continue to collapse… HYG at 3 month lows…

HYG (the high yield bond ETF) has seen outflows for 8 of the last 10 days)

With stocks and bonds notably divergent…

Notably the last few days have seen both bonds and stocks bid (just as both were sold in late Oct)

Treasury yields rose modestly today…

The Treasury yield curve continues to flatten. 5s30s is now down 10 days in a row – the longest flattening streak since March 2011 and Dec 2005 – if it goes 11 days that will be an all-time record.

And even banks are now starting to pay attention…

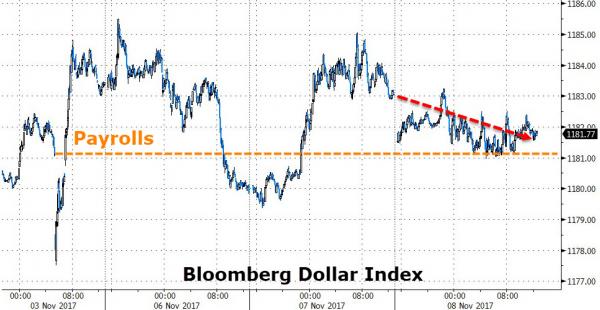

The Dollar Index drifted lower again, hovering at pre-payrolls levels…

Chaos in crude markets today as the DOE data sparked WTI selling, RBOB buying but then the machines took over and pumped’n’dumped it…

Gold and Silver managed to hold onto gains after selling off non-stop once Europe closed…

Leave A Comment