No stock has been hotter in this artificial intelligence (AI) cycle than Nvidia (NVDA), which recently eclipsed a market capitalization of $2 trillion.Whether it can continue at this pace is a much more difficult question. We scoured a universe of thematic equity exchange-traded funds (ETFs) listed in the U.S. market and found a number with more than 10% exposure to this single name.1If you’re evaluating these ETFs, which tend to be theme-based, there may be some options for exposure to those themes with more diversification. Three Strategies with Weight of 10% or More in NvidiaWe found three strategies with greater than 10% weight to Nvidia as of March 1, 2024:

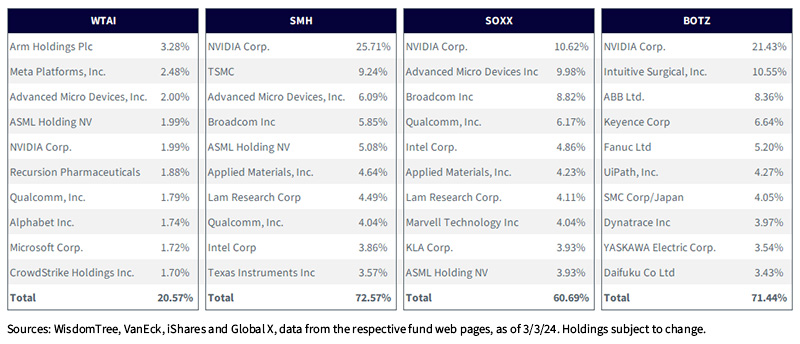

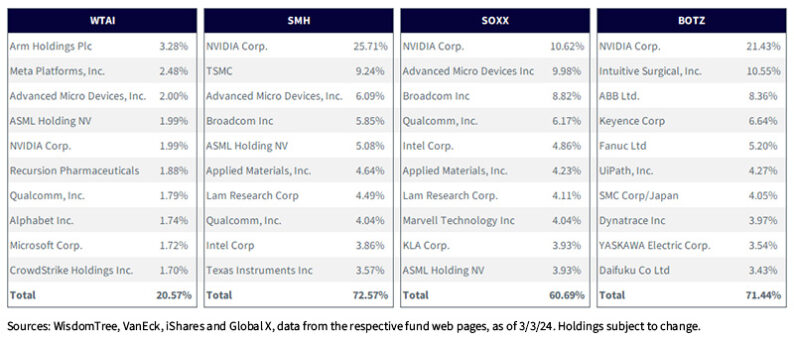

We compare these strategies—associated with AI as a catalyst—to the WisdomTree Artificial Intelligence and Innovation Fund (WTAI). WisdomTree Artificial Intelligence and Innovation Fund (WTAI) is tracking an index designed to consider a more full-ecosystem exposure to AI as opposed to concentrating on a specific area. Sometimes the market’s performance will favor concentrating on a particular position, like Nvidia, and sometimes it favors diversifying more broadly.Figure 1 provides, by showing the top 10 positions in each fund, a sense of the concentration in the single Nvidia position as well as within the overall top 10.A higher figure indicates that more of the overall strategy performance is being driven by the names seen in this figure as opposed to the rest of the strategy’s holdings. Figure 1: Comparison of Top 10 Holdings  Quantifying the Performance WaveNvidia’s share price after the launch of ChatGPT in November 2022 has been historic. Investors that we speak to are often nervous because they are simply not sure how long it can continue, particularly if they are initiating positions at present in 2024. We all recognize that a stock with a $2 trillion market capitalization can drop by 25% and still be worth $1.5 trillion—a very big number.WisdomTree Artificial Intelligence and Innovation Fund (WTAI), SMH, SOXX and BOTZ all had different exposures to Nvidia in figure 1—figures 2a, b and c showcase differences in performance across these four strategies.

Quantifying the Performance WaveNvidia’s share price after the launch of ChatGPT in November 2022 has been historic. Investors that we speak to are often nervous because they are simply not sure how long it can continue, particularly if they are initiating positions at present in 2024. We all recognize that a stock with a $2 trillion market capitalization can drop by 25% and still be worth $1.5 trillion—a very big number.WisdomTree Artificial Intelligence and Innovation Fund (WTAI), SMH, SOXX and BOTZ all had different exposures to Nvidia in figure 1—figures 2a, b and c showcase differences in performance across these four strategies.

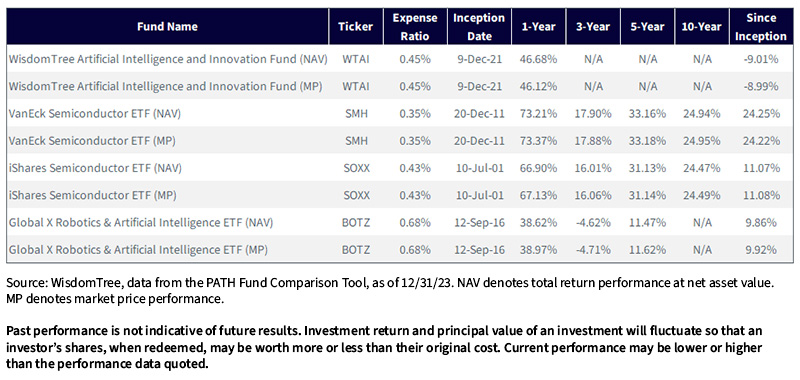

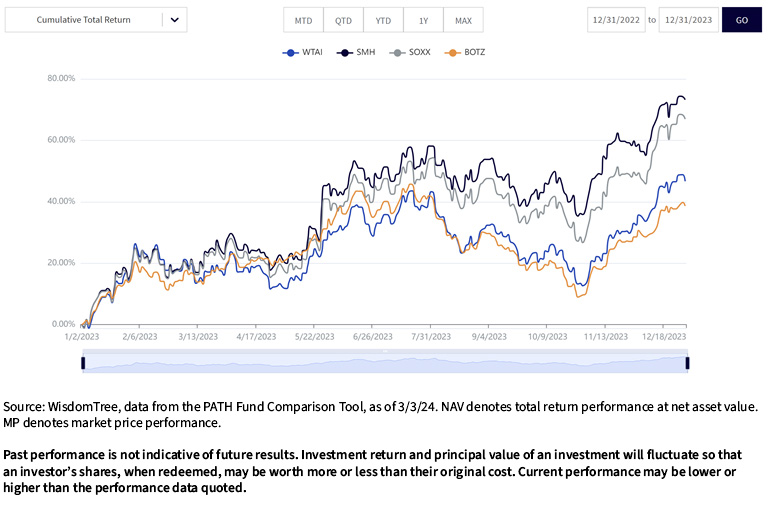

Figure 2a: Standardized Returns  For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WisdomTree Artificial Intelligence and Innovation Fund (WTAI), VanEck Semiconductor ETF (SMH), VanEck Semiconductor ETF (SMH) and VanEck Semiconductor ETF (SMH). Figure 2b: The 2023 Year (12/31/22–12/31/23)

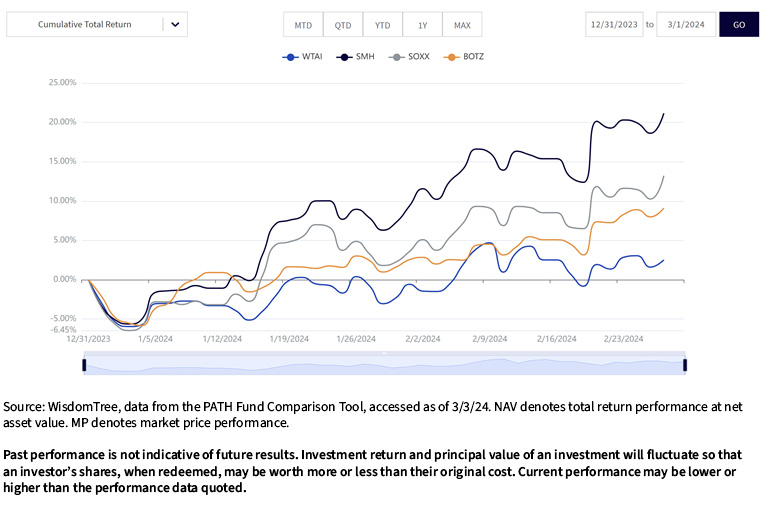

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WisdomTree Artificial Intelligence and Innovation Fund (WTAI), VanEck Semiconductor ETF (SMH), VanEck Semiconductor ETF (SMH) and VanEck Semiconductor ETF (SMH). Figure 2b: The 2023 Year (12/31/22–12/31/23)  For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WisdomTree Artificial Intelligence and Innovation Fund (WTAI), VanEck Semiconductor ETF (SMH), VanEck Semiconductor ETF (SMH) and VanEck Semiconductor ETF (SMH). Figure 2c: The First Two Months of 2024 (12/31/23–3/1/24)

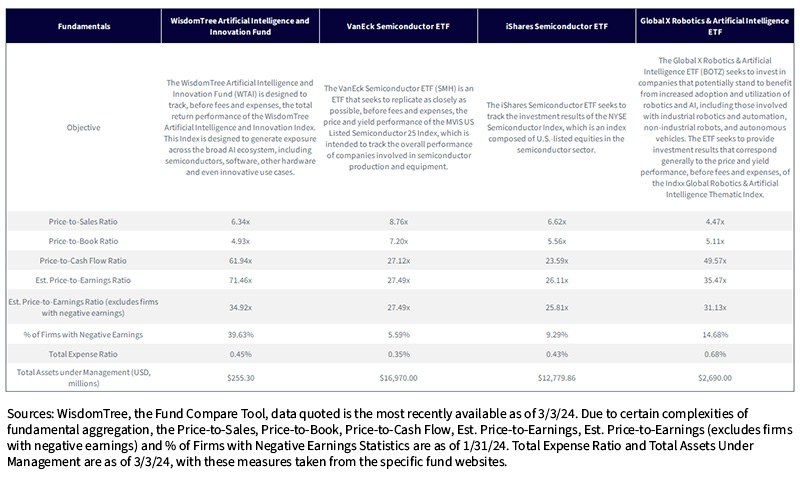

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WisdomTree Artificial Intelligence and Innovation Fund (WTAI), VanEck Semiconductor ETF (SMH), VanEck Semiconductor ETF (SMH) and VanEck Semiconductor ETF (SMH). Figure 2c: The First Two Months of 2024 (12/31/23–3/1/24)  For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WisdomTree Artificial Intelligence and Innovation Fund (WTAI), VanEck Semiconductor ETF (SMH), VanEck Semiconductor ETF (SMH) and VanEck Semiconductor ETF (SMH). Conclusion: $2 Trillion Is a Rather Big Number for a Firm’s Market CapitalizationWhile we can agree there is not necessarily an upper limit that defines how big any firm can be by way of market capitalization, execution takes time. Even if Nvidia’s revenues and profits march upwards, the share price incorporates a mix of those fundamentals alongside the hopes and dreams and aspirations of the broader crowd.Those aspirations and ultimately expectations can get ahead of reality, and it’s possible the share price will have to pause and let the execution and fundamentals catch up. The environment of the continual upward adjustments to the size of the AI accelerator chip market will eventually change, and the growth will eventually slow.We remind investors that AI, the theme, has been marching forward for decades, even if the combination of social media and smartphones put the headlines into the palms of our hands every minute of every day today, and the advent of processing power and cheap data storage allow for greater and greater breakthroughs.If you cannot predict where the hype might go next, we advocate a more holistic, broad ecosystem approach, like WisdomTree Artificial Intelligence and Innovation Fund (WTAI), such that there is a greater chance of capturing that next big AI topic.Figure 3: Important Further Information about the Funds Mentioned

For the most recent month-end and standardized performance and to download the respective Fund prospectuses, click the relevant ticker: WisdomTree Artificial Intelligence and Innovation Fund (WTAI), VanEck Semiconductor ETF (SMH), VanEck Semiconductor ETF (SMH) and VanEck Semiconductor ETF (SMH). Conclusion: $2 Trillion Is a Rather Big Number for a Firm’s Market CapitalizationWhile we can agree there is not necessarily an upper limit that defines how big any firm can be by way of market capitalization, execution takes time. Even if Nvidia’s revenues and profits march upwards, the share price incorporates a mix of those fundamentals alongside the hopes and dreams and aspirations of the broader crowd.Those aspirations and ultimately expectations can get ahead of reality, and it’s possible the share price will have to pause and let the execution and fundamentals catch up. The environment of the continual upward adjustments to the size of the AI accelerator chip market will eventually change, and the growth will eventually slow.We remind investors that AI, the theme, has been marching forward for decades, even if the combination of social media and smartphones put the headlines into the palms of our hands every minute of every day today, and the advent of processing power and cheap data storage allow for greater and greater breakthroughs.If you cannot predict where the hype might go next, we advocate a more holistic, broad ecosystem approach, like WisdomTree Artificial Intelligence and Innovation Fund (WTAI), such that there is a greater chance of capturing that next big AI topic.Figure 3: Important Further Information about the Funds Mentioned  If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.More By This Author:A Time-Tested Strategy: Laddered Treasury Solutions

If you are interested in diving more into the comparison of these Funds, please check out our Fund Comparison Tool.More By This Author:A Time-Tested Strategy: Laddered Treasury Solutions

Gold: Unique In Every Way

Magnificent Seven Earnings (Mostly) Impress

Leave A Comment