I often remind investors to look past the negative and find the positive. Last week provided no shortage of big splashy headline stories, from yet another high-profile personnel shakeup at the White House to a nail-biter special election in Pennsylvania’s 18th Congressional District, from Russia’s alleged nerve agent attack on a former double-agent spy to a tragic bridge collapse in Miami.

If this is all you were focused on, you might have missed what I believe was the most significant development of the past few days. Last Wednesday, the Senate, in a bipartisan vote, quietly approved plans to roll back key banking rules in 2010’s Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank).

If the House also approves the bill, President Donald Trump is expected to sign it into law, thereby providing much-needed relief to smaller lenders and community banks that millions of rural Americans and small businesses depend on. Aside from tax reform, I think the relaxation of Dodd-Frank will be seen as Trump’s crowning fiscal achievement so far, as it has the potential to contribute greatly toward his goal of at least 3 percent economic growth.

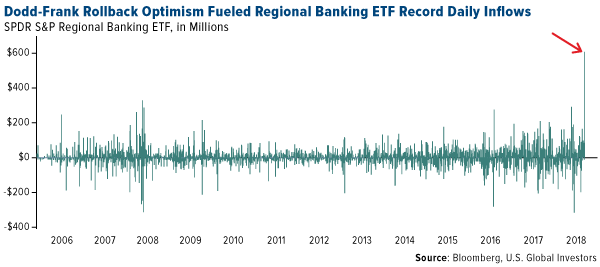

Investors piled into an ETF that holds small to midsize banks following the news last week. The SPDR S&P Regional Banking ETF (KRE) attracted $606 million in daily inflows, a record for the fund, according to Bloomberg.

The most sweeping and complex financial reform package since the Great Depression, Dodd-Frank was drafted in response to the financial crisis—yet few believe it would do much in the way of preventing another such crisis. Last year, the Treasury Department declared that the law, despite its ambitious scale and scope, has “failed to address many drivers of the financial crisis, while adding new regulatory burdens.” As such, the agency recommended a number of changes, including improving efficiency and decreasing unnecessary complexity.

Among the likely changes to Dodd-Frank: raising the threshold for tougher oversight from the current $50 billion in assets to $250 billion; exempting small banks from the so-called Volcker rule, which currently bars them from speculative trading; reducing the amount of financial reporting, particularly racial and income data on mortgage holders; lowering the frequency of regulatory exams; and easing the conditions of stress tests.

Leave A Comment