The utilities sector is well-known for housing conservative, high yield dividend investments.

Like many industries, it is most well-known for its largest constituents. Names like Southern Company (SO), Duke Energy (DUK), and Consolidated Edison (ED) are generally familiar names among dividend growth investors.

However, the utility industry also harbors many smaller, less familiar companies. Because they are less well-followed, they may create asset mispricings – or buying opportunities for opportunistic investors.

South Jersey Industries (SJI) could be an example of a smaller utility with investment appeal. With a market capitalization of $2.6 billion, it falls under the radar of many investors.

Despite its lack of media attention, South Jersey has a very long operating history and above-average dividend yield. By all measures, South Jersey is a blue chip stock.

The Blue Chip Stocks Excel Sheet contains pertinent investment information on companies in the Sure Dividend database with 100+ year operating histories and 3%+ dividend yields (including South Jersey Industries).

The majority of South Jersey’s business model is regulated in nature (reducing its risk), and the company’s 3.3% dividend yield has the potential to generate meaningful portfolio income. These factors combine to make South Jersey a potentially attractive opportunity for retired investors.

With that in mind, this article will analyze the investment prospects of South Jersey Industries in detail.

Business Overview

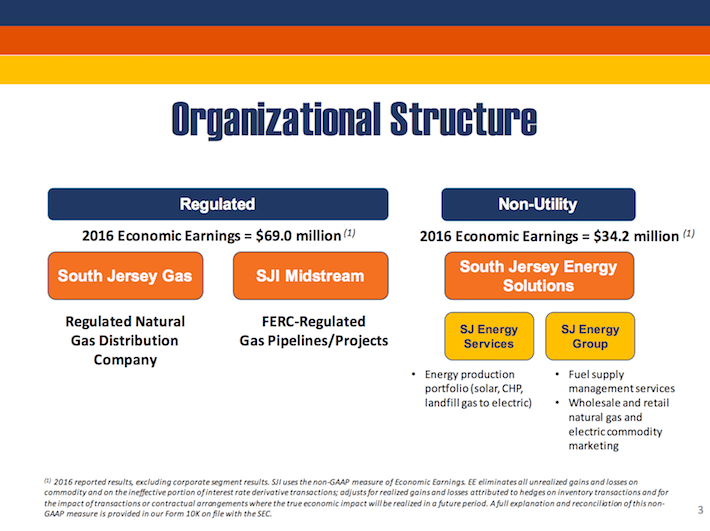

South Jersey Industries is a natural gas utility holding company that operates through three private subsidiaries:

*FERC denotes the Federal Energy Regulatory Commission.

In fiscal 2016, South Jersey’s regulated businesses generated $69 million of adjusted earnings while its non-regulated businesses generated $34.2 million of adjusted earnings.

A visual depiction of South Jersey Industries’ organizational structure can be seen below.

Source: South Jersey Industries Presentation At The 2017 American Gas Association Financial Forum, slide 3

South Jersey Gas, the holding company’s largest operating unit, distributes natural gas to approximately 377,000 customers in southern New Jersey. In aggregate, South Jersey Industries has a market capitalization of $2.6 billion.

Leave A Comment