Key bank earnings are scheduled for release this Friday which are likely to provide a better understanding of the sector’s prospects in the near future. Banking stocks were buoyed by their success in the recently conducted stress tests. Moreover, the Federal Reserve has allowed all sector heavyweights to go ahead with their capital spending plans.

But stocks from the industry have failed to replicate the gains they accrued in the immediate aftermath of the presidential elections. The absence of policy related stimulus means that they will have to rely on company specific factors in order to impress investors. In this context, key bank earnings scheduled for release over this week and the next, including The PNC Financial Services Group, Inc. (PNC – Free Report) and Wells Fargo & Company (WFC – Free Report) , assume greater significance.

With JPMorgan Chase & Co. (JPM – Free Report) and Citigroup (C – Free Report) scheduled to report on Jul 14, this may be a good time to consider which of these is a better stock. Both of them have a Zacks Rank #3 (Hold).

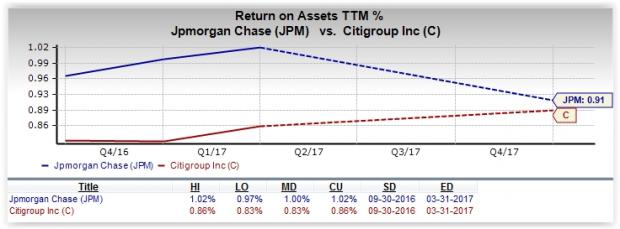

Return on Assets (ROA)

Currently, JPMorgan holds total assets of $2.49 trillion while Citigroup has total assets of $1.79 trillion. Our research shows that the average one year trailing 12-month ROA for JPMorgan stands at 1.02%, higher than 0.86% for Citigroup.

Price Performance

JPMorgan has gained 7.6% in the year to date period, outperforming the Zacks categorized Banks – Major Regional industry which has moved up 7.2%. In comparison, Citigroup has not only outperformed the broader industry but is also ahead of JPMorgan, gaining 12.4% over the same time frame.

Valuation

Compared with the S&P 500, the Banks – Major Regional industry is undervalued. This implies that the industry has the potential to gain in the near future. The industry has an average one year trailing 12-month P/B ratio – which is the best multiple for valuing banks because of large variations in their earnings results from one quarter to the next – of 1.56, which is below the S&P 500 average of 3.62. Hence, it might be a good idea not to stay away from stocks belonging to this industry.

Leave A Comment