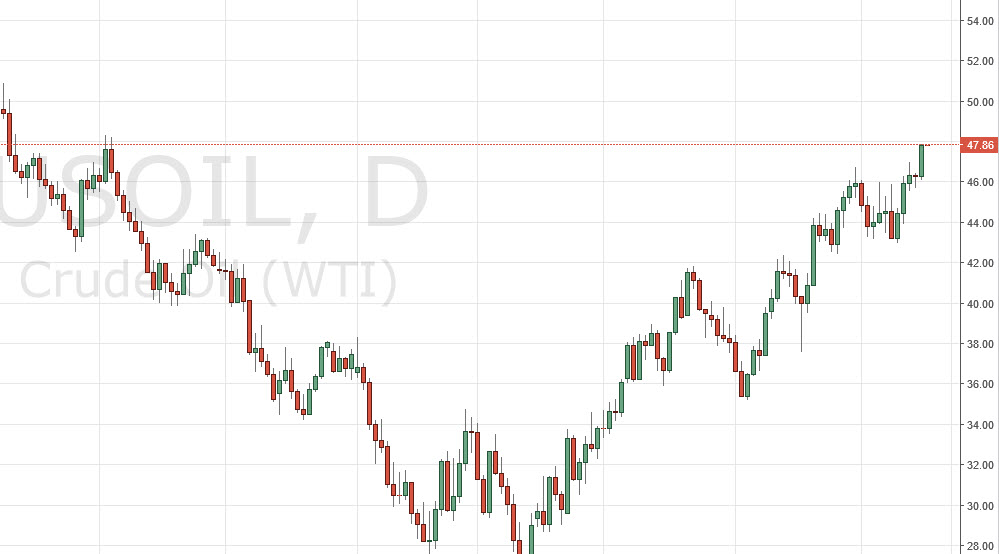

WTI Crude Oil

The WTI Crude Oil market rose during the course of the day on Monday, as we continue to see quite a bit of bullishness in this market. During the day, Goldman Sachs suggested that the excess supply is starting to dwindle, and if that’s the case it should continue to drive this market a bit higher. However, there is a lot of psychological importance when it comes to the $50 handle just above. It’s not until we get above there that it becomes a “buy-and-hold” market. In the meantime, short-term pullbacks could be buying opportunities for short-term trades only. After all, this is a market that’s been very volatile and has gone higher in a relatively short amount time. We could be running out of momentum as there is a lot of noise between here and the $50 handle, so expect very choppy trading conditions.

Natural Gas

Natural gas markets fell during the day on Monday, dropping down to just above the $2 level. There is a bit of an uptrend line just below, and it should continue to support the market. However, if we break down below the $2 handle, I feel at this point in time you can start selling natural gas again. Given enough time, I do expect this market to break down but we could get one last bounce. We have been rolling over lately, in the volatility has turned that this market into a sideways type of environment after a fairly strong bounce. Yes, drillers are starting to step away from the fields again, but it’s only a matter of time before they flood the market again.

If we do bounce from here, I would not expect this market to go above the $2.20 level which has been so resistive recently. I’m looking for a simple exhaustive candle in that general vicinity in order to start shorting again after the rally and will not buy into it.

Leave A Comment