WTI Crude Oil

The WTI Crude Oil market rose rather drastically during the day on Tuesday, breaking well above the $32 level. That’s a very bullish sign, but a lot of the movement would have been due to the fact that people are speculating that the Russians and the OPEC members are going to come to some type of an agreement as far as cutting production is concerned. Because of that, the market may be getting ahead of itself and we will simply wait to see whether or not we can break out to a fresh, new high. In the meantime, we believe that the market will more than likely find sellers above and turned the market back around to form a resistive candle. Ultimately, I do not have any real interest in going long at this point, because even though we had a very strong session, the reality is that the market is still very bearish.

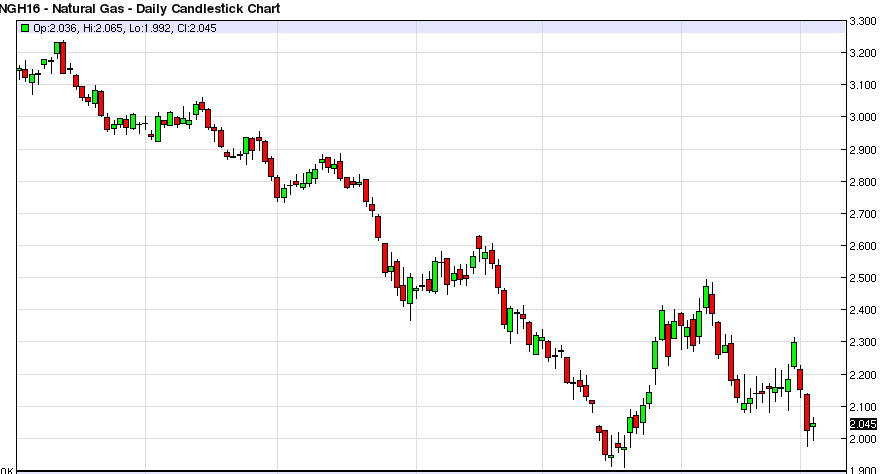

Natural Gas

The natural gas markets fell a bit during the course of the session on Wednesday, testing the $2.00 level. That area offered a bit of support though, so I believe that the market could bounce from here. However, that is a very short-term bounce waiting to happen, and I would simply look at that rally as an excuse to start selling at higher levels. I have no interest whatsoever in buying the natural gas markets as they are extraordinarily bearish.

Ultimately, it’s difficult to imagine that we will take care of all of the supply as there simply is not much in the way of demand. I think that every time this market rallies, you have to be thinking about selling as there is nowhere near enough interest in this market to the upside to continue rallies for any real length of time. I believe this market will eventually make fresh, new lows.

Leave A Comment