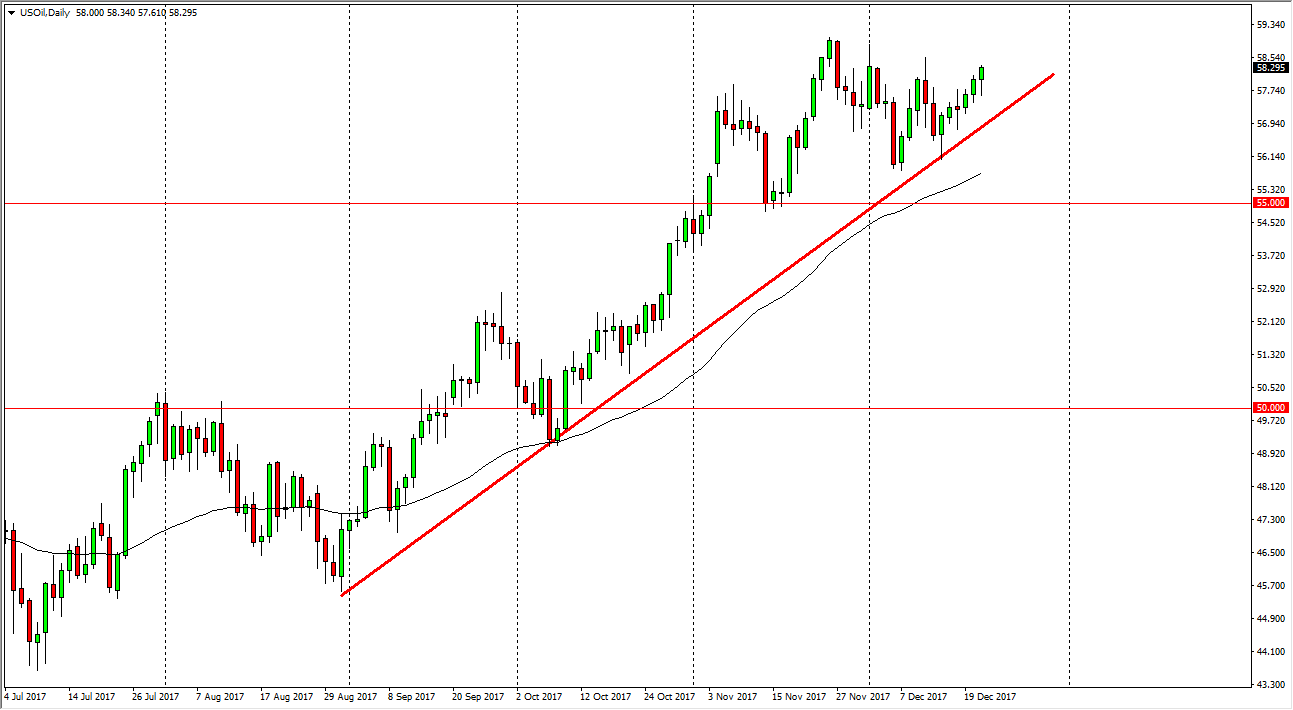

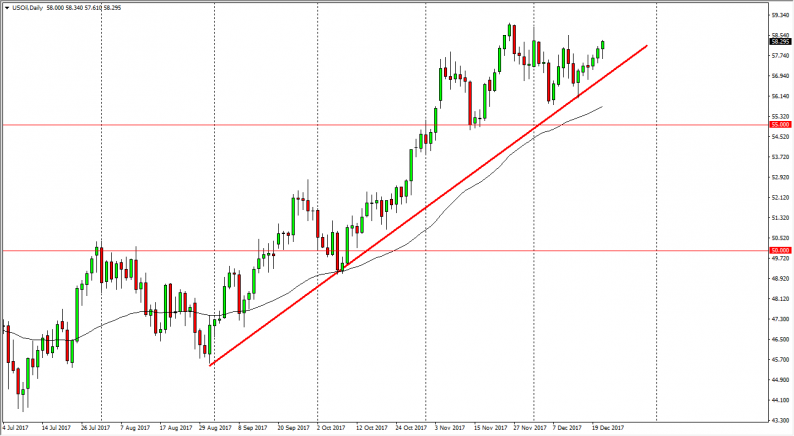

WTI Crude Oil

The WTI Crude Oil market initially fell on Thursday, but turned around to break out to the upside. Having said that, we are still very much in a larger consolidation area, and the uptrend line underneath has proven the point that the buyers are willing to come in and fight. I don’t think that we will be a break above the $59 level today though because quite frankly the volume will be there as traders had to the holidays. I think we will see more consolidation with an upward tilt, but beyond that, I don’t look too deep into this market.

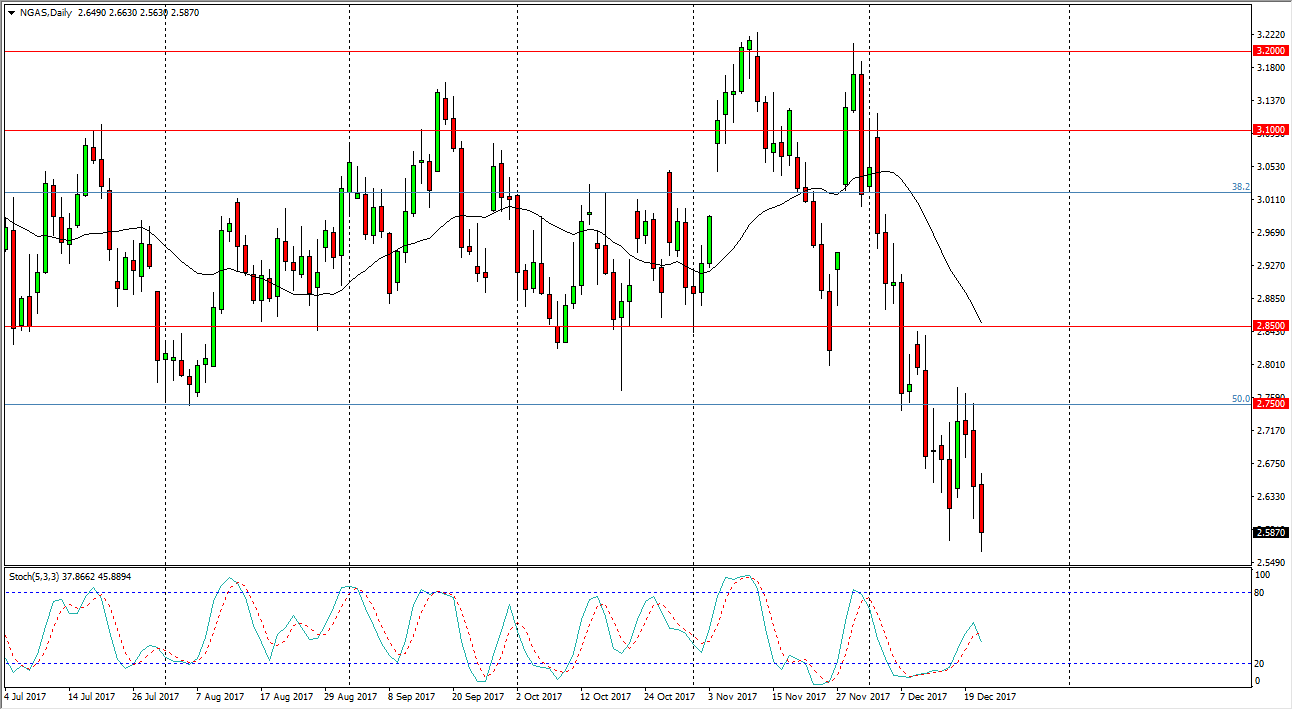

Natural Gas

Natural gas markets fell during the day, reaching towards the $2.55 level before bouncing. The market has a “hard floor” at the $2.50 level underneath. Some type rally from here could end up offering and I selling opportunity and I believe that the $2.75 level is resistance just waiting to happen. I like fading rallies in this market, but again, volume is going to be almost microscopic as we head towards Christmas on Monday. In general, I believe that the market is one that you should be shorting, but I wouldn’t do so at these low levels. Let the market bounce before you start selling yet again. This reminds me the gold market in the 1980s, a market that you simply sold every time it rallied as there was far too much in the way of bearish pressure. I mean, if we can keep gains during this time of year, when can we?

Leave A Comment