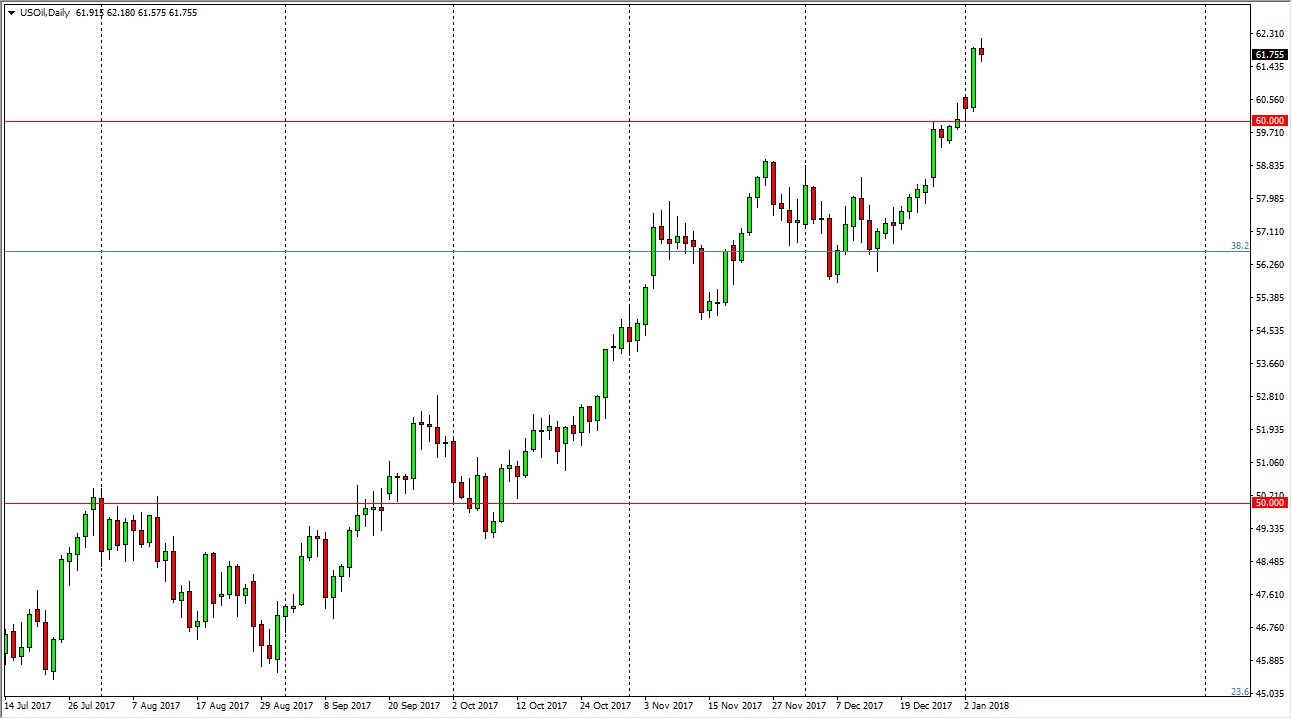

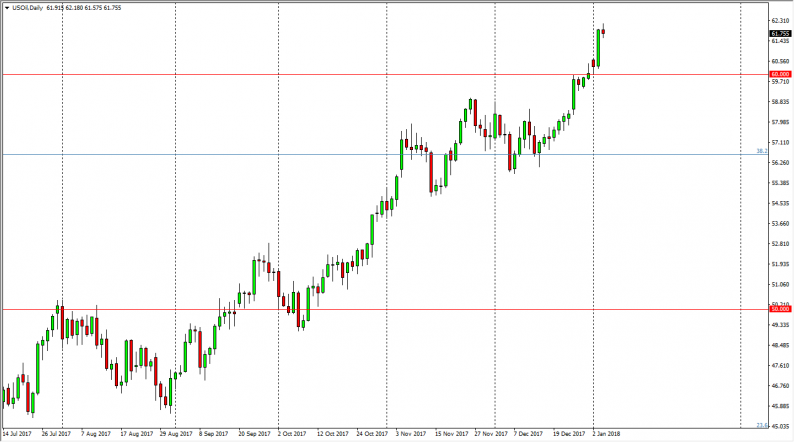

WTI Crude Oil

The WTI Crude Oil market initially pulled back during the trading session on Thursday, but turned around to form a hammer at the $62 handle. It looks likely that we are going to continue to go higher, but I recognize that there could be a bit of volatility today, due to the greenback reacting to the jobs number. I think the $60 level underneath continues to be the “floor” in the market, and it’s likely that we will continue to go much higher, perhaps reaching towards the $65 level. Ultimately, this is a market that I think continues to find a lot of support based upon not only the following US dollar but the political troubles in the Islamic Republic of Iran. As long as there is tension in the Middle East, there’s almost always somebody willing to put money into the oil market.

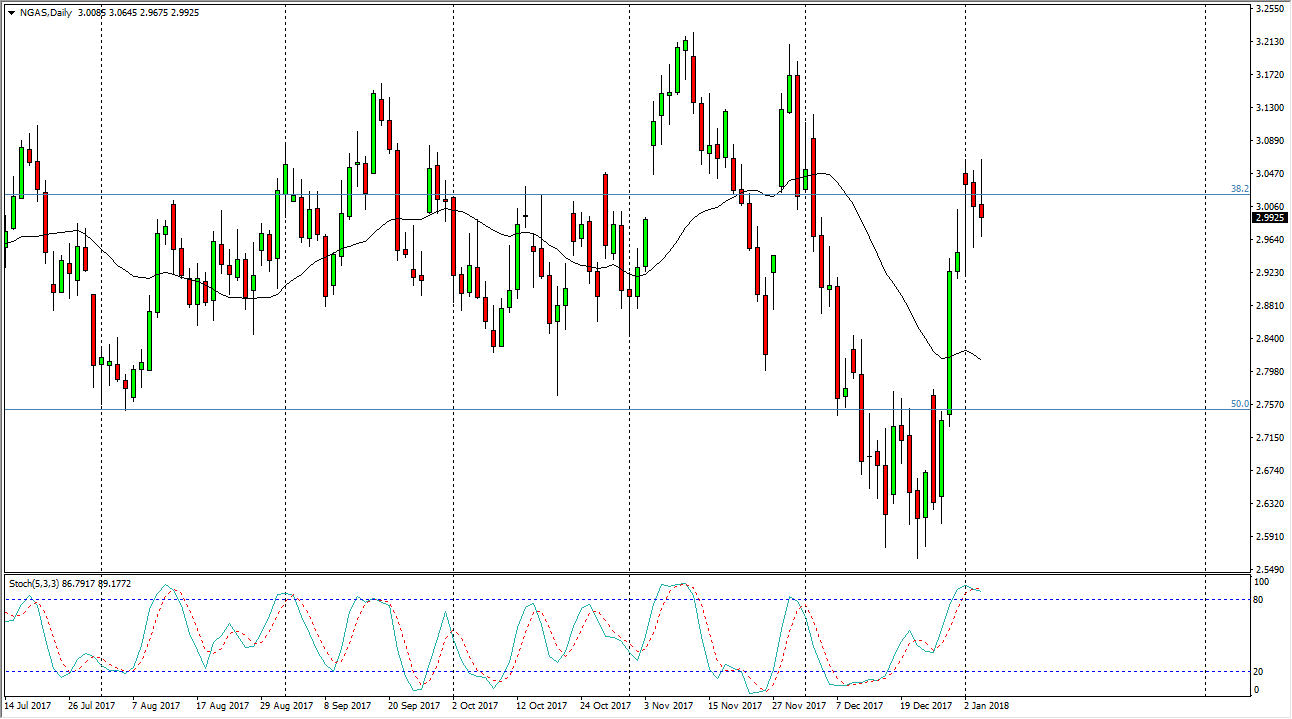

Natural Gas

Natural gas markets went back and forth during the trading session as we continue to hover around the $3 handle. Because of this, we ended up forming a very neutral candle, and I think at this point we are more than likely going to find selling pressure, but we haven’t seen the momentum pick up to the downside quite yet. Yes, the temperatures in the northeastern part of the United States continue to plunge, but we have such an oversupply of natural gas that any rally is going to be short-lived at best. I love the idea of shorting this market on a move below the $2.93 level, or some type of exhaustive daily candle. In the meantime, I’m willing to sit on the sidelines and simply wait for that opportunity.

Leave A Comment