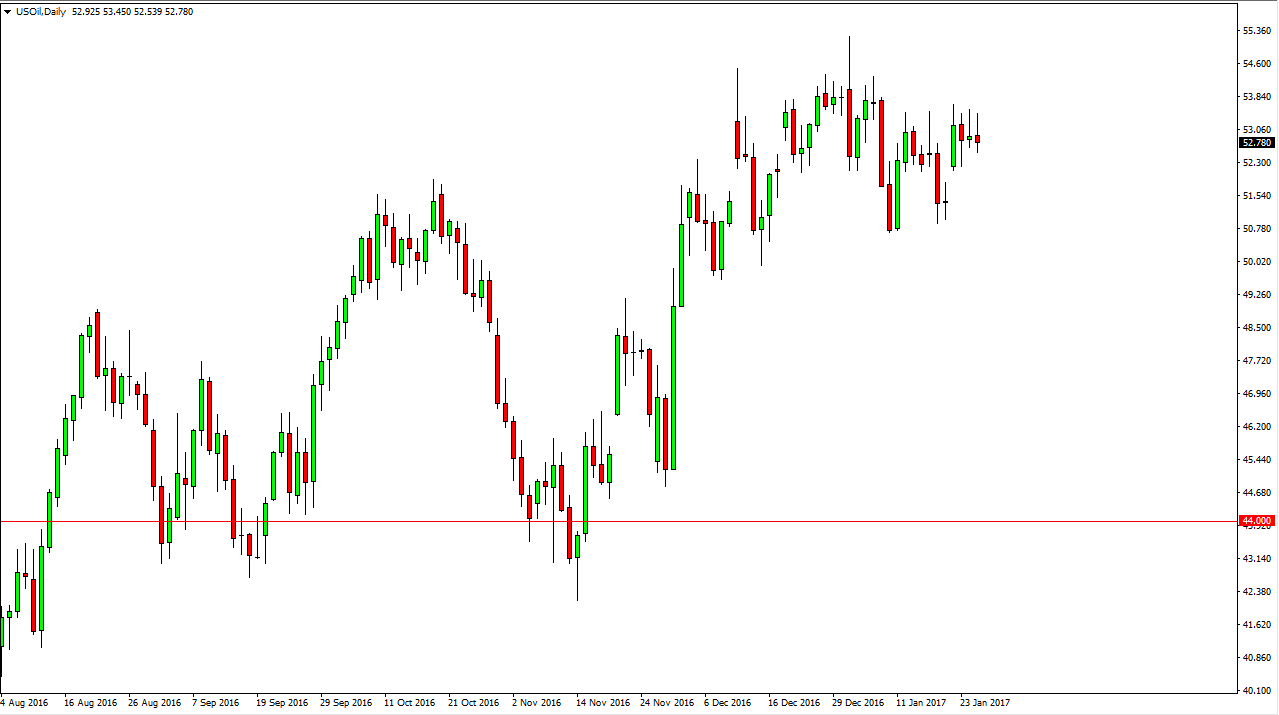

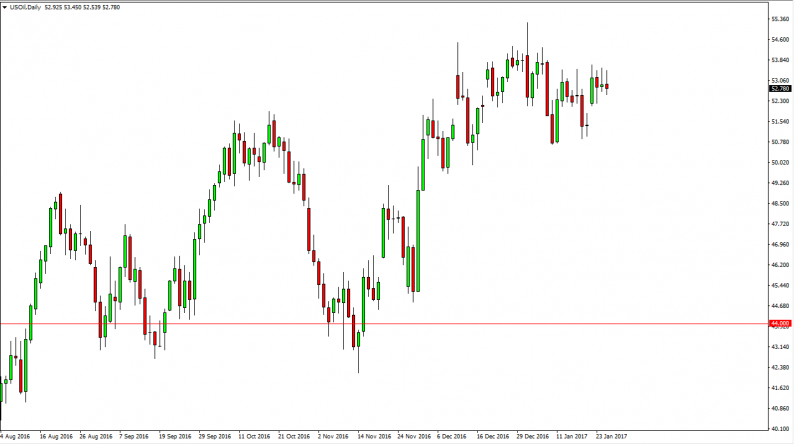

WTI Crude Oil

The WTI Crude Oil market initially tried to rally during the session on Wednesday, but turned around to form a less than stellar looking candle. Because of this, I believe that the market is going to continue to consolidate overall. The $51 level below is massively supportive, and it extends all the way down to the $50 level. Alternately, the $55 level above is massively resistive. Ultimately, I think that this is going to continue to be quite a bit of a back and forth type of situation. Because of this, options may be the best way to trade this market but either way it’s going to be a lot of short-term trading in the meantime.

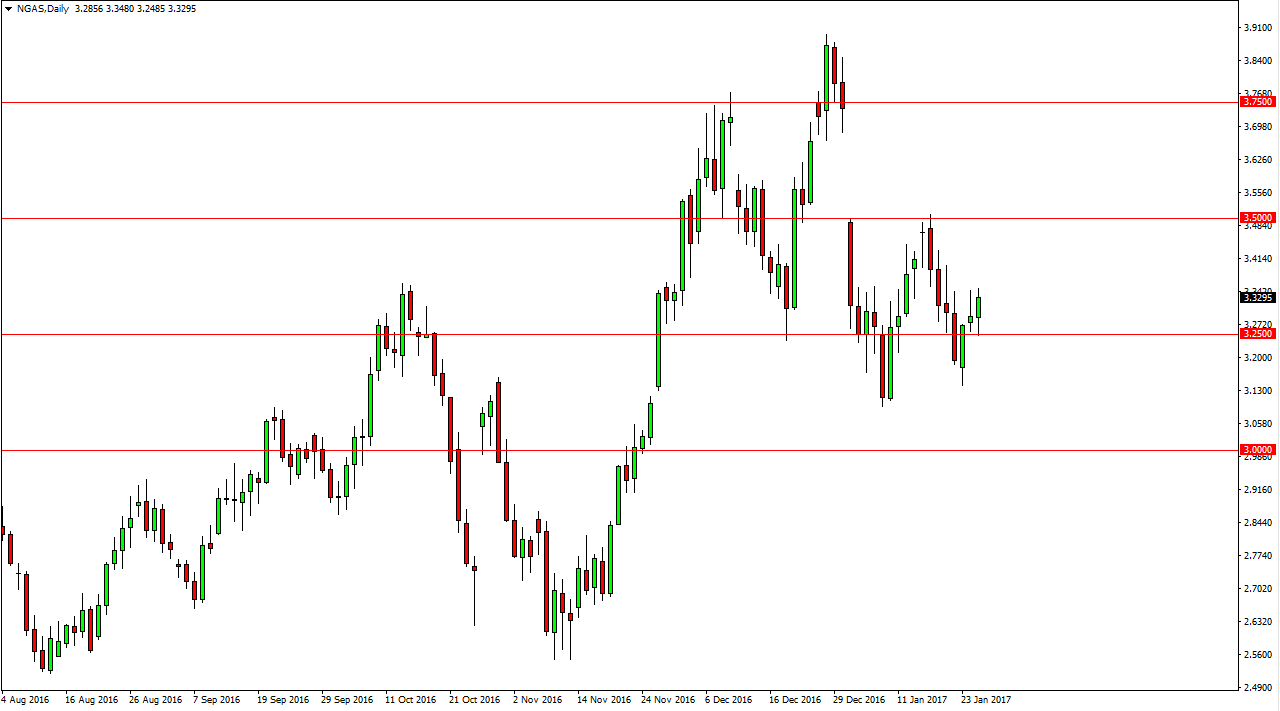

Natural Gas

The natural gas markets initially fell during the session on Wednesday, but found enough support at the 3.25 level to turn around and form a bullish candle. However, I think there’s a lot of noise above and I also recognize that the 3.50 level above is massively resistive. A break above there would fill the gap from a couple of weeks ago, and thus would be a very bullish sign at least for the short term. Ultimately, I think that the market should then turn around and find quite a bit of bearish pressure due to the oversupply concerns, and of course the lack of the demand in the northeastern part of the United States which is the largest consumer of natural gas. We have had stronger than anticipated temperatures during the month of January, and that should continue to weigh upon natural gas pricing anyway.

Beyond that, the oversupply that is known of in the United States as far beyond questionable, as we have over 300 years’ worth of energy and the natural gas sector alone. This doesn’t even include the Canadians.

Leave A Comment