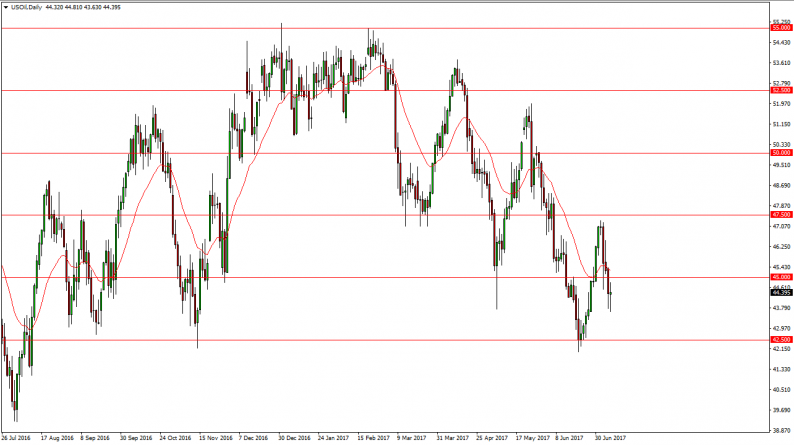

WTI Crude Oil

The WTI Crude Oil market was choppy on Monday, as we tried to rally but found it too much in the way of resistance near the $45 level. I think if we can stay below this level, the market is apt to continue to fall towards the 42.50 level. That’s not to say that is going to be easy, but obviously there’s a lot of bearish pressure in this market. You can see that we have wiped out a majority of the rally that had happened previously, and longer-term it seems as if every time this market rallies, the sellers will come back in to push lower. I believe that crude oil continues to suffer and oversupplied environment, and I don’t have a scenario in which I believe that oil suddenly takes off to the upside.

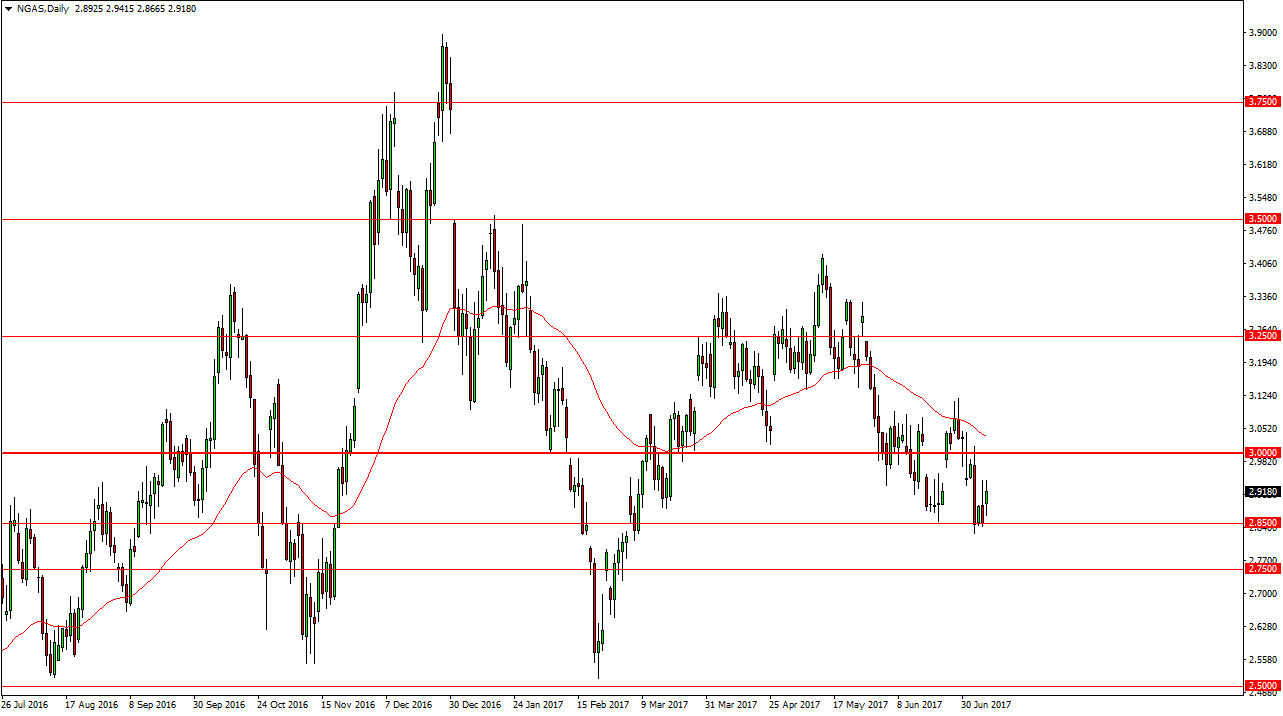

Natural Gas

Natural gas markets of course are choppy as well, and they did rally during the day. However, the $3.00 level above continues to be massively resistive, so as long as we stay below there, I believe the sellers are certainly in control, and I believe that if we can break down below the $2.85 level, the market continues to find sellers and then reaches towards the $2.75 level. I have no interest in trying to buy this market, because I believe that the $3.00 level continues to extend all the way to the $3.10 level above. I think it is more of a “zone” than anything else, and with that it’s difficult to imagine a scenario in which a willing to buy. Long-term, I believe that the market goes looking towards the $2.50 level underneath, which has been a massive floor over the last several months. A breakdown below there would open the floodgates for the sellers and would be catastrophic.

Leave A Comment