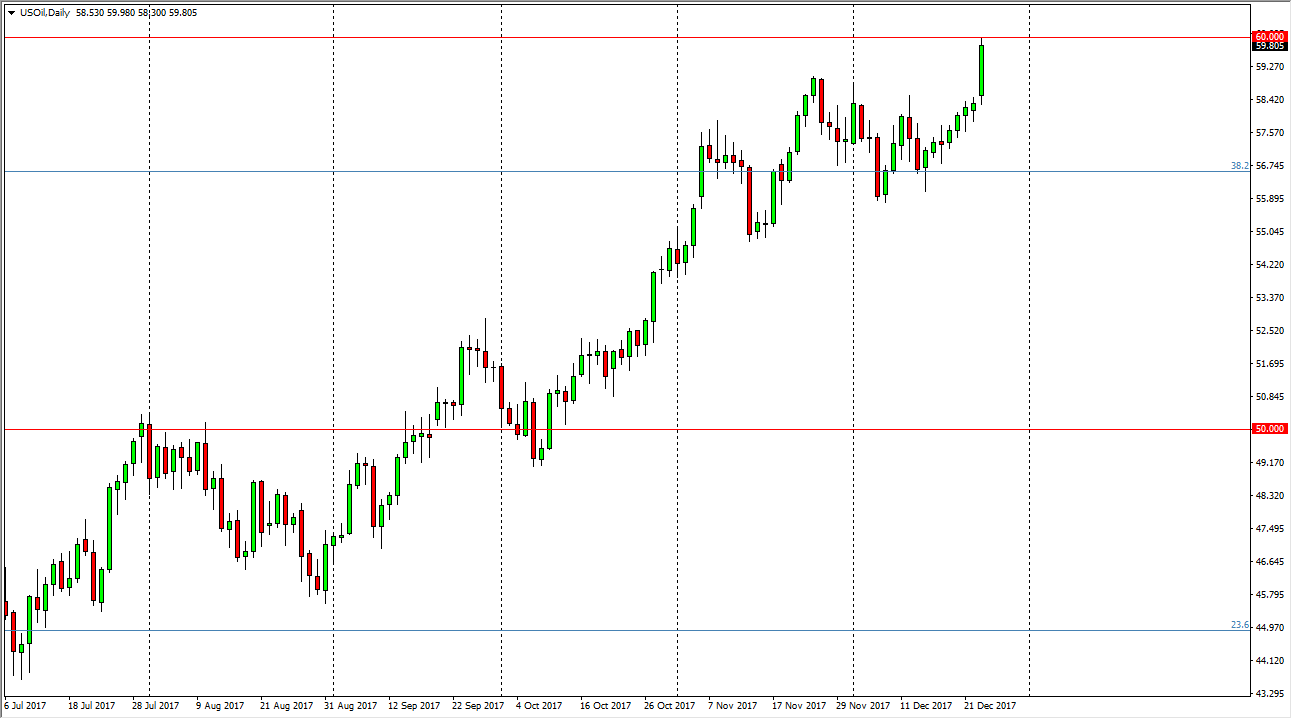

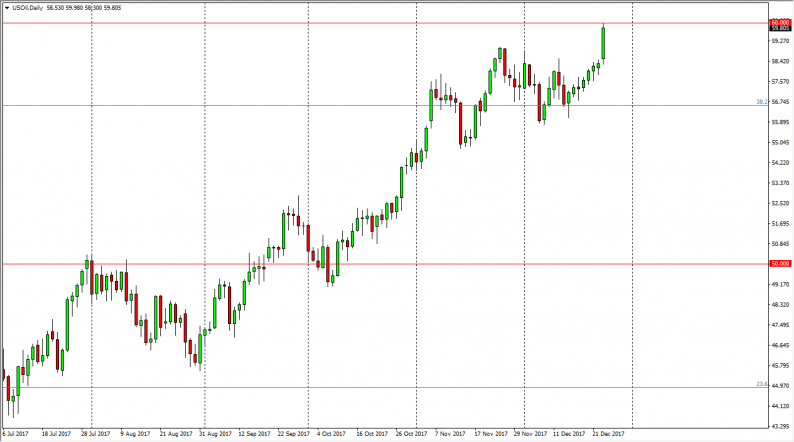

WTI Crude Oil

The WTI Crude Oil market gapped higher at the open on Tuesday, pulled back slightly to fill that gap, and then exploded to the upside to test the $60 level. By the end of the day, we did pull back slightly, but this looks like a market that is trying to break out above the $60 handle, which would be a very bullish turn of events. In fact, if we can do that exact move, we probably go looking toward $62.50 next, and then the $65 handle. The concern of course is that this was done in 10 volume, so it needs to “prove itself” to me first. I need to see a daily close above the $60 level to be convinced that I should be putting money to the upside. Pullbacks are to be expected at this point.

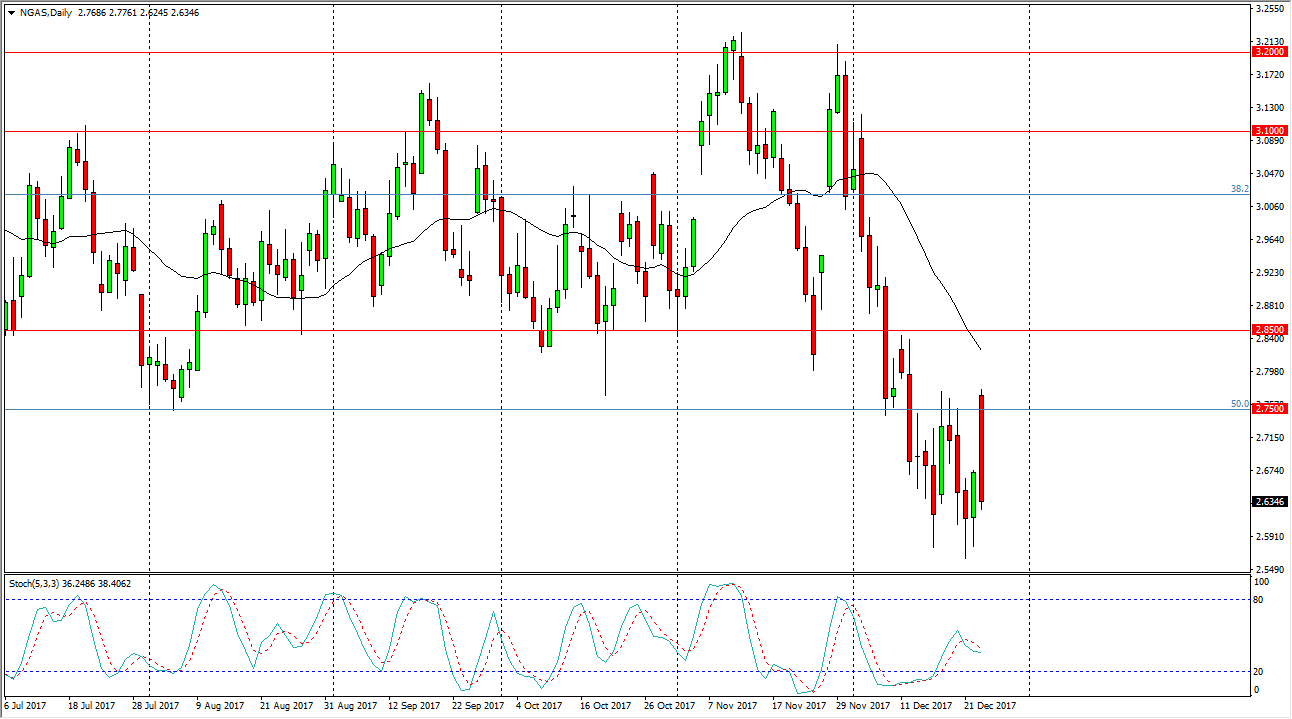

Natural Gas

Natural gas markets have been crazy as of late, and Tuesday was no different. We gapped higher at the open, reaching towards the $2.76 level, and then fell to fill the gap. We have filled the gap and now have broken below there as well. By doing so, this shows just how bearish this market is, and of course then it would have been further evidence of just how aggressive you should be every time this market rallies. Selling rallies has done quite well over the last several months, and even though we do see buying opportunities occasionally, the reality is that it’s much easier to sell this market longer term, and I think we will probably go looking towards the $2.50 level. There should continue to be a lot of noise, but overall, I think the main theme here is that natural gas cannot keep gains.

Leave A Comment