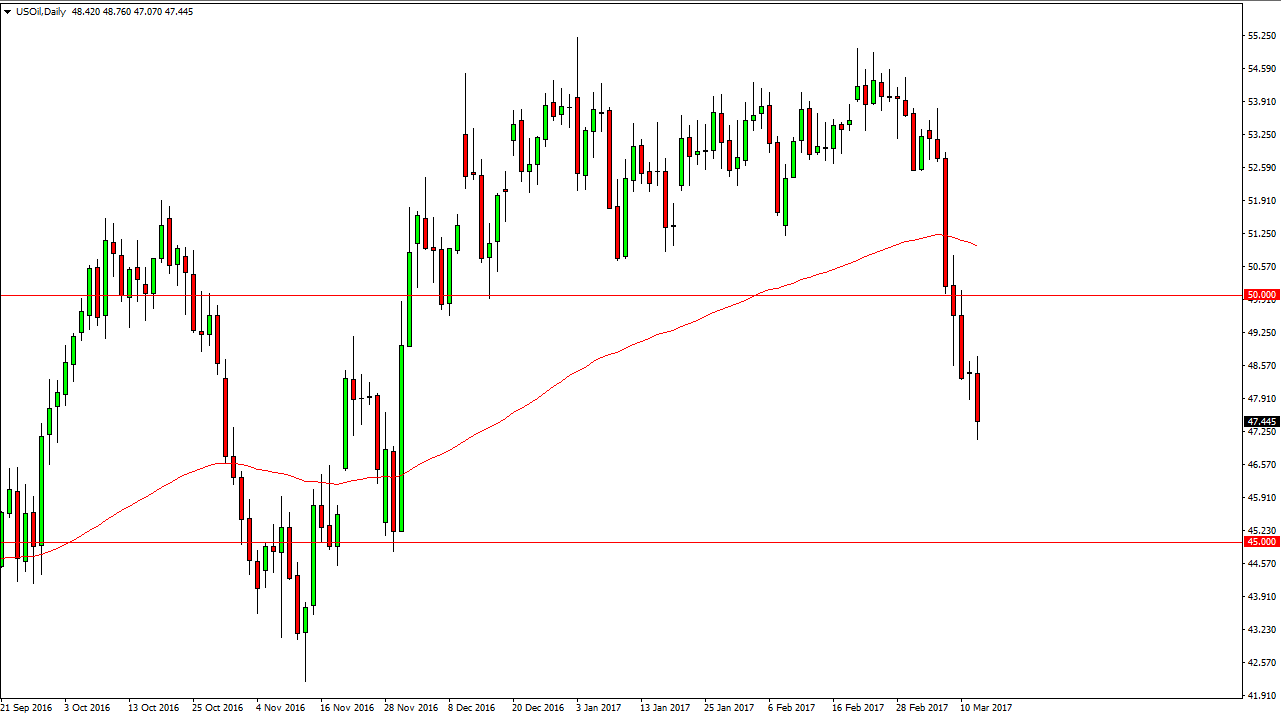

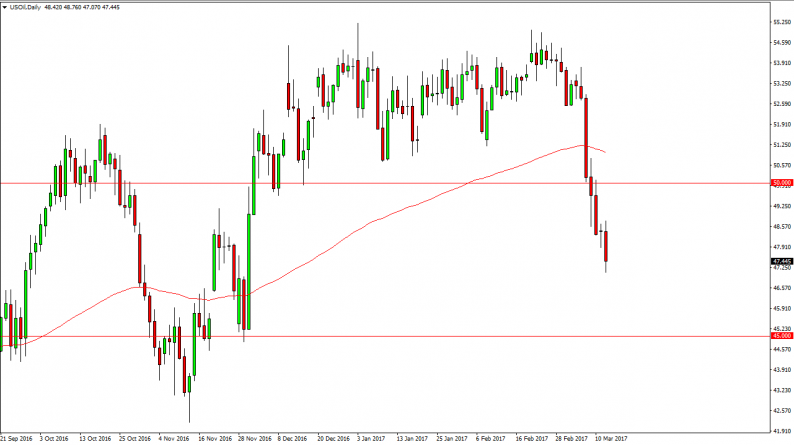

WTI Crude Oil

The WTI Crude Oil market broke down during the day on Tuesday, slicing through the hammer that formed on Monday. This is a very negative sign, and with the Crude Oil Inventories announcement coming out today it’s likely that there could be significant bearish news yet again. We are oversold, though, so quite frankly I would prefer to see a bounce that I could sell into. And exhaustive candle above would be a nice opportunity, and the $50 level above should be massive resistance. Ultimately, I think that the market should then go down to the $45 handle, which is naturally supportive and has been structurally supportive as well. I have no interest whatsoever in buying this market going forward.

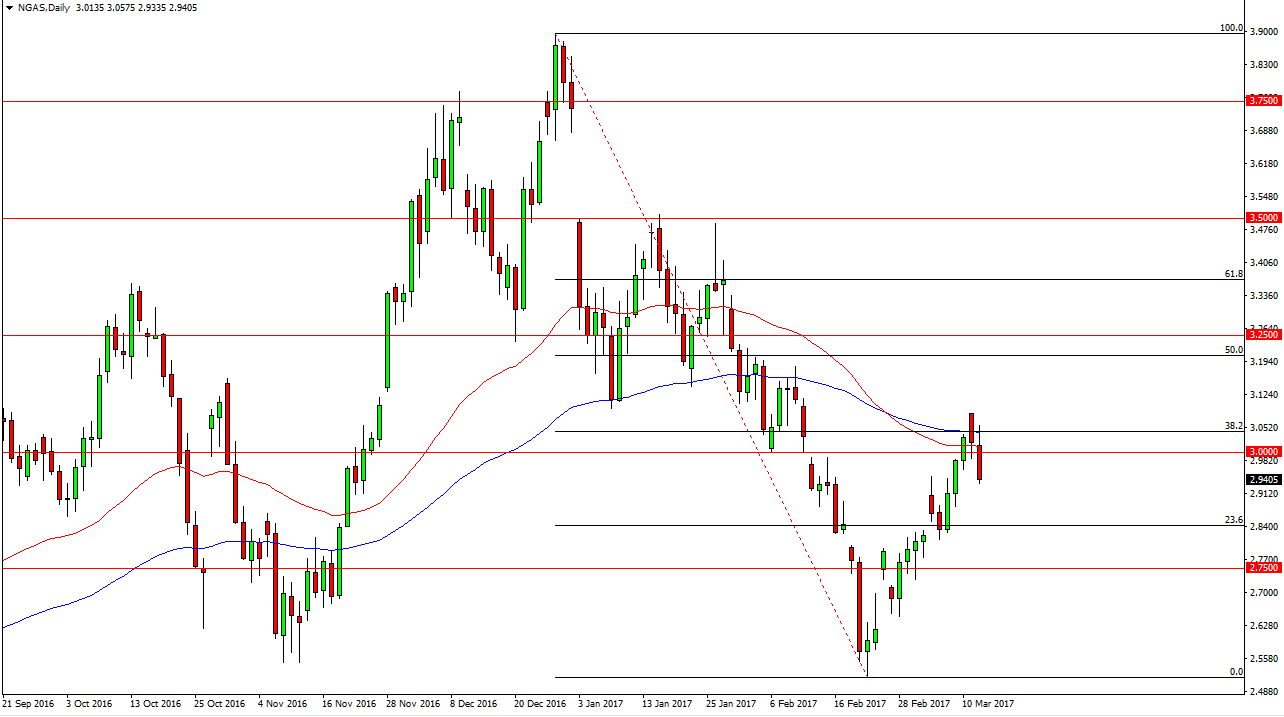

Natural Gas

The natural gas markets initially tried to rally during the Tuesday session but found enough resistance above to turn things around and sliced through the $3 level. Because of this, I am a seller and I believe that the market continues to go lower. It appears that the 100-exponential moving average has offered a significant amount of resistance, just as the 38.2% Fibonacci retracement has. I believe that the $2.75 level should be supportive underneath, and with that being the case I think that it’s more than likely going to bounce from there. However, I fully anticipate that the natural gas markets will reach the lows again, somewhere near the $2.50 area.

Rallies of this point in time should continue to be selling opportunities, there is far too much in the way of oversupply in the market to continue going higher. Ultimately, I believe that there is more than enough bearish pressure in the market to continue to break down any attempts to lift value. Natural gas is oversupplied in a way that I cannot even begin to explain to you, and therefore I remain bearish longer-term as well.

Leave A Comment