The sentiment-linked Australian and New Zealand Dollars traded modestly higher while the anti-risk Japanese Yen edged downward in otherwise quiet Asian trade. Regional bourses played catch-up to losses on Wall Street but benchmark US (S&P 500) and European (FTSE 100) index futures traded higher, pointing to a rebalancing of risk trends back toward neutral ahead of the upcoming Fed policy announcement.

A rate hike seems all but assured, with the priced-in probability of an increase implied in Fed Funds futures at 100 percent. Meanwhile, steady US economic news-flow and lingering fiscal policy uncertainty mean that the FOMC rate-setting committee will probably shy away from substantive changes to its baseline outlook. A status-quo result may register as a disappointment for traders looking to advance the case for steeper tightening, echoing post-NFP dynamics and sending the US Dollar lower.

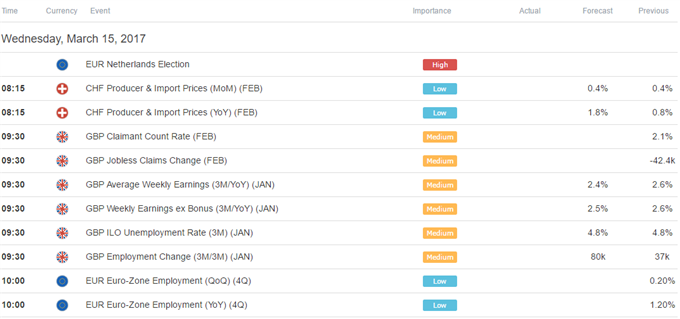

The European economic data docket is relatively quiet, putting the spotlight on the outcome of a general election in the Netherlands. The poll marks the first of several major contests between pro- and anti-EU forces on tap for 2017 and may be a preview of what is to come in French and German elections in the months ahead. A strong showing for Geert Wilders and his euro-sceptic Party of Freedom may stoke worries that the Brexit referendum was just the first of many seismic changes in the regional order on the horizon. That is likely to weigh heavily on the Euro.

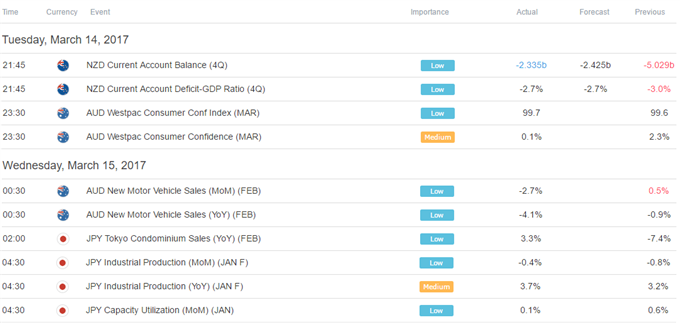

Asia Session

European Session

** All times listed in GMT. See the full DailyFX economic calendar here.

Leave A Comment