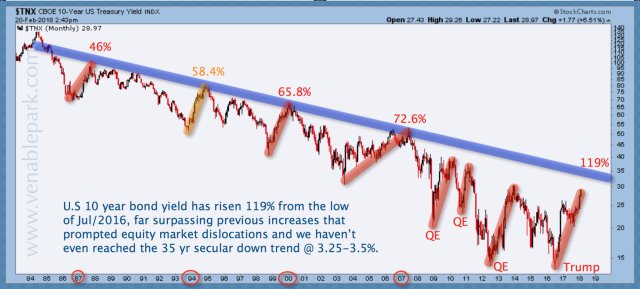

Starting from a record low of 1.34% in mid-2016, the increase in US 10-year Treasury yields to 2.9% over the past 18 months marks a massive 119% jump–the largest relative increase since 1982. Extremes breed extremes, and sure enough, as shown in this chart from my partner Cory Venable, the rate backup to date has already been about twice as much as during past tightening cycles, without even testing the 35-year secular downtrend (in purple).

With all the forecasts for 3 or 4 more Fed hikes this year, we note that the much lower relative rate increases in past credit cycles were enough to trigger economic recessions as circled in 1987, 1994, 2000 and 2007.

As rates rise and consumption slows, the economy falters and central banks traditionally abandon their tightening bias. Today, when the world is much, much more indebted across every sector, than ever before, will this time be different?

As we place our bets, this table of financial conditions today versus the secular low in 1982, offers further context for gauging the stage and strength of our current economic cycle.

Leave A Comment