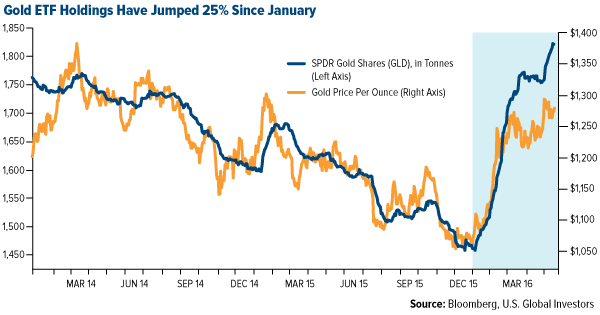

Strange are the times when a third of all government debt around the world carries a negative yield, and yet such is the case today. From Japan to eurozone countries, investors are faced with the tough decision of accepting subzero yields, doing nothing—or seeking other so-called “safe haven” options. Many have rediscovered gold, and as I pointed out earlier this week, demand for the yellow metal as an investment just had its best first quarter ever, with near-record inflows into gold ETFs.

But gold hasn’t been the only beneficiary.

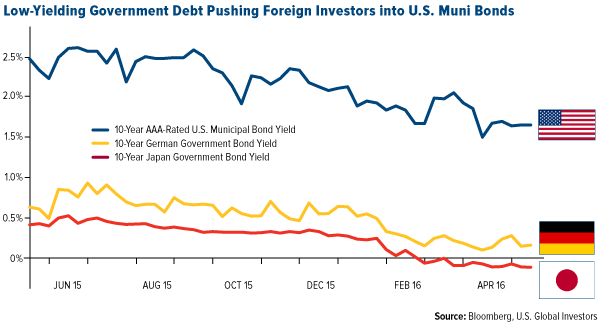

Overseas investors, starved for yield, are also flocking to investment-grade U.S. municipal bonds, which help fund infrastructure projects at the state and local levels. (Seventy-five percent of all infrastructure spending in the U.S., in fact, is financed with municipal bonds.) Munis offer a history of low volatility and near-zero default rates, not to mention diversification and attractive yields in a world of little to no yield. Below, notice that Japan’s 10-year government bond yield continues to edge lower into negative territory.

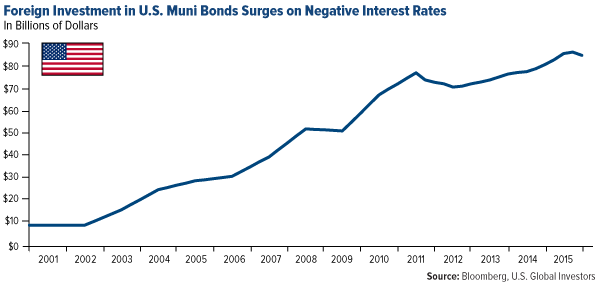

Unlike U.S. citizens, foreign investors are ineligible to take advantage of munis’ income tax-exempt feature. Nevertheless, they’re piling into the $3.7 trillion muni market, validating the “safe haven” status many investors assign to munis. By the end of 2015, foreign investors held more than $85 billion in American municipal debt, up from $72 billion in 2010.

As of the end of April, nearly $10 trillion worth of government bonds across the globe bore a negative yield. As this amount climbs, inflows into high-quality, short-term munis are expected to accelerate.

Muni bond funds are already seeing a sustained run of weekly inflows that began in October, with a massive $1.2 billion entering the market in the week ended May 11, following $709.7 million the previous week. This includes both American mutual funds and ETFs, so domestic and foreign investors are reflected here.

Leave A Comment