Just recently, a report was released discussing why you should NOT try and time the market, but rather “just stay invested for the long-haul.” To wit:

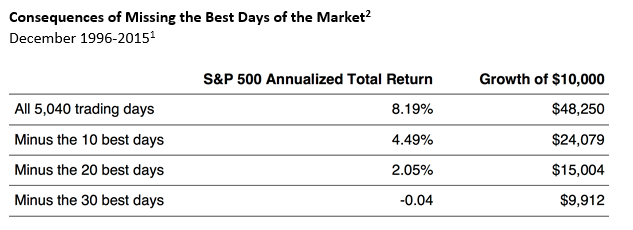

“Periods of high volatility and occasional bouts of uncertainty are a part of the investing process. When markets correct, you can’t control their length or severity, but you CAN control how you respond. The temptation is to exit the market entirely and sit on the sidelines waiting for the ‘right’ time to re-enter and re-invest. We believe that unfortunately, for the typical investor, this is not a prudent investment strategy. Why? Because we are not aware of anyone who can successfully time the market on a consistent basis and the consequences of missing just a few of the best days in the market can really put a dent in your long-term returns.”

The report then continues:

“Additionally, bear markets have tended to be short-lived while bull markets have been longer, stronger and more powerful creating a net positive for the long-term investor vs the ‘buy low, sell high’ investor.”

Unfortunately, the entirety of the analysis is based on faulty, mainstream, assumptions.

The “Math” Problem

For years, the investment industry has tried to scare clients into staying fully invested in the stock market at all times, no matter how high stocks go or what’s going on in the economy. The warnings are always the same:

“You can’t time the market.”

“Studies show that market timing doesn’t work.”

Of course, the reasoning for promoting “buy and hold” investing is not necessarily for “your benefit,” but generally for those wishing to extract a “fee” for their services.

But let’s get right to the “math” of it.

Is it true that over the long-term investors made most of their money from just a handful of big one-day gains? In other words, if you missed any of those days, your return would be “bupkis.” Obviously, since no one can predict when those few, big jumps are going to occur, it’s best to stay fully invested at all times, right? So just give them your money and bask in the warm blow of the “efficient market hypothesis.”

But, that’s entirely wrong. What it doesn’t address is the other half of the equation which makes the real difference to whether you should invest, when and how.”

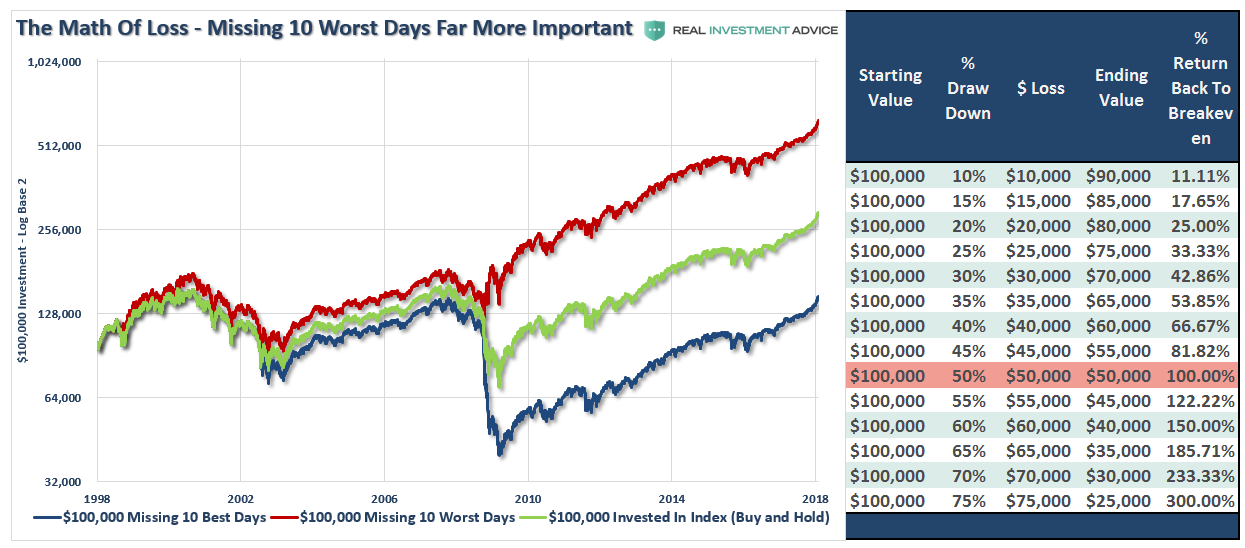

While it is true, that missing out on the 10-best days did reduce your gains, missing out on the 10-WORST days was far more lucrative.

Clearly, avoiding major drawdowns in the market is the key to long-term investment success. Given that markets spend roughly 95% of their time making up previous losses, avoiding major drawdowns leads to a greater probability of reaching long-term goals.

As Brett Arends once stated:

“The cost of being in the market just before a crash is at least as great as being out of the market just before a big jump and may be greater. Funny how the finance industry doesn’t bother to tell you that.”

Leave A Comment