While many were looking forward to the weekend in last week’s holiday-shortened week for some overdue downtime, the CEOs of five, mostly energy, companies had nothing but bad news for their employees and shareholders: they had no choice but to throw in the towel and file for bankruptcy.

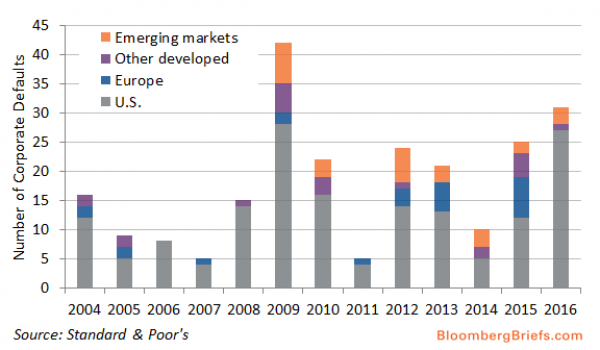

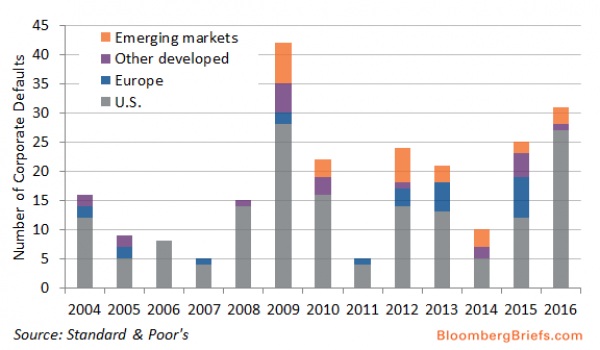

And, as Bloomberg reports, with last week’s five defaults, the 2016 to date total is now 31, the highest since 2009 when there were 42 company defaults, according to Standard & Poor’s. Four of the defaults in the week ended March 23 were by U.S. issuers including UCI Holdings Ltd. and Peabody Energy Corp., the credit rating company said.

This is just the beginning: we expect the real energy default tidal wave to be unleashed in a few weeks when, following the spring redetermination season, energy company liquidity evaporates as banks slash their committed exposure, and oil and gas firms – seeing no way out – and no longer able to raise equity and refinance bank debt, will have no choice but to make that last trek to bankruptcy court as they hand over the equity keys to the company’s unsecured and, in most cases, secured lenders.

We also wonder if at that moment when total 2016 to date defaults surpass 2009 (in roughly 2-3 months), whether the so called “market” will also hit fresh all time highs.

Leave A Comment