Conagra Brands, Inc. (CAG – Free Report) has carved a name for itself in the processed & packaging food industry with superior processed food items for household and commercial clients.

Currently, CAG has a Zacks Rank #2 (Buy), but that could definitely change after the release of its second-quarter fiscal 2018 (ended November, 2017) results.

We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: CAG’s adjusted earnings from continuing operations in second-quarter fiscal 2018, came in at 55 cents, above with the Zacks Consensus Estimate of 52 cents.

Revenue: CAG posted revenues of $2,173.4 million, above the Zacks Consensus Estimate of $2,070 million.

Key Stats: CAG is poised to grow on the back of stronger sales, greater innovation and efficient operations. The company anticipates to accrue earnings near the higher-end of the previously stated guidance range of $1.84-$1.89 per share for fiscal 2018. The company anticipates to experience input cost inflation of roughly 3.7% for fiscal 2018.

Stock Price: At the time of writing, the stock price of CAG was up nearly 3.07% ($1.17) in the pre-market trade on Nasdaq. Clearly the initial reaction to the release is optimistic. We view the company’s better-than-expected second-quarter 2018 result as the primary reason behind the positive sentiment.

Shares prices of CAG did not change on a pre-market trading basis.

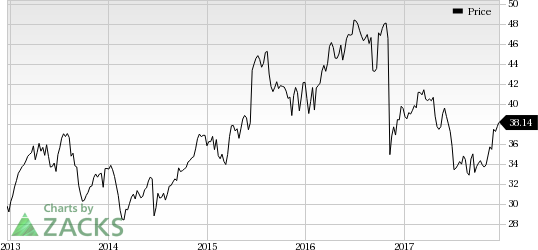

As of Dec 20, 2017, CAG’s closed the trading session at $38.14 per share.

Conagra Brands Inc. Price

Conagra Brands Inc. Price| Conagra Brands Inc. Quote

Leave A Comment