Last year, I created the Rock Solid Ranking, a dynamic stock ranking list that shows a value for each dividend stock I follow. I’ve worked on calculations that consider several metrics in order to find the best companies among all those on the stock market. This list is particularly useful when the stock market is becoming highly valued (not overvalued yet in my opinion).

Each month, I’ll be sharing with you, for free, the top 10 dividend growth stocks for both the US and Canadian markets. You can download your report here: March 2016 Top 20 Rock Solid Ranking

Why Update this list on a monthly basis?

The idea of providing you with an updated top 10 list monthly is to show how metrics and rankings can change from month to month. This becomes highly important during the earnings’ season as lots of new data come out at the same time and it’s hard to digest everything. The updated Rock Solid Ranking gives you a quick view in a few minutes of which companies are best or worst. This printer friendly report stands on a single page with lots of metrics to help you quickly analyze if the company deserves more attention for your next pick.

Out of this top 10 for each stock market, I review 2 companies each month; one US and one Canadian. We start this month with a high yield stock: CALM!

CALM – Cal-Maine Foods

All right, I’ll be honest, I would have never discovered this company if this wasn’t for my rankings! Cal-Maine Foods is a leading producer and supplier of consistently, high quality fresh eggs and egg products in the United States. The company, founded in 1957, is known for growing rapidly through acquisitions. Since 1989, the company has successfully acquired 18 existing egg production and processing facilities. It is a fully integrated egg producer. Cal-Maine sells 90% of its eggs to retail buyers such as Wal-Mart, Costco, Food Lion, etc.

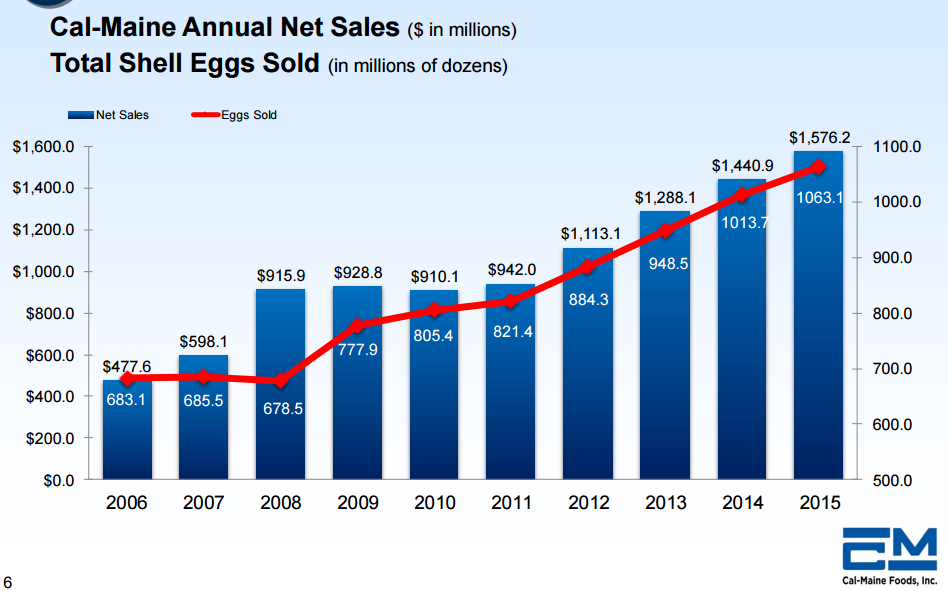

As you can see on the following chart, the egg sector has grown steadily throughout the years offering another growth vector for CALM:

Source: CALM investor presentation

I must admit I like the defensive taste of this small company (market cap of 2 billion) combined with a spicier taste for growth by acquisitions. While CALM is the biggest US egg producer, there are over 60 smaller egg producers under them. This is a highly fragmented market opening the door to CALM to use their acquisition expertise in order to grow even faster in the upcoming years.

The company has an unorthodox way to pay their dividend by distributing a variable dividend which is equivalent to ? of net income quarterly. This makes for a strange dividend growth curve but it is still effective as the company is not stuck with high dividend payments and keeps their payout ratio at 33%:

Leave A Comment