Since the U.S. economic recovery from the 2008 financial crisis, institutional economists began each subsequent year outlining their well-paid view of how things will transpire over the course of the coming 12-months. Like a broken record, they have continually over-estimated expectations for growth, inflation, consumer spending and capital expenditures. Their optimistic biases were based on the eventual success of the Federal Reserve’s (Fed) plan to restart the economy by encouraging the assumption of more debt by consumers and corporations alike.

But in 2017, something important changed. For the first time since the financial crisis, there will be a new administration in power directing public policy, and the new regime could not be more different from the one that just departed. This is important because of the ubiquitous influence of politics.

The anxiety and uncertainties of those first few years following the worst recession since the Great Depression gradually gave way to an uncomfortable stability. The anxieties of losing jobs and homes subsided but yielded to the frustration of always remaining a step or two behind prosperity. While job prospects slowly improved, wages did not. Business did not boom as is normally the case within a few quarters of a recovery, and the cost of education and health care stole what little ground most Americans thought they were making. Politics was at work in ways with which many were pleased, but many more were not. If that were not the case, then Donald Trump probably would not be the 45th President of the United States.

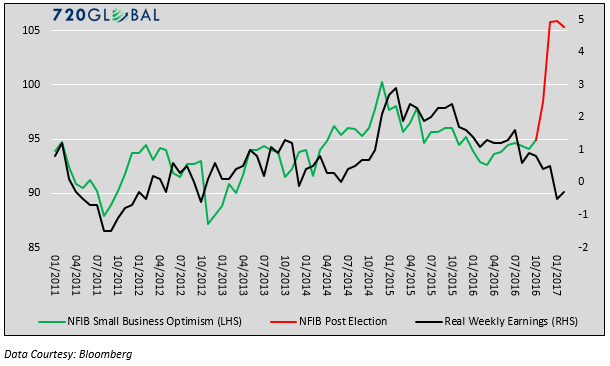

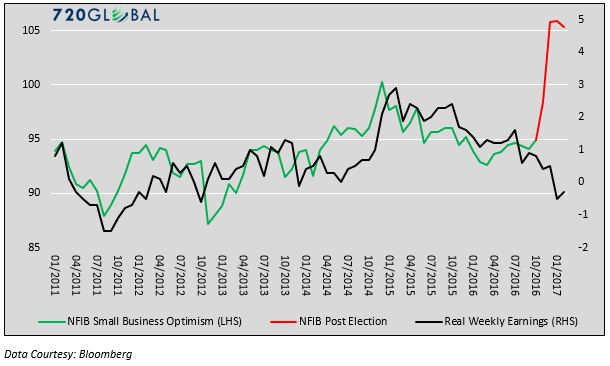

Within hours of Donald Trump’s victory, U.S. markets began to anticipate, for the first time since the financial crisis, an escape hatch out of financial repression and regulatory oppression. As shown below, an element of economic and financial optimism that had been missing since at least 2008 began to re-emerge.

What the Federal Reserve (Fed) struggled to manufacture in eight years of extraordinary monetary policy actions, the election of Donald Trump accomplished quite literally overnight. Expectations for a dramatic change in public policy under a new administration radically improved sentiment. Whether or not these changes are durable will depend upon the economy’s ability to match expectations.

Often Wrong, Never in Doubt

The institutional economists searching for a coherent outlook for 2017 are now faced with a fresh task. President Trump and his cabinet represent a significant departure from what has come to be known as “business-as-usual” Washington politics over the past 25 years. Furthermore, it has been 89 years since Republicans held control of the White House as well as both the House of Representatives and the Senate. The confluence of these factors suggests that the outlook for 2017 – policy, the economy, markets, geopolitical risks – are highly uncertain. Despite what appears to be an inflection point of radical change, most of which remains unknown, the consensus opinion of professional economists and markets, in general, are well-aligned, optimistic and seemingly convinced about how the economy and markets will evolve throughout the year[A1] . The consensus forecast based upon an assessment of economic projections from major financial institutions appears to be the result of a Ph.D. echo chamber, not rigorous independent analysis.

Leave A Comment