<< Read More: Part I – “Buy & Hold” Can Be Hazardous To Your Wealth

<< Read More: Part II – Why Crashes Matter & The Saving Problem

<< Read More: Part III – Valuations & Forward Returns

<< Read More: Part IV – The Math Of Loss

<< Read More: Part V – Choosing The Right Portfolio Benchmark

<< Read More: Part VI – Should You Invest Like Warren Buffett?

<< Read More: Part VII – The Myths Of Stocks For The Long Run

<< Read More: Part VIII – The Myths Of Stocks For The Long Run

<< Read More: Part IX – The Myths Of Stocks For The Long Run

<< Read More: Part X – The Myths Of Stocks For The Long Run

CHAPTER 11 – Portfolio Strategies For The Long-Run

Over the previous 10-chapters of this series, we have discussed many of the fallacies of investing for the long-term. The two biggest of these issues, which impacts performance over time, is the lack of capital to invest and human psychology. As Howard Marks once said:

“I’ve been in this business for over forty-five years now, so I’ve had a lot of experience.In addition, I am not a very emotional person. In fact, almost all the great investors I know are unemotional. If you’re emotional then you’ll buy at the top when everybody is euphoric and prices are high. Also, you’ll sell at the bottom when everybody is depressed and prices are low. You’ll be like everybody else and you will always do the wrong thing at the extremes.”

While the idea of “buy and hold” investing is proselytized by the mainstream media, the reality is that ultimately all investors wind up “buying tops” and “selling bottoms.”

There are numerous “investing legends” who are revered for their investment knowledge and success. While we idolize these individuals for their respective “genius,” we can also save ourselves time and money by learning from their wisdom and their experiences. Their wisdom was NOT inherited, but was birthed out of years of mistakes, miscalculations, and trial-and-error. Most importantly, what separates these individuals from all others is their ability to learn from those mistakes, adapt, and capitalize on that knowledge in the future.

Experience is an expensive commodity to acquire, which is why it is always cheaper to learn from the mistakes of others.

Most importantly, not one of these legendary investors has “buy and hold” as a rule. Yes, they believe in long holding periods, but they also have a healthy respect for valuation, risk and capital preservation. They sell when value is no longer present and/or the risk of capital loss outweighs the potential reward.

There are only a few basic “truths” of investing, and protecting the value of your investment capital is the most important.

In 2010, Brett Arends wrote “The Market Timing Myth” which sets up our discussion for today.

“For years, the investment industry has tried to scare clients into staying fully invested in the stock market at all times, no matter how high stocks go or what’s going on in the economy. ‘You can’t time the market,’ they warn. ‘Studies show that market timing doesn’t work.’

They’ll cite studies showing that over the long-term investors made most of their money from just a handful of big one-day gains. In other words, if you miss those days, you’ll earn bupkis. And as no one can predict when those few, big jumps are going to occur, it’s best to stay fully invested at all times. So just give them your money… lie back, and think of the efficient market hypothesis. You’ll hear this in broker’s offices everywhere. And it sounds very compelling.

There’s just one problem. It’s hooey.

They’re leaving out more than half the story.

And what they’re not telling you makes a real difference to whether you should invest, when and how.”

In this chapter, we will explore three broad and basic strategies for managing a portfolio. These are just examples to explain the concept of managing risk, and we hope it encourages you to explore, learn, and expand your investing knowledge and expertise.

1. Technical – Stock/Bond Swap Using 12-Month Moving Avg.

It is true that you “can’t time the market.”

Importantly, we are not endorsing “market timing” which is specifically being “all in” or “all out” of the market at any given time.

However, having a methodology to “buy” and “sell” investments is the core of investing, hence the very basic rule of investing which is to “buy low and sell high.”

While there are many sophisticated methods of handling risk within a portfolio, even using a basic method of price analysis, such as a moving average, can be a valuable tool over the long-term holding periods. Will such a method ALWAYS be right? Absolutely not. However, will such a method keep you from losing large amounts of capital? Absolutely.

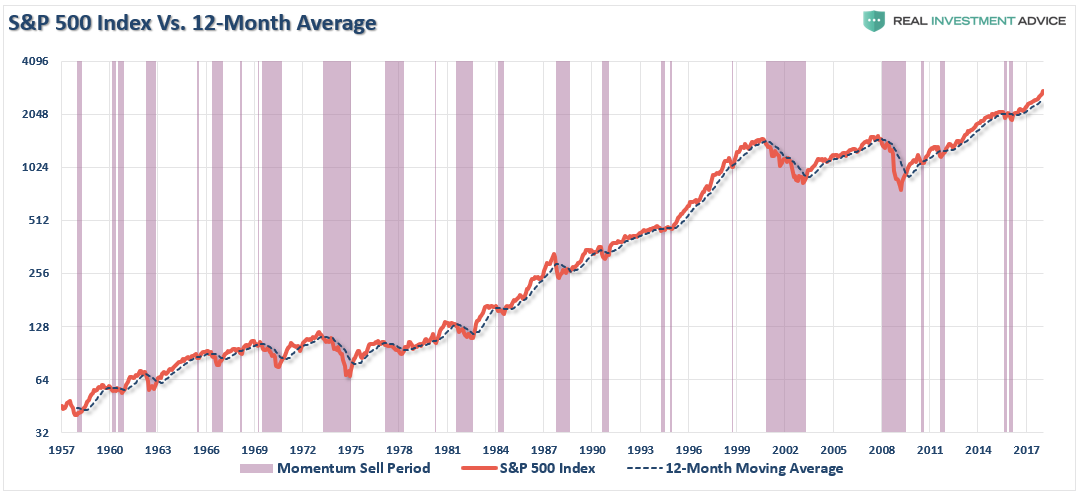

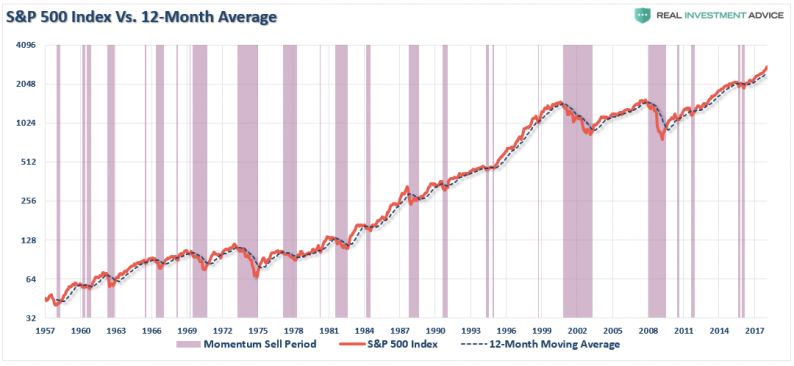

For example, the chart below shows a simple 12-month moving average study. What becomes clear is that using a basic form of price analysis can provide useful identification of periods when portfolio risk should be REDUCED.

Importantly, I did not say risk should be eliminated; just reduced.

Again, no one is suggesting, or stating, that such signals mean going 100% to cash. The overarching premise is that when “sell signals” are given, it is often time where some action should be taken to manage portfolio risk.

Let’s review an example of this strategy at work.

In 1988, Bob was 35 years old, had saved up a $100,000 nest egg and decided to invest it in the S&P 500 index. He added $625/month to the index every month and never touched it. When Bob retires at 65, he wants to maintain his current $75,000 lifestyle. We will assume he can generate 3% a year in retirement on his nest egg.

Leave A Comment