Over the last couple of week’s most of the weekend reading list has been attributed to the market’s stumble since the beginning of this year. Importantly, as we rapidly head into January’s close, there seems to be little to reverse the negative tide sweeping through the market.

As I wrote earlier this week, this isn’t a good thing.

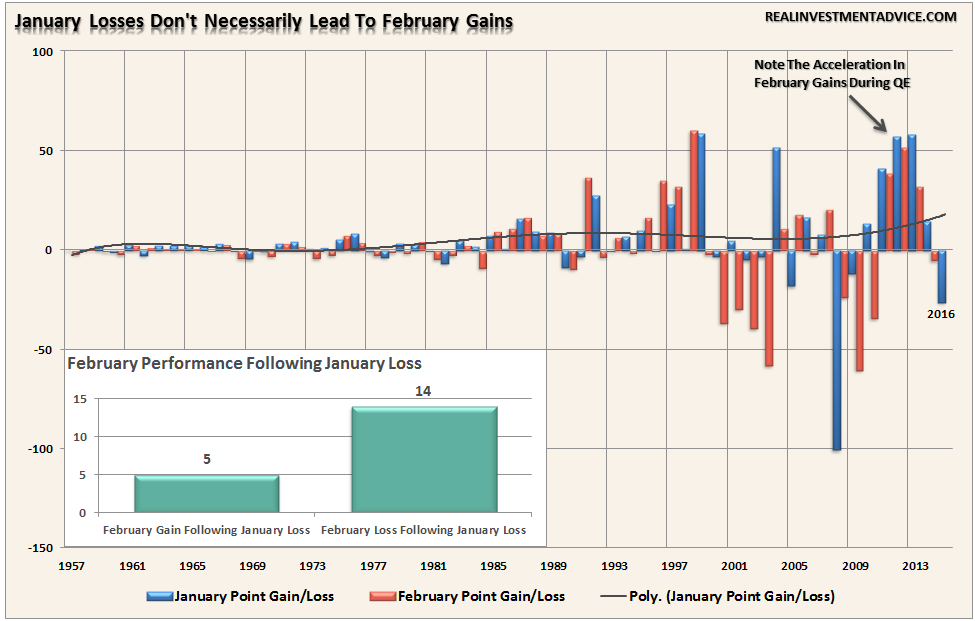

“It would seem logical that a weak performance in January would lead to some recovery in February. Markets are oversold, sentiment is bearish and February is still within the seasonally strong 6-months of the year. Makes sense.

Unfortunately, the historical data suggests that this will likely not be the case. The chart below is the historical point gain/loss for January and February back to 1957. Since 1957, there have been 20 January months that have posted negative returns or 33% of the time.”

“February has followed those 20 losing January months by posting gains 5-times and declining 14-times. In other words, with January likely to close out the month in negative territory, there is a 70% chance that February will decline also.

The high degree of risk of further declines in February would likely result in a confirmation of the bear market. This is not a market to be trifled with. Caution is advised.”

In other words, there is a real probability that if the markets don’t get a lift between now and the end of the month, February could be the beginning of a technical bear market decline.

But were could that lift come from? The first is month-end window dressing by fund managers after a brutal start to the new year. After much liquidation, fund managers will need to rebalance holdings.

The second is the potential for Central Banks to intervene which could embolden the bulls as further support could temporarily delay the onset of a bear market and recession. Note: I said temporarily. Pulling forward future consumption is not a long-term solution to organic economic growth.

Leave A Comment