U.S. stocks were mostly flat yesterday. Investors didn’t know whether they were coming or going. We don’t know, either. But we rate the odds of “going” a lot higher than the odds of “coming.”

As we pointed out yesterday, there are two possibilities…

What we’ve seen over the past two weeks or so is a correction in a continuing bull market in stocks. Or we are in the early stages of a major bear market.

Most likely, it will be interpreted both ways. Because we probably are at the beginning of a bear market. And also not too far away from another explosive move higher for stocks.

Fixers on the Job

Why?

Because the authorities are not likely to let a bear market proceed in the normal way.

Instead, as it intensifies, they are likely to intervene with such massive force (remember, this is war!) that it will send stocks flying, like the bumper of an automobile that has just hit a land mine.

Yesterday, Wall Street’s shills in the mainstream press were out in force explaining that in a pullback like this investors could expect to wait four months before the market has fully recovered.

We suspected that this phenomenon describes something other than the normal functioning of a healthy market. So we asked our research team to have a look.

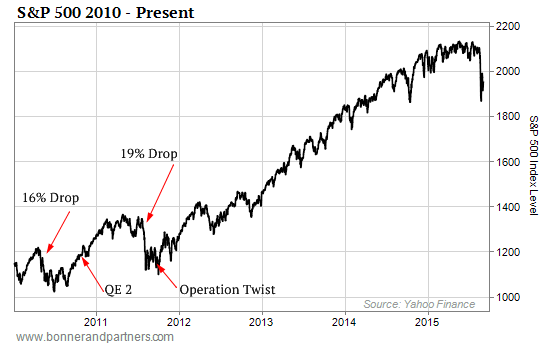

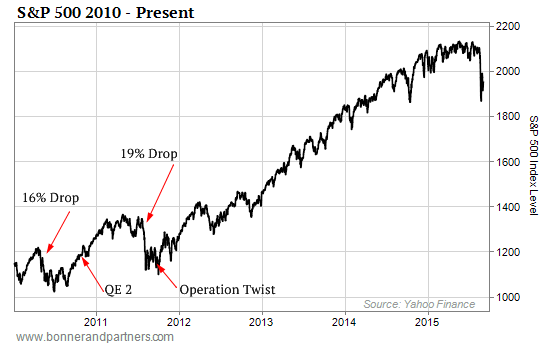

There were two major corrections since 2009. In each case, stocks recovered all their losses within about four months.

But if you look carefully, you see that this was hardly a case of natural market forces at work. Instead, the fixers from the Fed were on the job.

In both instances, the Fed announced new liquidity programs near the bottom of the corrections. Stocks headed up again soon after.

Take a look at the chart. You’ll see what was going on.

What this reveals is not a solid bull market, with periodic sell-offs, followed by a healthy revival of buying. Instead, it’s a market so heavily rigged by the feds that it can only be kept aloft by huge doses of credit easing.

Leave A Comment