The destruction of honest financial markets by the Fed and other central banks has created a class of hedge fund hot shots that are truly hard to take. Many of them have been riding the bubble ever since Alan Greenspan got it going after the crash of 1987 and now not only claim to be investment geniuses, but also get downright huffy if the Fed or anyone else threatens to roil the casino.

Leon Cooperman, who is an ex-Goldman trader and now proprietor of a giant fund called Omega Advisors, is one of the more insufferable blowhards among these billionaire bubble riders. Earlier this week he proved that in spades.

It seems that his fund had a thundering loss of more than 10% in August during a downdraft in the stock market that the Fed for once took no action to counter. But rather than accept responsibility for the fact that his portfolio of momo stocks took a dive during a wobbly tape, Cooperman put out a screed blaming the purportedly unfair tactics of other casino gamblers:

Lee Cooperman, the founder of Omega Advisors, has joined the growing chorus of investors blaming last week’s stock market sell-off — and his own poor performance in August — on esoteric but increasingly influential trading strategies pioneered by hedge funds like Bridgewater.

Well now. Exactly how was Bridgewater counting the cards so as to cause such a ruction at the gaming tables?

In a word, Ray Dalio, the storied founder of the giant Bridgewater “All-Weather” risk parity fund, has been doing the same thing as Cooperman, and for nearly as many decades. Namely, counting the cards held-out in plain public view by the foolish monetary central planners domiciled in the Eccles Building.

To be sure, Dalio’s fund has had superlative returns and there is undoubtedly some serious algorithmic magic embedded in Bridgewater’s computers. But at the end of the day it’s all a function of broken capital markets that have been usurped and rigged by the Fed.

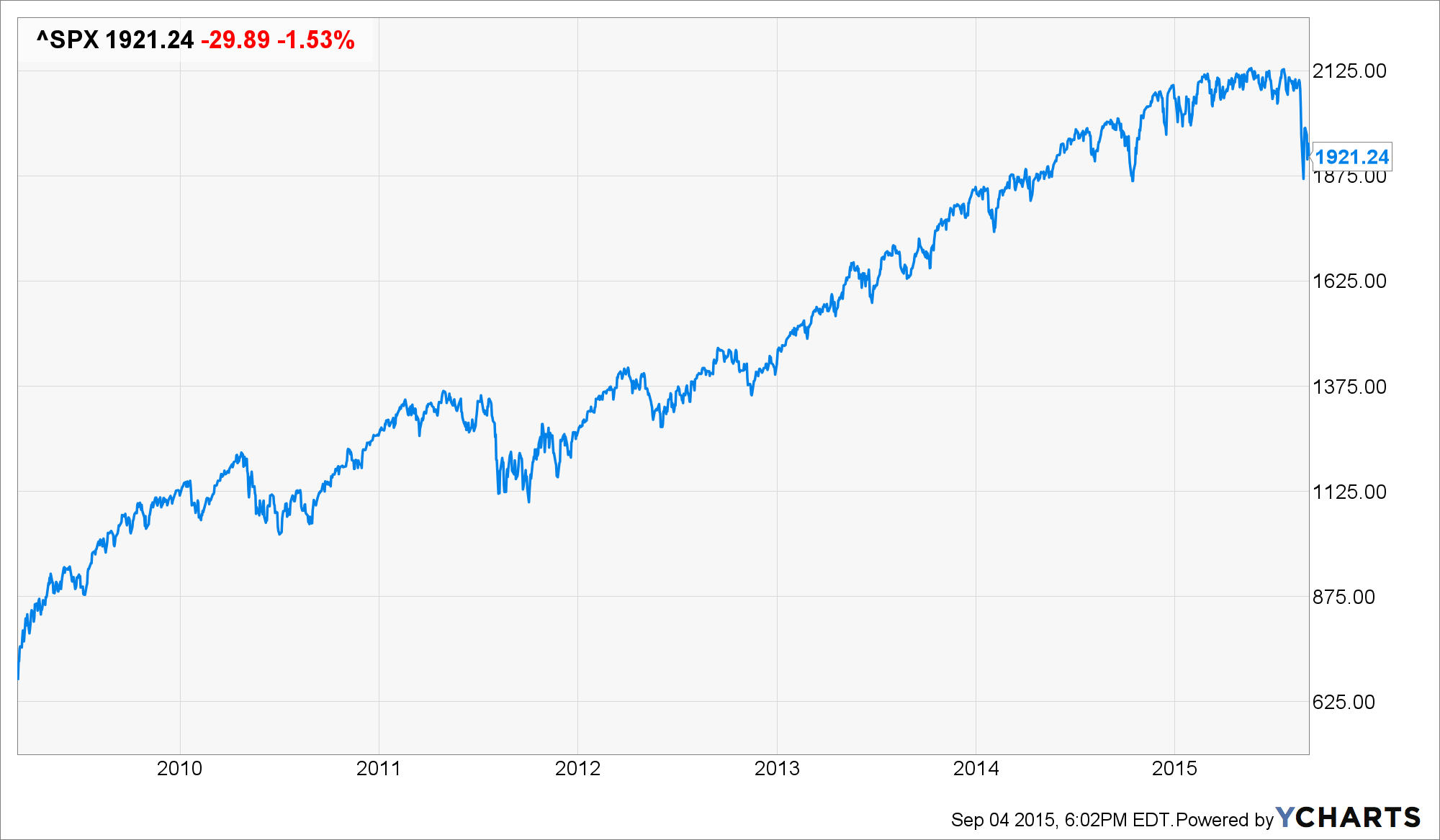

The only thing your need to know about the vaunted “risk parity” strategies that have served Bridgewater and their imitators so handsomely, and which have now aroused the ire of more primitive gamblers like Cooperman, is the graph below:

^SPX data by YCharts

The above, of course, is the Fed’s “wealth effects” printing press at work. There have been about 30 identifiable “dips” since the March 2009 low and every one of them have been bought by the casino gamblers. And for good reason.

The Bernanke Fed’s egregious, desperate and utterly unwarranted bailout of Wall Street at the time of the post-Lehman crash taught the gamblers a profound lesson. That is, they could be exceedingly confident that the Fed would keep the free money flowing at all hazards, and that it would resort to any price rigging intervention as might be necessary to keep the stock averages rising.

Indeed, never in all of history have a few ten thousand punters made so many trillions in return for so little economic value added. But what Dalio did in this context was to invent an even more efficient machine to strip-mine the Fed’s monumental largesse.

To wit, Bridgewater’s computers buy more stocks on the “rips”, when equity volatility is falling and prices are rising; and then on the “dips” they rotate funds into more bonds when equity volatility is rising and the herd is retreating to the safe haven of treasuries and other fixed income securities, thereby causing the price of the latter to rise.

Leave A Comment