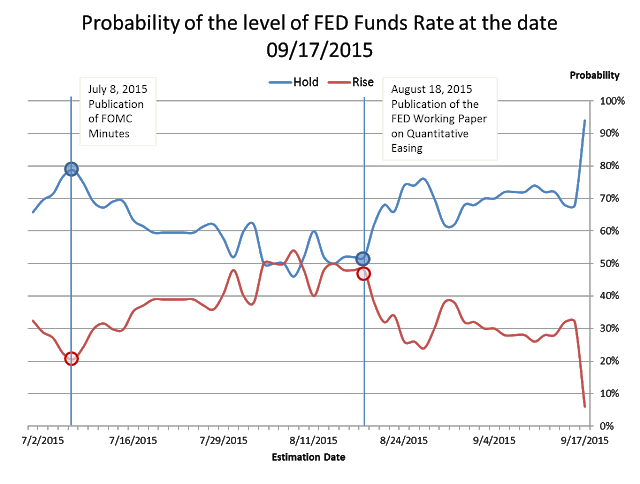

After the FED’s decision of 17th September leaving interest rates unchanged, a great confusion has spread throughout the markets. The varied opinions have oscillated from the “disappointed” who were expecting, if not a rate increase, at least clear commitments towards

October 4, 2015