After a smooth ride last year, the U.S. stock market is experiencing a shaky 2015 due to successive issues that have been lashing the bourses and heightened volatility. In Q3, global growth concerns played foul, crushed all risky assets and

October 17, 2015

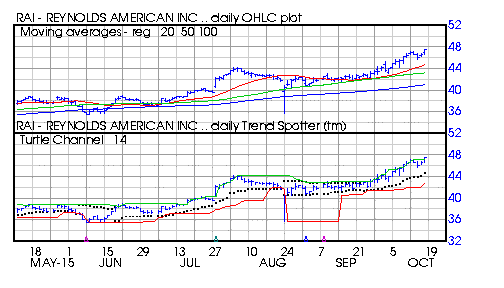

This week I added the following stocks to the Barchart Van Meerten New High portfolio for superior upward momentum: Reynolds America (NYSE:RAI), Synnex (NYSE:SNX), Global Payments (NYSE:GPN), Selective Insurance (NASDAQ:SIGI) and Central Garden and Pet (NASDAQ:CENTA). Reynolds America Barchart technical indicators: 96% Barchart technical buy signals 64.00+ Weighted Alpha Trend Spotter