The “darlings” of mutual funds and institutional funds is a popularity contest tracked by Credit Suisse that might be almost used as a contrarian indicator, in a note titled The Darlings of Active Managers The Most Crowded Names in US Small, Mid & Large Cap Funds . As a general rule, the report authors note, “owning too many darlings gives less opportunity for differentiation.”

Crowded Trades

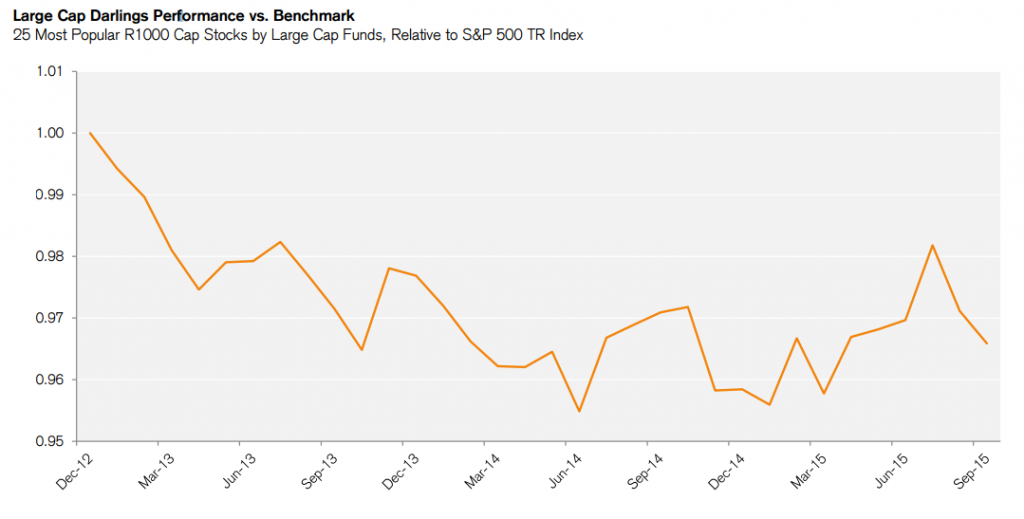

Large cap darlings underperformed while “Cherished Cousins” delivered

Following darlings in large caps has not been a profitable strategy, the report noted, as twenty five of the most popular stocks are trading below the S&P 500 total return index benchmark. The current darlings of large caps reads like a who’s who of Wall Street’s most discussed names, seven of which are in tech, including Apple Inc., (AAPL) owned by 398 funds, Microsoft (MSFT) owned by 347 funds. Banks on the list include JPMorgan Chase (JPM) , which is set to report earnings on Tuesday, is owned by 291 funds, Wells Fargo (WFC), owned by 268 funds and Citigroup (C) owned by 209 funds, are expected to report later this week. Bank of America was a notable off the darlings list.

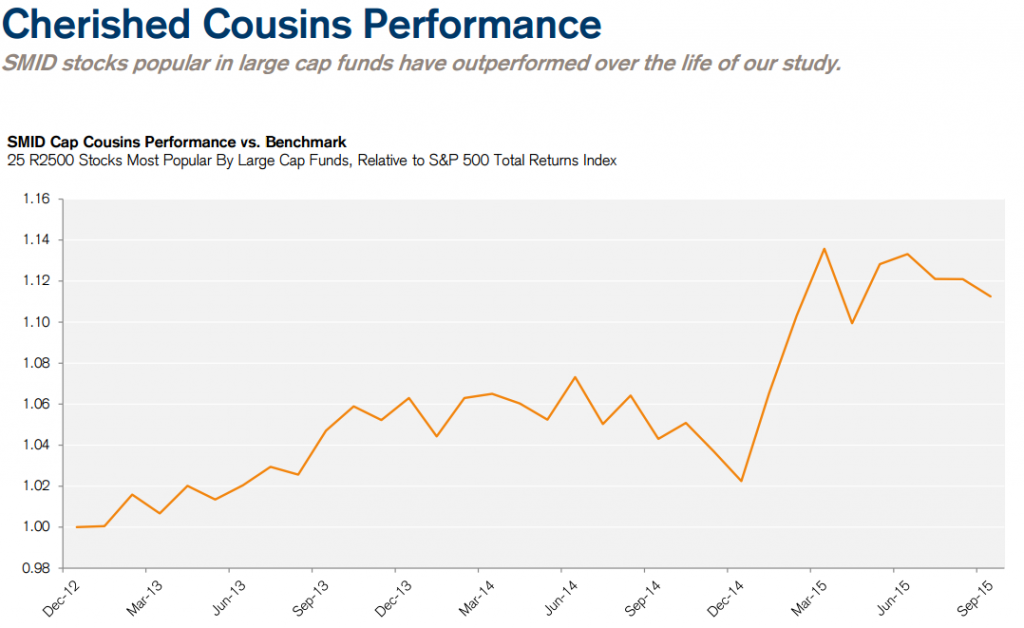

What has generated performance is the “Cherished Cousins,” Credit Suisse notes. These are the most popular names in large cap funds, when managers move down cap to the Russell 2500. Relative to the S&P 500 total return index these stocks outperformed by nearly 12 percent since December of 2012. In particular, this stock grouping has rocketed since December of 2014. Notable names include Lear Corporation (LEA), owned by 63 large cap funds, Alaska Air Group (ALK), owned by 48 funds and Jones Lang LaSalle (JLL), owned by 44 funds.

Crowded Trades

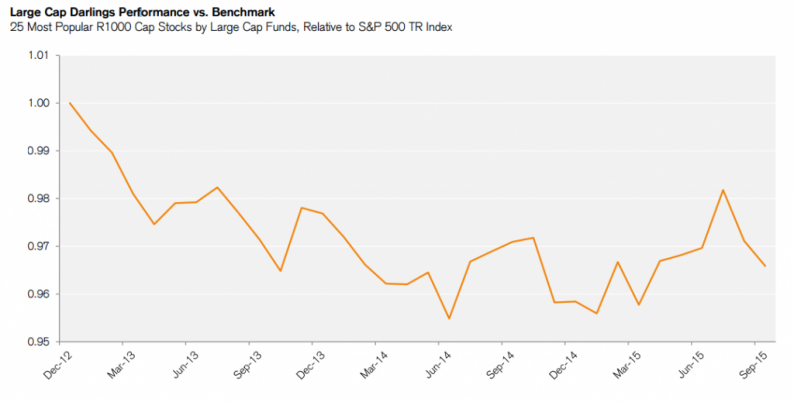

Crowded Trades – Large cap rising stars have good then less than stellar performance

Large cap rising stars got off to an early start in the Credit Suisse report, but have had difficulty out-performing more recently. The 25 stocks with largest increase in large cap fund ownership topped out with 15 percent outperformance in March 2014, but are now outperforming by near 5 percent relative to S&P 500 Total Returns Index. The study also revealed that Fading Star stocks generally lagged in the quarter after names were sold, while highly owned Fading Stars have tended to rebound and outperform.

Leave A Comment