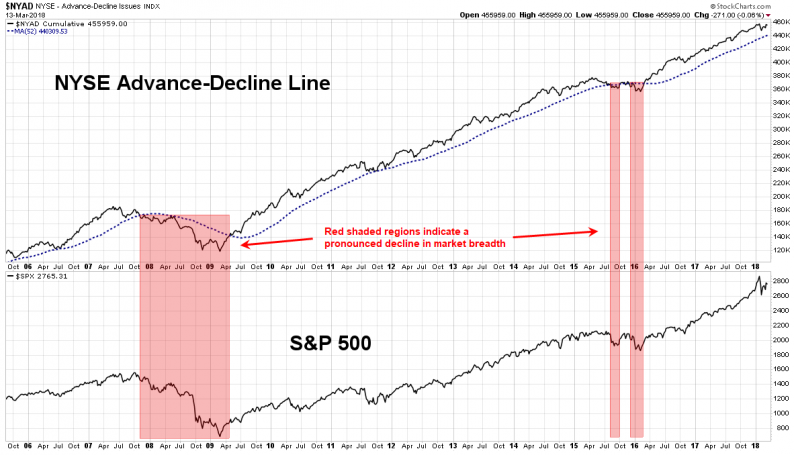

Though we’ve seen markets swing a bit recently, we’re still in positive territory for the year. This time on Financial Sense Newshour, we spoke with Dave Nicoski of Vermillion Research for his take on whether recent pullbacks hint at a more significant

March 13, 2018