The majority of U.S. equities have outperformed auto stocks during this most recent bull market. However, economic conditions are picking up for this industry. 2015 looks to book solid growth in both domestic and foreign car sales which will lead the charge in gains for these three stocks Bret Jensen loves to own.

Global auto production and sales in 2014 has been a mixed bag. Domestic sales racked up another good year and are close to being back to the robust levels before the financial crisis. This strength should continue in 2015 with the average age of a U.S. vehicle being over a decade, low financing rates, and the best spurt of job growth in a decade.

Europe continues to struggle with new car registrations near two decade lows. In addition, sanctions on Russia have cratered sales from Europe to Russia. However, auto registrations in the Eurozone have started to creep up in recent months.

South America is suffering through slowing growth and plunging currencies have negatively impacted American operations there. Finally, Chinese auto sales continued to grow at a solid clip. This is a critical market and likely to be the largest auto market for decades to come. Importantly, U.S. automakers are gaining share mostly against the Japanese makers in the Middle Kingdom. Ford (NYSE: F) has doubled its market share over the past two years.

South America is suffering through slowing growth and plunging currencies have negatively impacted American operations there. Finally, Chinese auto sales continued to grow at a solid clip. This is a critical market and likely to be the largest auto market for decades to come. Importantly, U.S. automakers are gaining share mostly against the Japanese makers in the Middle Kingdom. Ford (NYSE: F) has doubled its market share over the past two years.

Overall I am positive on the global auto market in 2015. Domestic sales should show a gain in the low single digits next year, China should again post impressive growth and it is hard to see Europe getting any worse. South America should remain problematic but is a much less important market for automakers’ operations than the other three.

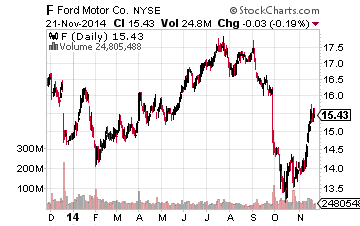

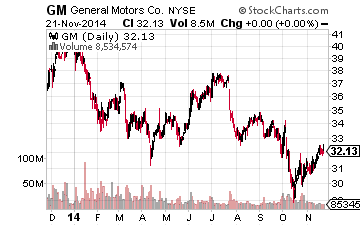

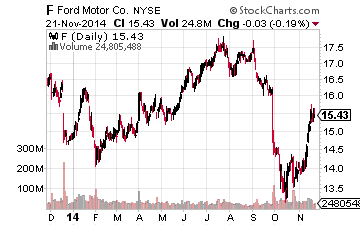

I have been accumulating shares in Ford as well as General Motors (NYSE: GM) in recent weeks. Both look set to outperform the market in 2015 after being laggards in 2014. Both American manufacturing icons are cheap compared to the overall market. Ford goes for less than 10 times next year’s earnings and GM sells for just over seven times next year’s projected earnings. These values are hard to come by in a market that goes for just under 16 times forward earnings currently.

I have been accumulating shares in Ford as well as General Motors (NYSE: GM) in recent weeks. Both look set to outperform the market in 2015 after being laggards in 2014. Both American manufacturing icons are cheap compared to the overall market. Ford goes for less than 10 times next year’s earnings and GM sells for just over seven times next year’s projected earnings. These values are hard to come by in a market that goes for just under 16 times forward earnings currently.

Leave A Comment