If you invested in Google right after its IPO you would have realized an over 1,000% return by today. But, investing in Google today will not give you those same returns, but these three stocks just may.

In late October, the NASDAQ Composite rose above its 200 day moving average shortly after technology bellwether Alphabet Inc. (NASDAQ: GOOG), formerly known as Google, released stellar third quarter 2015 financial results that exceeded Wall Street analyst consensus estimates. As a result, the stock rose over 7% on more than double its average daily volume. While the $700 per share technology leader may still be a solid play at current levels, we have uncovered three small cap technology stocks growing faster than Alphabet, Inc.’s projected 18% EPS growth rate that offer even greater upside potential.

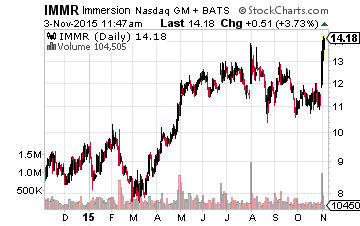

Immersion Corp. (NASDAQ: IMMR)

Much like Alphabet (Google), Immersion Corp. recently released 3Q15 financial results that blew away Wall Street estimates. Earnings per share (EPS) for the period were $0.08 versus expectations of break-even operating figures as the company enjoyed record quarterly revenue. On the heels of this outperformance, IMMR is forecast to double its EPS to $0.40 in 2016 from $0.20 in 2015. As exciting as the future financial growth may be, the company’s technology itself is practically futuristic.

With 2,000 patents to its name, Immersion is the leading innovator of a touch technology known as haptics. The company provides touch feedback solutions to create realistic experiences that enable and enhance digital interactions. Immersion’s technology has been adopted via license in more than 3 billion digital devices that include mobile, automotive, gaming, medical, and consumer electronics developed by world-class companies.

One of the fastest growing applications is the use of the technology in devices used in virtual reality gaming such as wearables, gaming controllers, and even smart phones and tablets. With adoption of the technology accelerating, a 25-30% rise in the stock in the coming months is in the cards. This target represents a reasonable 2016E P/E of around 40x, a premium to most growth stocks due to its high EPS growth rate and technology leadership standing.

Leave A Comment