(Photo Credit: Chris Potter)

Tuesday, October 20

Wednesday, October 21

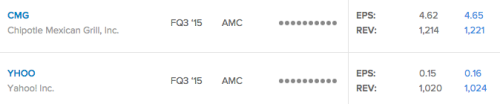

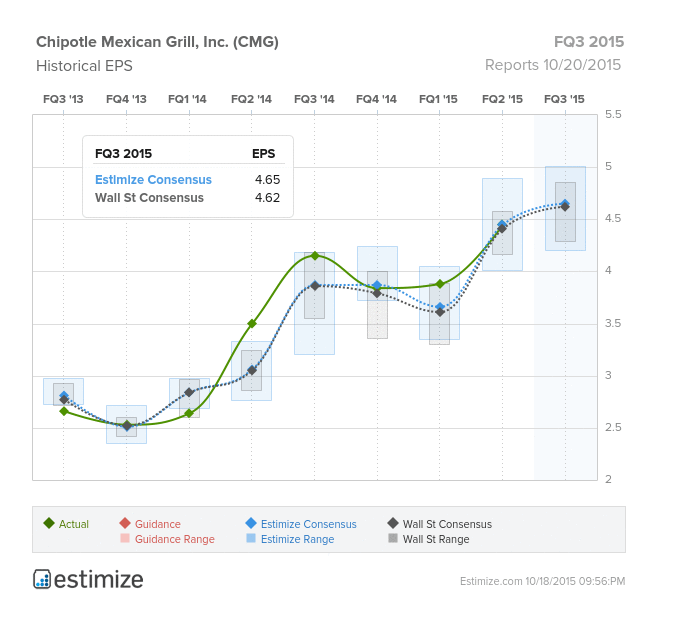

Chipotle (CMG)

Consumer Discretionary – Hotels, Restaurants & Leisure | Reports October 20 after the close.

The Estimize consensus calls for EPS of $4.65, greater than Wall Street’s prediction for $4.62, an increase of 12%. Revenues of $1.221B are slighter higher than the Street’s $1.214B, signaling an expectation for 13% YoY growth, continuing the streak of double digit sales growth since the company IPO’d in 2005.

What to watch: There is always speculation that Chipotle’s growth is slowing down, with same store sales numbers for the second quarter showing a decline YoY and QoQ, however, the estimates for Q3 still paint an encouraging story. For one thing, carnitas returned to the fast casual chain during the third quarter. At the beginning of the year Chipotle decided to suspend relations with its primary pork supplier because they failed to meet their animal welfare standards. The unavailability of pork was part of the reason for the lower SSS in Q2 (some analysts say it shaved off as much as 2%), but at the same time the move was applauded by loyal customers. The company in know for it’s move toward more organic, sustainably grown or raised, non-genetically modified organisms, and lower carbohydrate ingredients. It recently became the first national restaurant company to use only non-GMO ingredients. In recent quarters the fast casual joint has seen improved guest traffic driven by menu innovation. Chipotle has been doing so well domestically that it is now making a big play for Europe, specifically expanding their operations in the UK.

Yahoo (YHOO)

Information Technology – Internet Software & Services | Reports October 20 after the close.

The Estimize consensus calls for EPS of $0.16, one penny higher than Wall Street, but signaling a 69% decline YoY. Revenues are roughly in-line at $1.02B, falling 6.4%.

Leave A Comment