The last 6 years have been great for US companies. Record low interest rates have enabled firms to borrow and refinance expiring borrowing cheaply. Low interest rates have also kept up consumer demand, inflated stock and property prices and therefore also had a wealth effect on consumer expenditure.

Low interest rates have also led to capital outflows to emerging markets and helped emerging market economies do well. In turn this has boosted US export demand further helping profits. In addition wage pressures have been muted as workers have accepted low wage rises as they have been happy just to keep their jobs as the recovery took hold.

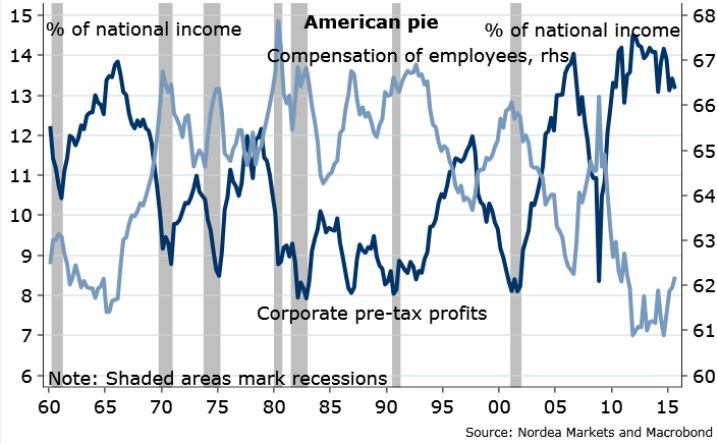

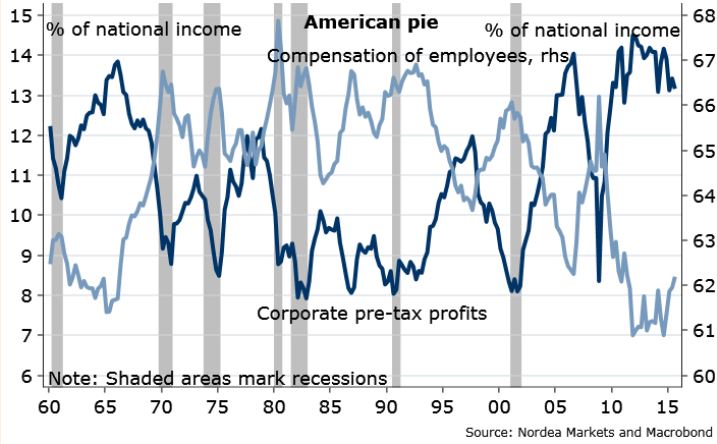

But I have a feeling things are about to change, as the chart below shows while profitability is close to a peak as measured by share of GDP (13%) wage compensation is near record lows (62%). With interest rates about to rise and labour markets relatively tight with US unemployment at 5.00% then we can expect profitability to start to fall and workers to start to demand a bigger share of GDP. Recessions in the actual economy seem to occur when wages shares are around or above the 66% of GDP level. So a recession is not necessarily lying ahead but a fall in profitability for corporates probably is as shares above 13% do not seem to hold for long.

Leave A Comment