Global commodity prices have plummeted over the past few months. Iron ore prices for example, are near ten-year lows; having reached close to US$200 per tonne in 2011, the value was a mere US$39.25 per tonne on Wednesday.

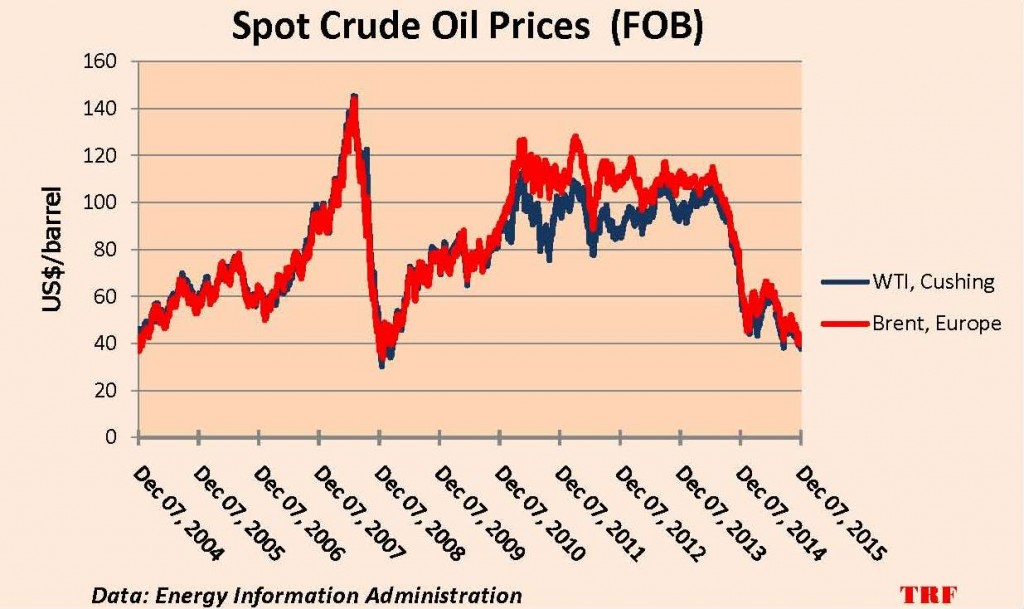

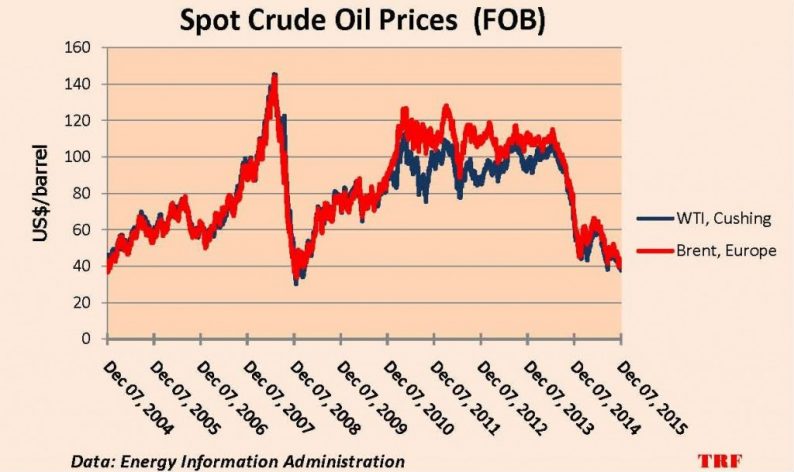

Crude oil prices have also continued a downward trend, driven by a lingering imbalance ? excess of supply over demand ? estimated to be more than 2 million barrels per day (bpd). In the aftermath of the 168th meeting on December 4, of the Conference of the Organization of the Petroleum Exporting Countries, OPEC, crude oil prices closed at near seven-year lows. At that meeting, OPEC resolved not to reduce crude oil output. On Monday (7 December 2015), the international benchmark Brent closed at US$39.69 per barrel and West Texas Intermediate, at US$37.65 per barrel.

The current supply overhang grew largely from the massive production ramp-up in unconventionals, mainly in the United States (shale) and to some extent, Canada (oil sands).

In what was termed a sheikh-versus-shale duel, OPEC, particularly the Gulf States led by Saudi Arabia, sought to rein in those higher-cost producers by increasing output to drive down prices and retain, if not gain market share.

Mission Accomplished

That OPEC strategy is seemingly yielding intended results. The International Energy Agency, IEA, reports that non-OPEC oil supply which was growing at the rate of 2.2 million bpd at the beginning of the year, had fallen to just 300,000 bpd in November. Growth is expected to vanish completely by 2016 due mainly to declining U.S. shale production. According to the Energy Information Administration (EIA), total U.S. crude oil production fell 500,000 bpd between April and November 2015.

The impact of OPEC’s decision on the global oil and gas industry has been significant. With many large-scale projects either cancelled or deferred, capital expenditure declined by 20% in 2015 and is expected to fall an additional 11% in 2016, according to Evercore ISI. As cost-cutting measures, oil and gas as well as oil services companies have laid off a sizeable number of staff and divested billions of dollars worth of assets. In parts of the North American oil patch, once-bustling communities have become near ghost towns.

Leave A Comment