As I wrote this past Tuesday, we were lucky. Thousands who live along the Texas coastline were not.

I am thankful. I am grateful. I am hopeful.

The return to “normalcy,” for most of us, will take some time. It will happen. Let’s just try and remember this fellowship and hang onto it for a while longer.

Review & Update

Speaking of a return to “normalcy,” it didn’t take long for the markets to overlook the disaster from “Hurricane Harvey,” and begin rationalizing why this is yet another “support” for the continuing “bull market.”

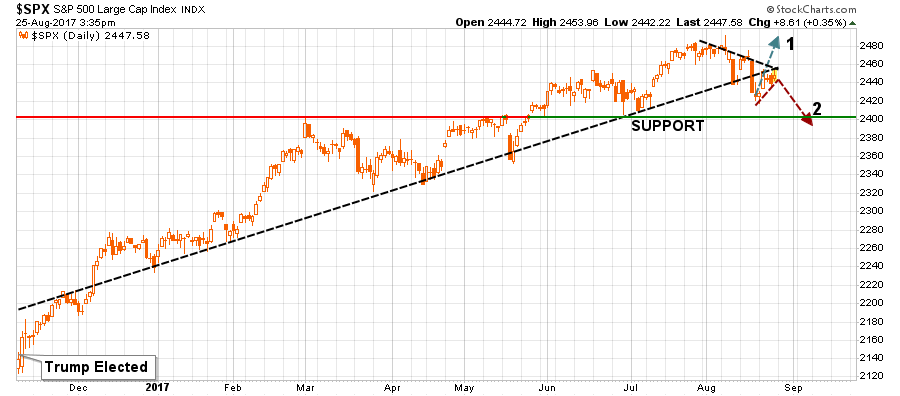

In last week’s missive, I laid out two “scenarios” for the market as noted below:

Scenario 1:

The market regains its footing next week and rallies strongly enough to break above the downward trending levels of previous rally attempts. Such action would confirm the bullish trend remains intact and would provide the opportunity to rebalance equity exposure to model weights accordingly.

Scenario 2:

The market rallies to the upwardly sloping “bullish trend line” that began with the election of President Trump. The rally fails at resistance and turns lower. Such a failure would confirm the current short-term bullish trend has likely concluded leading to a reduction of equity exposure, increases in cash positions and fixed income, and a reduction in overall portfolio equity risk.

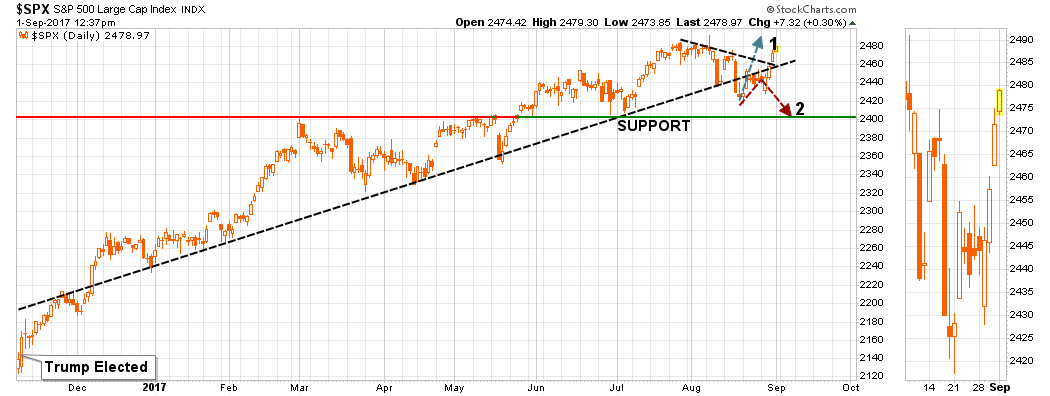

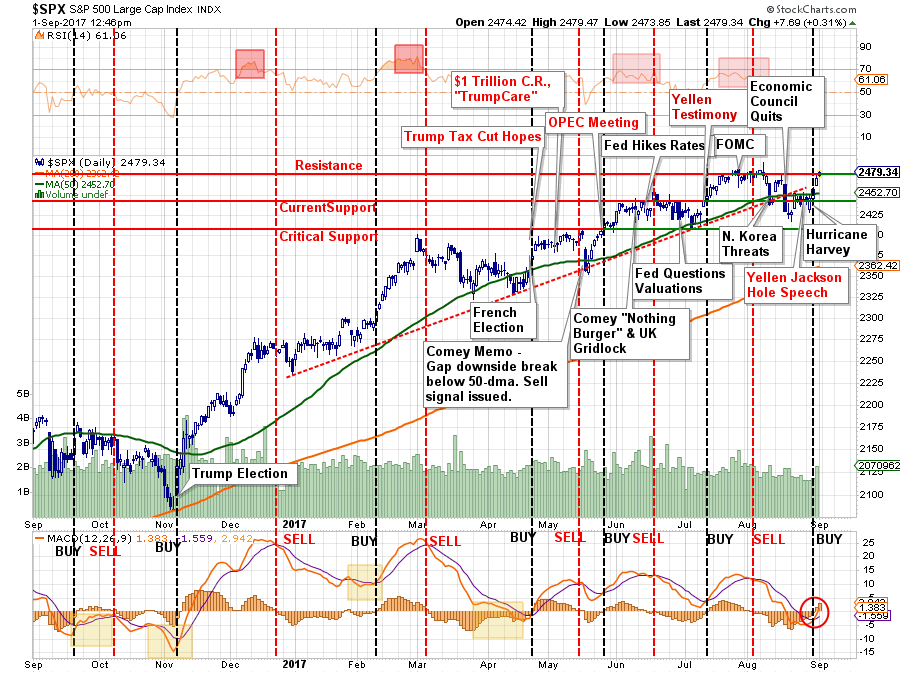

While it looked like “scenario 2” was going to play out early last week, that was reversed as the markets started to bet on the optics of a stimulus fueled boost to the economy.

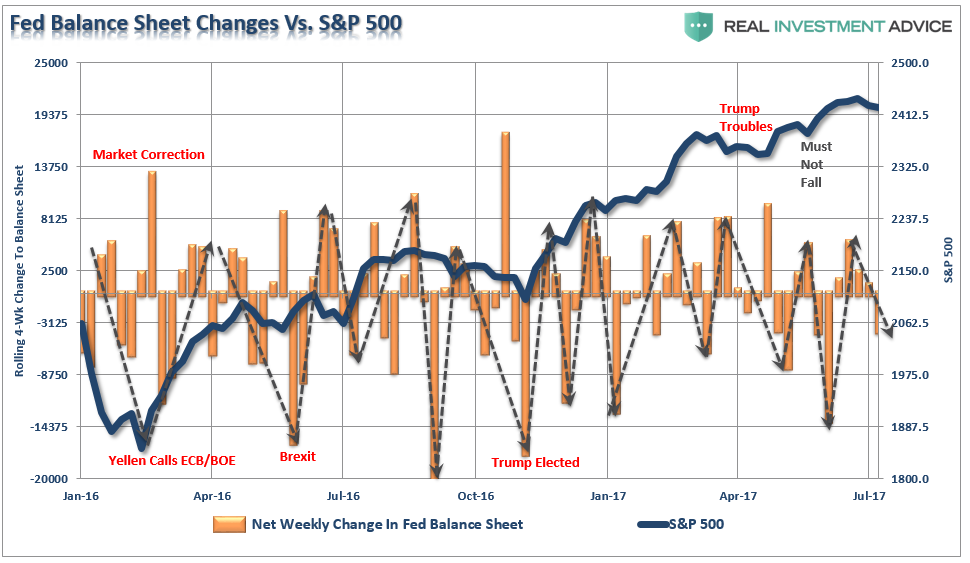

(I have a sneaky suspicion that when I update the Fed Balance Sheet reinvestment analysis next week, shown below, we are going to find a substantial, well-timed, reinvestment by the Central Bank. Wanna bet?)

Regardless, the market broke back above its 50-dma and cleared the recent downtrend to re-confirm the bullish bias. Furthermore, the reversal of the short-term “sell signal” also provides a tailwind for investors currently which suggests that markets should be able to reach all-time highs before the next corrective action begins.

Importantly, the bullish trend remains intact thereby keeping portfolios allocated toward equity risk. This “return to normalcy” is occurring within the context of a very short-term view. With valuations extended, economic data weak and exuberance elevated, this is not a time to ignore the rising longer-term risks to overly aggressive portfolio allocations.

The Rule Of 20

It is this longer-term view I want to focus on for today.

Bryon Wien recently asked the question of where we are in terms of the economy and the market to a group of high-end investors. To wit:

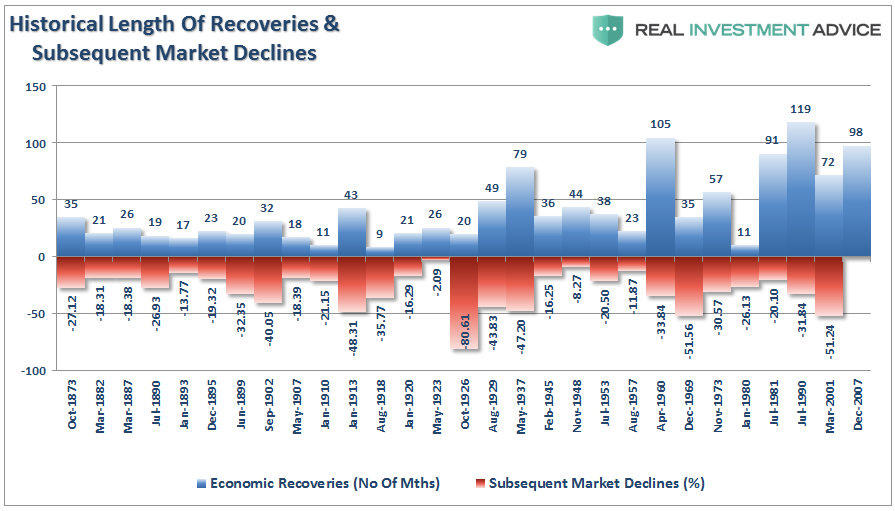

“The one issue that dominated the discussion at all four of the lunches was whether or notwe were in the late stages of the business cycle as well as the bull market. This recovery began in June 2009 and the bull market began in March of that year. So we aremore than 100 months into the period of equity appreciation and close to that in terms of economic expansion.“

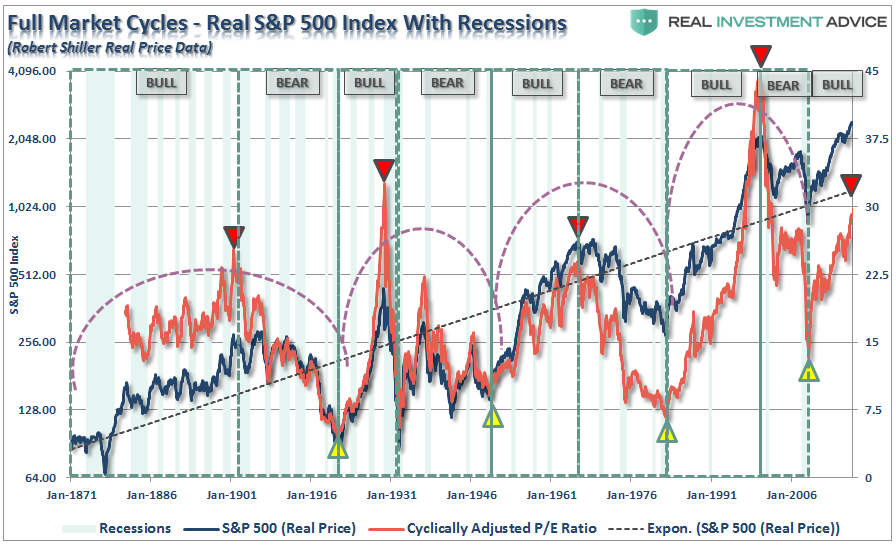

Importantly, it is not just the length of the market and economic expansion that is important to consider. As I explained just recently, the “full market cycle” will complete itself in due time to the detriment of those who fail to heed history, valuations, and psychology.

“There are two halves of every market cycle. “

“In the end, it does not matter IF you are ‘bullish’ or ‘bearish.’ The reality is that both ‘bulls’ and ‘bears’ are owned by the ‘broken clock’ syndrome during the full-market cycle. However, what is grossly important in achieving long-term investment success is not necessarily being ‘right’ during the first half of the cycle, but by not being ‘wrong’ during the second half.

Will valuations currently pushing the 3rd highest level in history, it is only a function of time before the second-half of the full-market cycle ensues.

That is not a prediction of a crash.

It is just a fact.”

Leave A Comment