AT40 = 52.7% of stocks are trading above their respective 40-day moving averages (DMAs)

AT200 = 56.7% of stocks are trading above their respective 200DMAs

VIX = 11.8

Short-term Trading Call: neutral

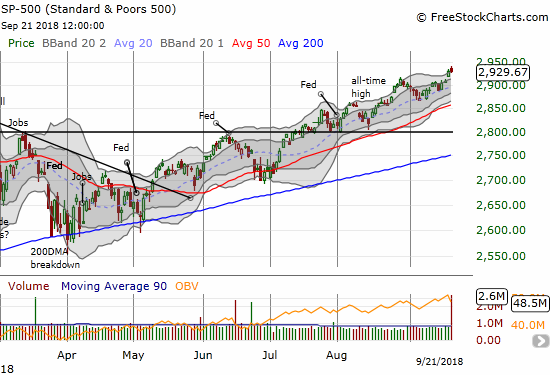

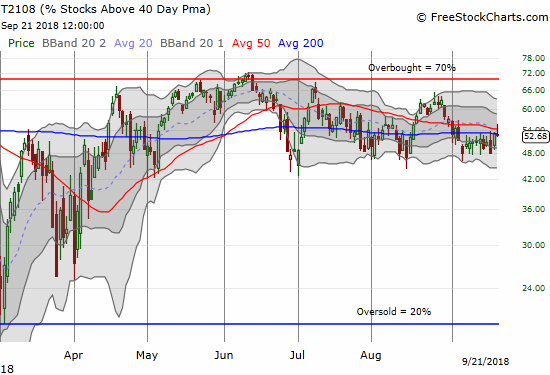

The stock market is not quite out the (short-term) woods yet. Last Wednesday I pointed out why the latest bearish divergence forced me to back down from my cautiously bullish short-term trading call. My neutral stance reflected a fresh wariness over an S&P 500 (SPY) grinding higher without the confirmation of a higher AT40 (T2108), the percentage of stocks trading above their respective 40-day moving averages (DMAs).

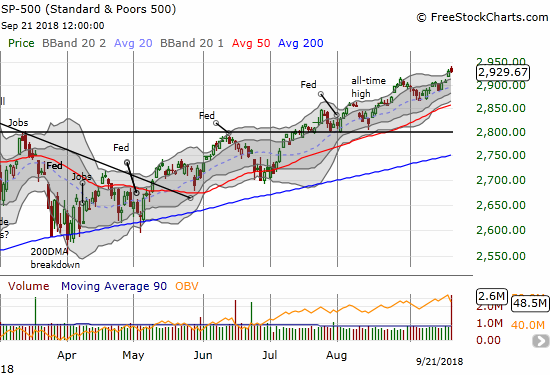

The S&P 500 (SPY) proceeded to bolt higher on Thursday to a fresh all-time high with a close that stretched above its upper Bollinger Band (BB). AT40 traded higher along with the S&P 500, but my favorite technical indicator failed to break out from its two week range which itself is at the bottom of a 5 month range. The stretch above the upper-BB was enough to prevent me from chasing the S&P 500 against my change in short-term trading call. The lack of confirmation from AT40 sealed the deal and even increased the risk for an imminent pullback by my calculation.

On Friday, the S&P 500 (SPY) pressed higher intraday only to fade to a slightly lower close. AT40 broke out and then faded right back into its trading range. With a Federal Reserve meeting as a potential catalyst, I go into the coming week wary of the next short-term pullback.

The S&P 500 is stretching higher on an apparent march toward 3000. However, lately, trading action at the upper Bollinger Band (BB) tends to proceed small pullbacks.

AT40 (T2108) is making no progress and suggests that just a few key stocks/sectors are cajoling the S&P 500 higher these days.

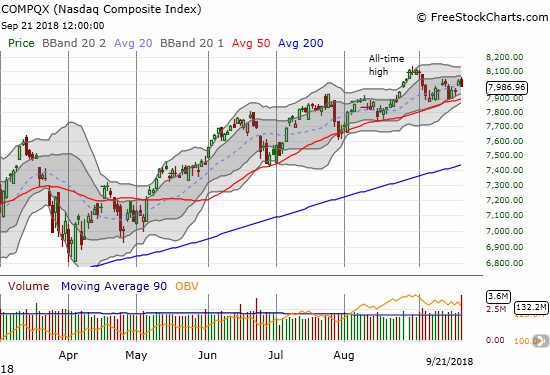

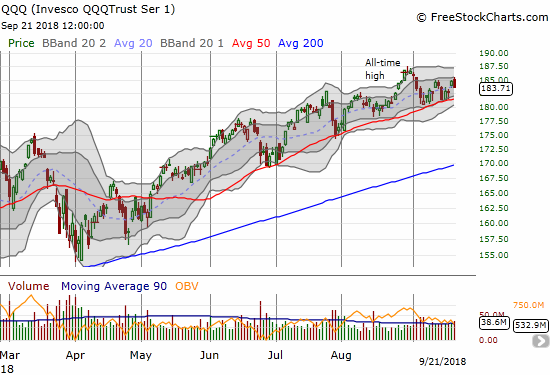

In an on-going change of fortunes, the tech-laden NASDAQ and Invesco QQQ Trust (QQQ) are lagging the S&P 500. Both indices last hit all-time highs almost a month ago. Tech stocks have been unable to regain momentum since then even though the uptrending 20 and 50DMAs continue to guide tech stocks.

The NASDAQ is stuck in a 2-week trading range pivoting around the uptrending 20DMA and guided by uptrending 50DMA support.

The Invesco QQQ Trust (QQQ) is following the pattern of the NASDAQ.

The volatility index, the VIX, remains a very interesting part of the stock market’s divergent behavior. The VIX ended a down week at 11.7, just above recent lows and just above the 11 level which marks “extremely low volatility” (ELV). This level of complacency underlines the market’s overall bullish mood. It also makes portfolio protection very cheap. October is the last month of the year that includes a history of danger for the stock market, so it makes sense to load up on the “bargains” on SPY put options and long volatility trades. Since I am not (yet?) bearish, I chose with the long volatility trade. I bought yet another tranche of ProShares Ultra VIX Short-Term Futures (UVXY) call options at the same time I let the last tranche wither away to nothingness.

Leave A Comment