Back in September, the FOMC announced that it was in October going to start normalizing its balance sheet. The policy statement issued that day included all the usual qualifications of “solid”, “strengthen”, and “picked up.” The near-term risks to the economy, it was written, “appear roughly balanced.”

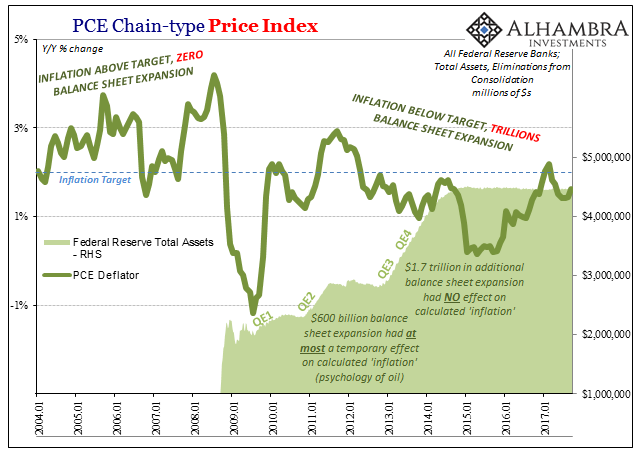

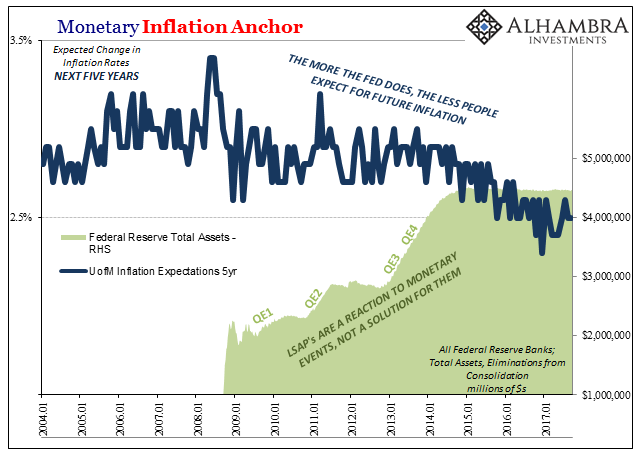

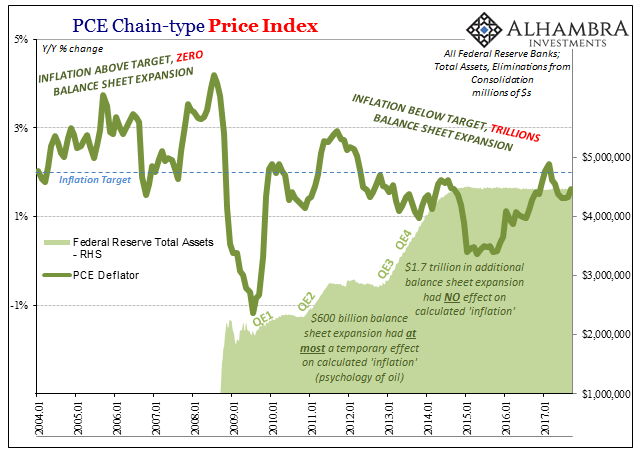

Not all was well with the economic situation, however, as the central bank’s policymaking body continues to wrestle with inflation. They might wish for political relief to their dual mandate, but in this case they have no choice but to live with the results – especially since they are largely of their own making. After mentioning economic risks, the statement then throws out there, “but the Committee is monitoring inflation developments closely.”

Having missed their definition of price stability, 2% sustained growth for the PCE Deflator, so many times, they can’t just ignore it, nor can they keep suggesting that it is delayed due to “transitory” factors.

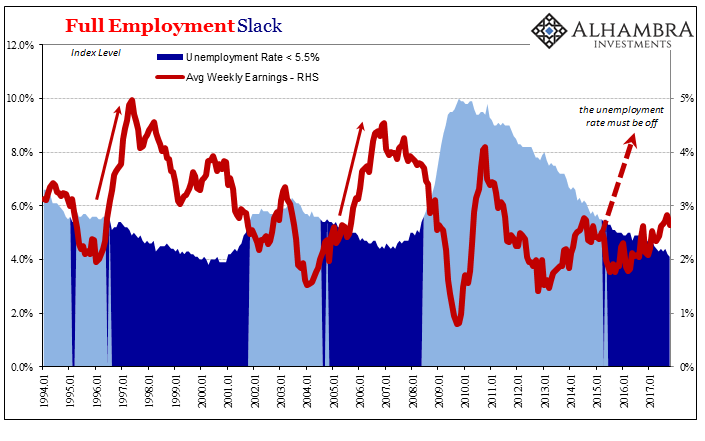

As noted this morning, the Committee has put most if not all of its inflation eggs in the unemployment rate basket. The one thing they are counting on that might otherwise clearly suggest inflation to behave is a low and lower unemployment rate. As labor market slack is used up and exhausted, employers will have to compete for workers, raising wages and pay, leading, the FOMC believes, to 2% sustained consumer inflation at some point.

That magical point, however, never seems to arrive, and worse the data never really suggests it is close.

No matter how low the unemployment rate goes, wage inflation remains clearly absent. There is a growing minority dissent within the FOMC because of this. Enough time has passed at a very low unemployment rate such that if it was going to happen it would have long before October 2017. Therefore, it is only logical to start to question whether or not policymakers know what they are talking about in this matter (and then every other).

Leave A Comment