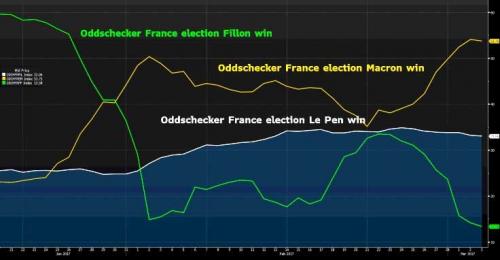

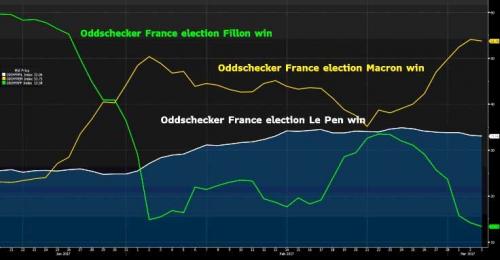

World stocks pulled back from all-time highs, and European bourses initially followed U.S. futures and Asian shares lower, however both European risk sentiment as well as E-Minis rebounded after an Odoxa poll showed Macron overtaking Le Pen in the 1st round for the first time, and that the addition of Juppe instead of Fillon may see a 2nd round run-off between Macron vs Juppe, leading to a slump in Bund futures to session lows, and a bounce in European stocks. The Bloomberg Dollar Index (BBDXY) was set to break its longest winning streak since May, as Janet Yellen prepared to weigh in on the path for interest rates at 1pm today.

France: First time: #Macron (EM-*) takes the lead (Odoxa poll). #Sondage #Presidentielle2017 pic.twitter.com/dW8nzKgXWh

— Europe Elects (@EuropeElects) March 3, 2017

Meanwhile, as reported yesterday, the Fillon presidential campaign is all but over, after authorities raided his home, many Republicans disavowed him, and earlier this morning his spokesman announced his resignation.

However, today’s main event is not in Europe, but in Chicago, where at 1pm all eyes will be on Fed chair Yellen to see if she will confirm the recent dramatic hawkish turn in Fed sentiment. As DB’s Jim Reid puts it, there is no doubt that this week’s main story has been the big rates repricing. President Trump’s speech was hotly anticipated and closely watched but ultimately has still left many questions unanswered. Instead markets have been busy scurrying to reassess Fed tightening expectations following a chorus of hawkish Fed commentary over the last few days.

As a result, since the close last Friday the market has gone from essentially pricing in a low-ish probability of a March Fed rate hike to now debating when the second rate hike of 2017 might be with March now not far off fully priced. The final nail in the coffin might could be Yellen’s speech this afternoon when she is due to speak on the economic outlook at an event in Chicago. The speech is due at 1pm ET and it would be a very bold move to contradict the recent guidance provided by her Fed colleagues this week. In addition to Yellen, we will also hear from Vice-Chair Fischer at 12:30pm ET, as well as Evans, Lacker and Powell prior to that. So there’s plenty to get through.

Asia started off weak, with South Korean equities tumbling with the won on reports that China will curb tourism to the country. The euro and the yen initially strengthened, paring weekly losses caused by increasing confidence that the Federal Reserve will raise rates this month, however, the Yen has since slumped on the abovementioned risk-on news out of Europe. The 10-year Treasury yield was flat after climbing for the past four days and gold edged lower.

Investors are awaiting justification from Yellen for the recent advance in the dollar and stocks suggesting increasing odds for tighter monetary policy. Rallies in equities and commodities predicated on stronger economic growth failed to keep pace even as reports showed a pickup in European inflation and a tighter U.S. jobs market. A report from Japan showed a gauge of consumer prices rose for the first time since December 2015.

“After the gains in the past few days, people are happy to wait to see what next week holds,” said Ben Kumar, a London-based investment manager at Seven Investment Management, which oversees about 10 billion pounds ($12 billion). “The narrative is that we’re in a rate hiking cycle now and any disruption to that will be perceived negatively.”

The dollar index was poised for its fourth straight weekly gain, though it was about 0.1 percent lower on Friday. “The U.S. dollar has been snapped up across the board as a March Fed hike is heavily priced in,” said Sean Callow, a senior currency strategist at Westpac. “All it took was about a hundred comments from Fed officials, but markets have finally decided that “fairly soon” means less than two weeks and that perhaps 3 hikes this year means 3 hikes this year.”

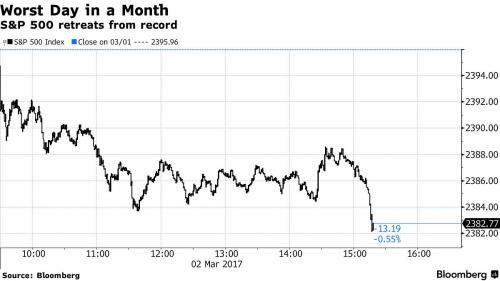

Expectations of a Fed rate hike soured the party on Wall Street, however, as financials led major U.S. indices lower. That weakness spilled over to Europe where the benchmark STOXX 600 fell for a second day dragged lower by industrials and consumer-related stocks.

The total market value of global stock markets hit an all-time high of $56.7 trillion earlier this week, having added more than $4 trillion since Donald Trump’s election as U.S. president last November. More than half of those gains were down to the rally in U.S. stocks, into which investors have pumped money for four of the past five weeks, according to the latest data from Bank of America Merrill Lynch and fund tracker EPFR.

In Europe, economic data continued to point to a brightening recovery as activity in euro zone businesses grew at its quickest pace in nearly six years in February and job creation reached its fastest in almost a decade. Rising euro zone inflation, along with easing anxieties over elections in France and growing talk of a March U.S. rate rise, put Germany’s benchmark 10-year government bond yield on track for its biggest weekly rise since November’s U.S. election.

Leave A Comment