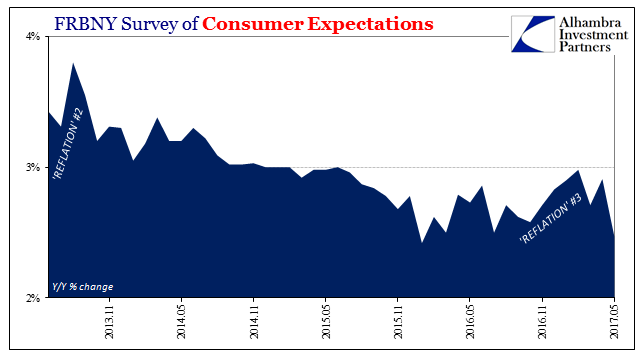

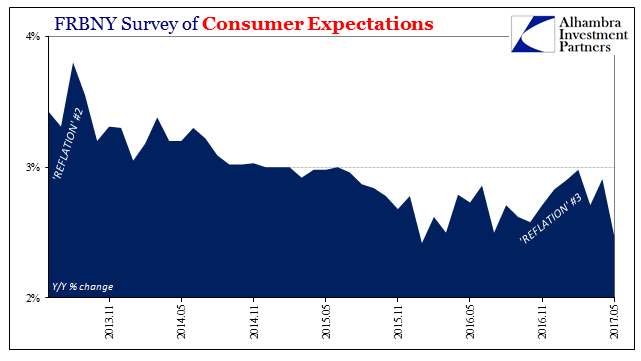

The Federal Reserve Bank of New York has for the past almost four years conducted its own assessment of consumer expectations. Though there are several other well-known consumer surveys, FRBNY adding another could be helpful for corroborating them. Unfortunately for the Fed, it has.

The latest update for May 2017 suggests a considerable decline in forward inflation expectations, particularly those asked of consumers for three years ahead. At a median level of just 2.47%, that is barely more than the series low of 2.45% registered in January last year. So much for “reflation.”

Though the data does not go back all that far, it does capture now two “reflation” episodes. The first in 2013 was as the UST yield curve, eurodollar futures, or practically anything else. Consumers were as markets enamored with the idea of full recovery as well as it being close at hand. For this series, the mediam 3-year expectation was nearly 4% at its peak. That infatuation was only brief, as despite constant mainstream rhetoric and predictions for better days, inflation expectations as well as markets continued only in the wrong direction over the next few years of the “rising dollar.”

It has left officials exasperated, even as the acceleration of inflation this year was predictably brief.

The data may add to concerns over a recent decline in U.S. inflation, which has led investors to take a skeptical view toward additional Fed interest-rate increases. The U.S. central bank’s Federal Open Market Committee is widely expected to vote on a rate hike when it concludes a two-day gathering in Washington on Wednesday, but market odds on increases at their meetings in September and December are only about one in four a piece, according to the prices of federal funds futures contracts.

It isn’t just US inflation that has, for authorities anyway, disappointed. Last Friday, Chinese government sources reported that country’s CPI at 1.5% year-over-year also for May 2017. That is half the rate specified by government decree, an explicit target set by political officials for the PBOC to hit via monetary policy means. Though 1.5% is slightly above 0.8% estimated for February, it is still more like early 2016 than global or domestic “reflation.”

Leave A Comment