Two credit card giants, American Express and Visa, are scheduled to report their earnings within a day of each other. American Express reports after markets close tonight, and Visa reports tomorrow afternoon. While American Express is struggling to appeal to affluent users, Visa is advancing in technology by making Visa Checkout one of the major online payment tools. Overall, analysts are optimistic for both companies but for different reasons.

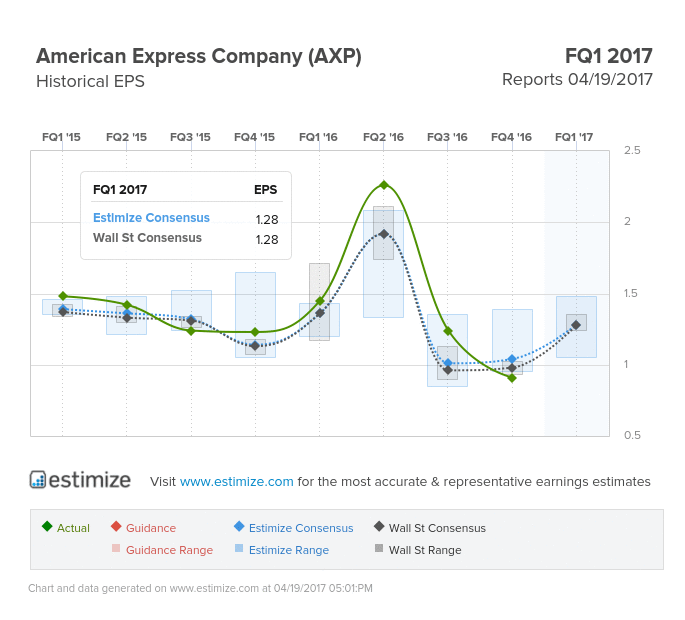

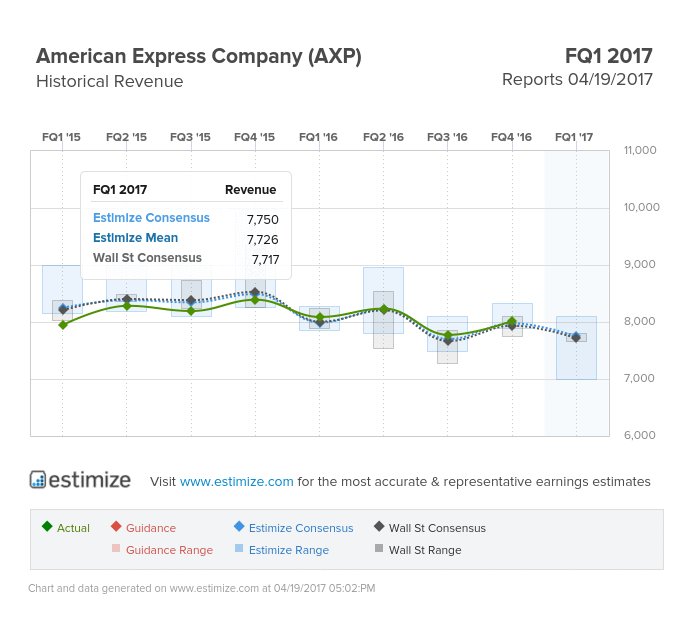

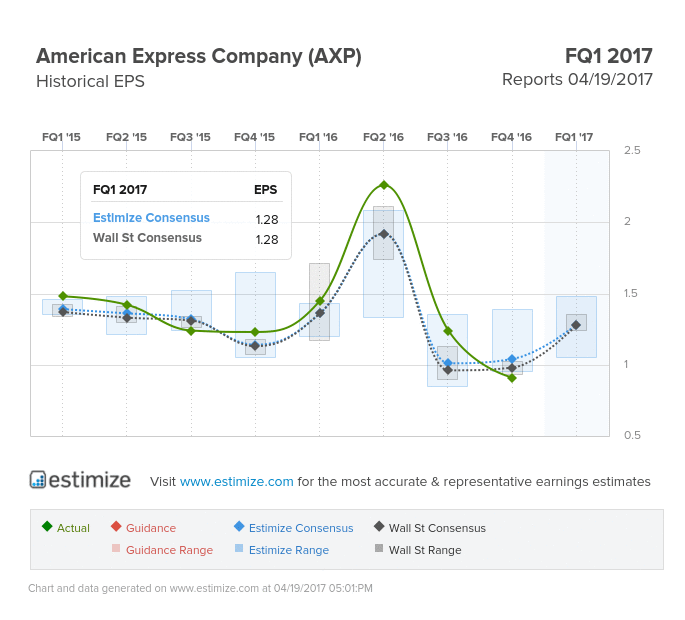

American Express (AXP) Reports April 19th: The Estimize community is calling for earnings per share of $1.28, one cent above the Wall Street estimate, and revenue of $7.731 billion, which is $14 million ahead of Wall Street. The year-over-year (YoY) growth estimate is -12%, but still 14 percentage points higher than last quarter. In 2016, AXP struggled with its earnings growth due to its lost partnership with Costco. However, analysts at Estimize have shown a lot of confidence for this quarter due to the company’s strong position and customer base in the credit market. One challenge that awaits AXP is its generational gap between new and long-time users. The new generation places higher value on rewards and experiences rather than the traditional and stable lifestyle that AXP represents.

Visa, Inc (V) Reports April 20th: Analysts at Estimize are calling for earnings per share of $0.82, 3 cents ahead of the Wall Street estimate, and $4.343 billion in revenue, $46 million ahead of the sell side’s estimate. The expected year over year growth rate stands at 16%, which is 8 percentage points lower than last quarter’s estimate. Overall, analysts are optimistic about Visa because of its edge in digital lending. Visa recently announced that it has reached a milestone by expanding Visa Checkout to more than 20 million enrolled accounts. Visa Checkout offers consumers an expedited and secure payment experience for online transactions.

Leave A Comment