Apple and most stocks do routinely well during the 4th quarter, and especially the last couple of months of trading after earnings are out, and the fund managers are pushing everything up with the goal of making their trading numbers by year end window dressing. It is amazing more people don`t realize this phenomenon and just buy December expiration calls on the SPY after the usual selloffs that happen in the third quarter, and wait for the holiday rally where stocks routinely melt up at year end.

$125 a Share

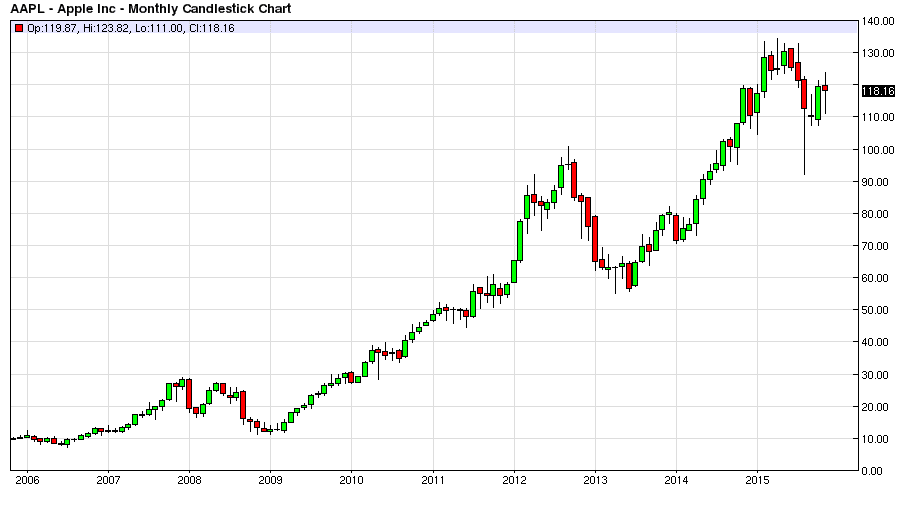

Apple almost touched $124 a share after earnings before some negative news came out regarding the supply chain which hinted at slower demand for iPhones towards year end, and the stock reached its all-time high of almost $135 a share in late April of 2015. But if you are not already in at a good price for a long term short of Apple stock, then hope for one more run-up into year-end holiday trading to position yourself for the inevitable decline in this once Wall Street darling. Anything over $125 a share is an excellent price entry point to short this stock, and have a long term positive expected return on your investment from the short side. This stock should continue to put in lower highs and lower lows for the next five years, and ultimately continue lower for the next decade as this company eats through its massive cash reserves trying to come up with their next iPhone blockbuster product in a declining margin world.

Large Institutional Ownership

Apple stock is a widely held stock by institutions, hedge funds and fund managers. This stock is basically a core holding in many fund managers portfolios, this is bad news once the bloom comes off of this rose, and investors start to see the long-term writing on the wall regarding increased costs and declining margins across the variety of Apple products it offers to consumers. In the end they are in a commoditized business, and this story never ends well judging by the history in this space over the last 50 years.

Leave A Comment