The Australian dollar was on fire in a very busy week, reaching new highs. The upcoming week is not as busy but still, consists of the all-important employment report. Here are the highlights of the week and an updated technical analysis for AUD/USD.

The RBA left the interest rates unchanged and tried to talk down the Aussie, but to no success. GDP came out at a robust 0.8%, giving a boost to the currency. On the other hand, retail sales disappointed by remaining flat and the trade balance fell short as well. AUD/USD also enjoyed the weakness of the US dollar, that suffered from the Fed’s dovishness.

Updates:

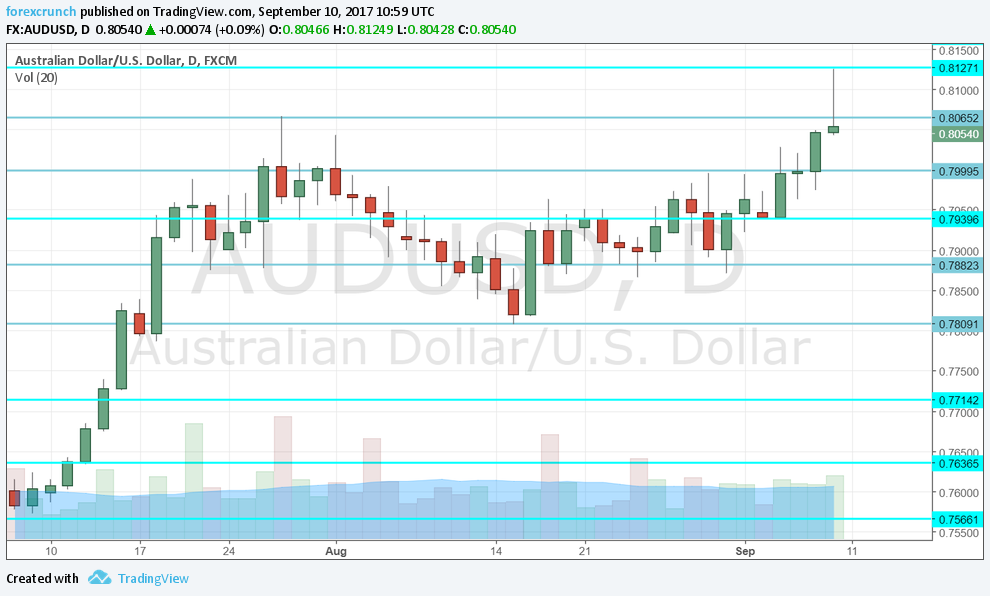

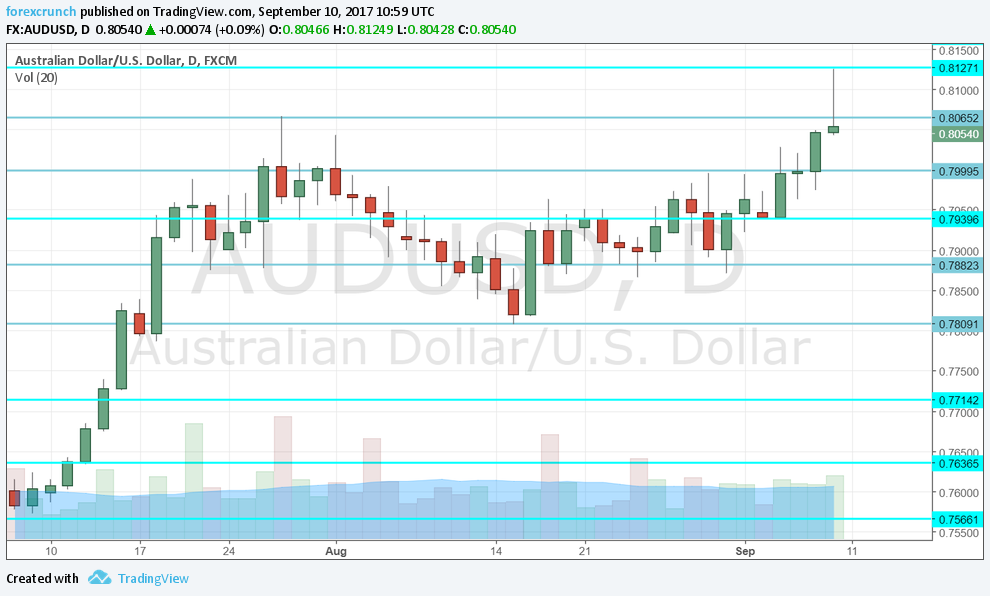

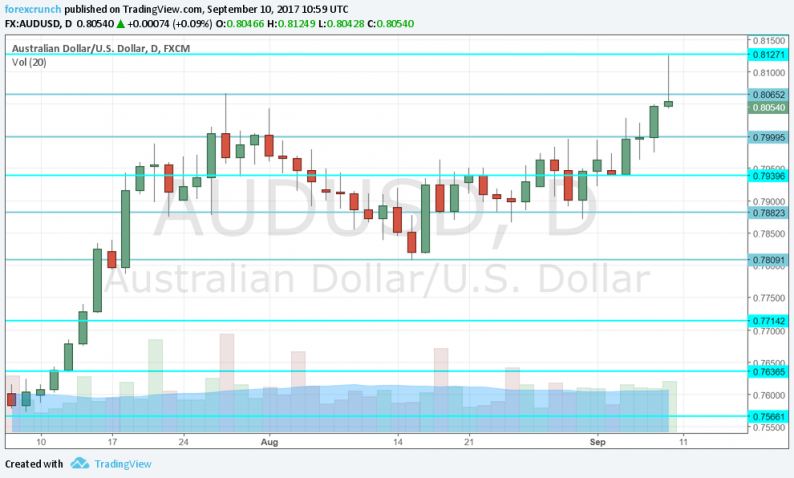

AUD/USD daily graph with support and resistance lines on it. Click to enlarge:

NAB Business Confidence: Tuesday, 1:30. The National Australia Bank has reported a rise in business confidence back in July: a rise from 8 to 12 points. Given the mixed past, we could see a slide now.

Westpac Consumer Sentiment: Wednesday, 00:30. Consumer sentiment has been falling in most recent months. In August, sentiment dropped by 1.2%, after rising in July. We now get the figure for September.

MI Inflation Expectations: Thursday, 1:00. The Melbourne Institute’s inflation measure fills the gap: the government releases CPI data only once per quarter. According to MI, expectations for prices rises remain elevated. An advance of 4.2% was seen in July.

Jobs report: Thursday, 1:30. Australia’s job market is quite robust. During most months this year, job gains exceeded expectations. A gain of 27.9K was seen in July. A rise of 19.2K is on the cards. The unemployment rate stood at 5.6%, lower than earlier in the year. A similar figure is expected 5.6%.

Chinese industrial output: Thursday, 2:00. China is Australia’s No. 1 trade partner, and a rise in Chinese industrial production implies higher demand for Australian metals. Output rose by 6.4% y/y in July, lower than expected but similar to levels seen earlier in the year. Note that the world’s No. 2 economy also publishes fixed asset investment and retail sales. A rise of 6.6% is projected.

Leave A Comment