Yes, austerity really kills real people, and it kills the societies they live in. Let’s try and explain this in simple terms. It’s a simple topic after all. Austerity is a mere left-over from faith-based policies derived from shoddy economics, and economics is a shoddy field to begin with. The austerity imposed on and in several countries and their economies after 2008, and the consequences it has had in these economies, cannot fail to make you wonder what level of intelligence the politicians have who did the imposing, as well as the economists who advised them in the process.

We should certainly not forget that the people who make these decisions are never the ones affected by them. Austerity hurts the poor. For those who are living comfortably -which includes politicians and economists that “matter”-, austerity at worst means eating and living somewhat less luxuriously. For the poor, taken far enough, it will mean not eating at all, not being able to afford clothing, medical care, even housing. Doing without 10% of very little hits much harder than missing out on 10% of an abundance.

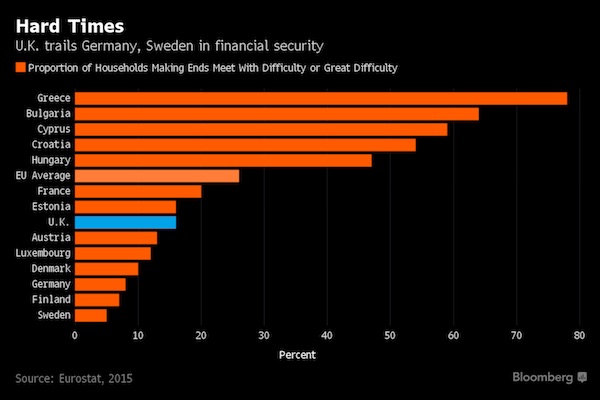

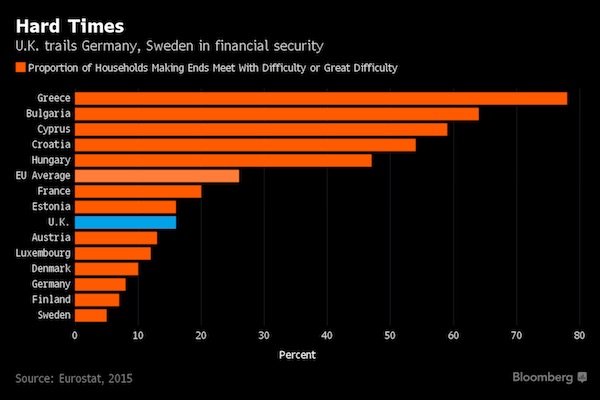

And even then there are differences, for instance between countries. The damage done to British housing, education and health care by successive headless chicken governments is very real, and it will require a huge effort to restore these systems, if that is possible at all. Still, if the British have any complaints about the austerity unleashed upon them, they should really take a look at Greece. As this graph of households having a hard time making ends meet makes painfully clear:

Britain ‘only’ suffers from economically illiterate politicians and economists. Greece, on top of that, has to cope with a currency it has no control over, and with the foreign -dare we say ‘occupying’?- powers that do. A currency that is geared exclusively to the benefit of the richer Eurozone nations. The biggest mistake in building the EU, and the Eurozone in particular, is that the possibility has been left open for the larger and richer nations to reign over the smaller and poorer almost limitlessly. These things only become clear when things get worse, but then they really do.

This ‘biggest mistake’ predicted the end of the ‘union’ from the very moment it was established; all it will take is time, and comprehension. Eurozone rules say a country’s public debt cannot exceed 60% and its deficit must remain less than 3%. Rules that have been broken left right and center, including by the rich, Germany, France, who were never punished for doing so. The poor are.

These limits are completely arbitrary. They come from the text books of the same clueless cabal of economists that the entire Euro façade is based on. The same cabal also who now demand a 3.5% Greek budget surplus into infinity, the worst thing that can happen to an already impoverished economy, because it means even more money must flow out of an entity that already has none.

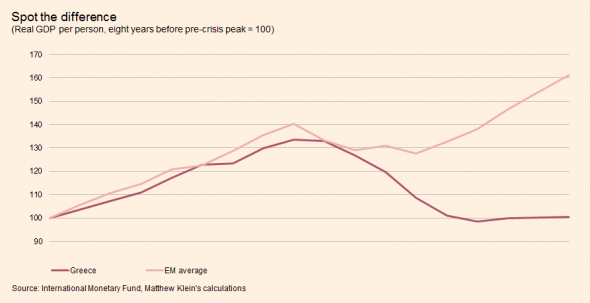

But let’s narrow our focus to austerity itself, and what makes it such a disaster. And then after that, we’ll take it a step further. We can blame economists for this mess, and hapless politicians, but that’s not the whole story; in the end they’re just messenger boys and girls. First though, here’s what austerity does. Let’s start with Ed Harrison talking about some revealing data that Matt Klein posted on FT Alphaville about comparing post-2008 Greece to emerging economies:

Europe’s Delusional Economic Policies

Here’s how Matt put it: “Greece had a very different post-crisis experience: it never recovered. By contrast, all the other countries were well past their pre-crisis peak after this much time had elapsed. On average, Argentina, Brazil, Indonesia, Thailand, and Turkey have outperformed Greece by more than 40 percentage points after nine years.”

“.. unlike those countries, Greece lacked the ability to use the exchange rate as a shock absorber. So while Brazil and Greece faced the same type of downturn in dollar terms – about 45% in GDP per person – Brazilian living standards only deteriorated about 2%, compared to 26% in Greece. The net effect is that Greece had a relatively typical crisis in dollars but an unprecedently painful one in the terms that matter most”.

[..] Greece doesn’t have its own currency so the currency can’t depreciate. Greece must use the internal devaluation route, which makes its labor, goods and services cheaper through a deflationary path – and that is very destructive to demand, to growth, and to credit.

[..] it’s not about reforms, people. It’s about growth. And the euro – and the policies tied to membership – is anti-growth, particularly for a country like Greece that is forced to hit an unrealistic 3.5% primary surplus indefinitely.

Another good report came from the WaPo at about the same time Ed wrote his piece, some 4 weeks ago. After Matt Klein showing how hard austerity hit Greece compared to emerging economies, Matt O’Brien shows us how austerity hit multiple Eurozone countries, compared to what would have happened if they had not cut spending (or introduced the euro). It is damning.

Austerity Was A Bigger Disaster Than We Thought

Cutting spending, you see, shouldn’t be a problem as long as you can cut interest rates too. That’s because lower borrowing costs can stimulate the economy just as much as lower government spending slows it down. What happens, though, if interest rates are already zero, or, even worse, you’re part of a currency union that means you can’t devalue your way out of trouble? Well, nothing good.

House, Tesar and Proebsting calculated how much each European economy grew — or, more to the point, shrank — between the time they started cutting their budgets in 2010 and the end of 2014, and then compared it with what actually realistic models say would have happened if they hadn’t done austerity or adopted the euro.

According to this, the hardest-hit countries of Greece, Ireland, Italy, Portugal and Spain would have contracted by only 1% instead of the 18% they did if they hadn’t slashed spending; by only 7% if they’d kept their drachmas, pounds, liras, escudos, pesetas and the ability to devalue that went along with them if they hadn’t become a part of the common currency and outsourced those decisions to Frankfurt; and only would have seen their debt-to-GDP ratios rise by eight percentage points instead of the 16 they did if they hadn’t tried to get their budgets closer to being balanced.

In short, austerity hurt what it was supposed to help, and helped hurt the economy even more than a once-in-three-generations crisis already had.

[..] the euro really has been a doomsday device for turning recessions into depressions. It’s not just that it caused the crisis by keeping money too loose for Greece and the rest of them during the boom and too tight for them during the bust. It’s also that it forced a lot of this austerity on them. Think about it like this. Countries that can print their own money never have to default on their debts – they can always inflate them away instead – but ones that can’t, because, say, they share a common currency, might have to.

Just the possibility of that, though, can be enough to make it a reality. If markets are worried that you might not be able to pay back your debts, they’ll make you pay a higher interest rate on them – which might make it so that you really can’t.

In other words, the euro can cause a self-fulfilling prophecy where countries can’t afford to spend any more even though spending any less will only make everything worse.

That’s actually a pretty good description of what happened until the ECB belatedly announced that it would do “whatever it takes” to put an end to this in 2012. Which was enough to get investors to stop pushing austerity, but, alas, not politicians. It’s a good reminder that you should never doubt that a small group of committed ideologues can destroy the economy. Indeed, it’s the only thing that ever has.

Leave A Comment