Photo Credit: Louis Raphael

Adobe Systems Inc. (ADBE) Information Technology – Software | Reports March 16, After Market Closes

Adobe Systems kicks off fiscal 2017 tomorrow with its scheduled first quarter report after the closing bell. The significant strides Adobe made in the Creative Cloud and Marketing Cloud businesses continue to translate into robust financial performance. Earnings and revenue in each of the past 10 quarters exceeded analysts expectations, leading to a strong surge in the stock price.Shares climbed nearly 40 percent in the past 12 months and historically increase an additional 3 percent immediately following an earnings report. Investors expect the first quarter to accomplish 2 key goals; beat target estimates and push share prices higher.

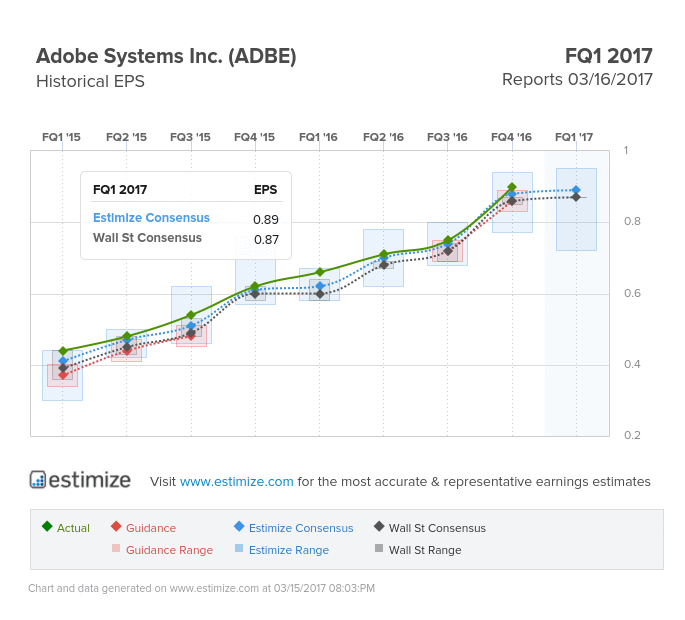

Analysts at Estimize peg earnings at 89 cents per share, roughly 34 percent higher than the same period the previous year. That estimate is essentially unchanged since Adobe’s most recent report in December. Revenue for the period is expected to jump 20 percent to $1.65 billion, marking 7 consecutive quarters of over 20 percent growth.

A large portion of the company’s recent success originates from strong adoption in Creative Cloud and Digital Media segments. The former along with Document Cloud drove digital media annualized recurring revenue to $4.01 billion in the fourth quarter, representing a 27 percent increase from the previous quarter. Digital Media posted more impressive gains, expanding by 33 percent from a year earlier to $1.08 billion. Rounding out the Q4 report was a 32 percent increase in revenue from marketing cloud to $465 million. Strong adoption rates continue to drive robust revenue, profit and cash flow in recent quarterly reports and will serve as a catalyst for future reports.

That said, investors will be carefully watching the company’s annualized recurring revenue. If this begins to slow down it indicates that users are letting their subscriptions expire or the company isn’t doing a good job of upselling its existing user base. Moreover, lower end market demand and increasing competition from companies like Microsoft could weigh down earnings.

Leave A Comment