Experian recently released their Q4 2016 Automotive Finance Market update which includes a lot of statistics that seem to confirm our frequently documented concerns about the sustainability of the current level of annual auto sales (see here, here and here for our recent notes on the topic).

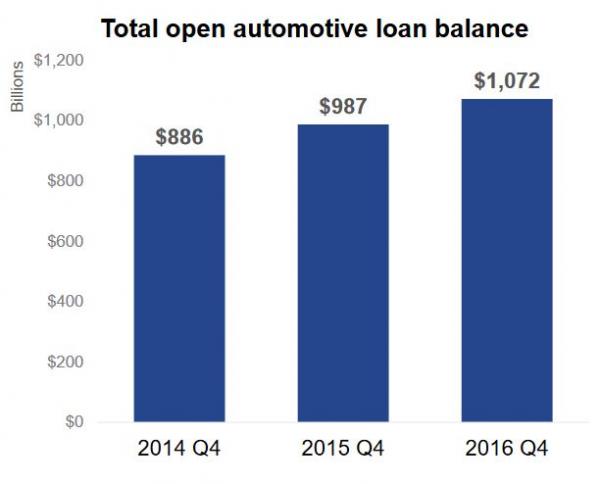

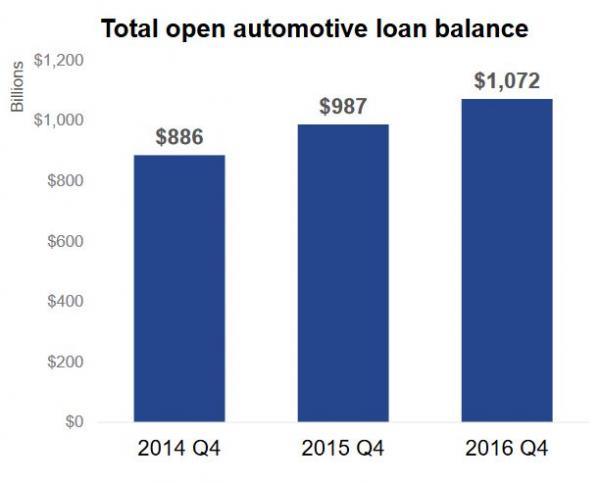

First, there is the staggering growth of auto loans outstanding. It should be readily apparent to almost anyone that a 21% expansion in credit issuance over the course of just two years likely implies there has been at least some degradation in underwriting standards.

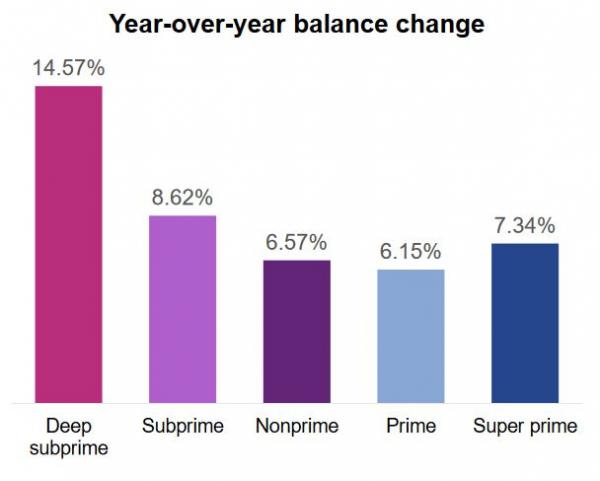

But you don’t have to speculate as Experian lays out the facts…and, sure enough, the outstanding loan balances of “Deep Subprime” borrowers have increased by double the amount of any other bucket, other than the plain “Subprime” folks, of course.

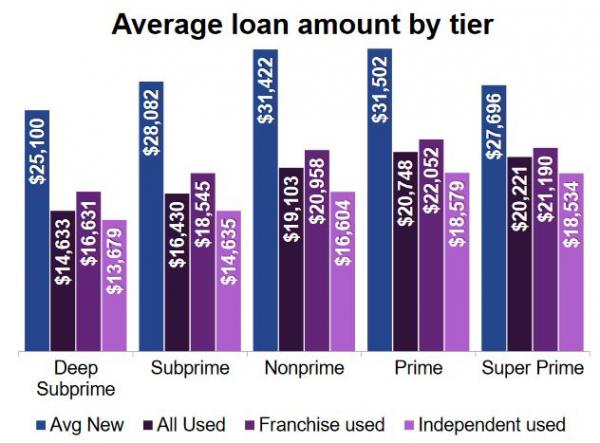

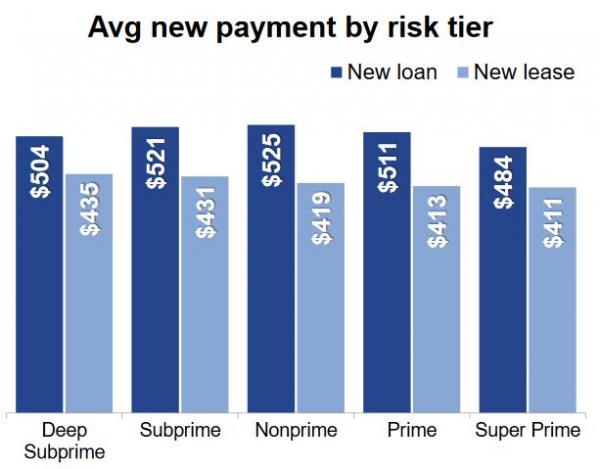

Of course, an impaired credit profile has, in no way, hampered America’s entitled consumers’ demand for driving around in style as average subprime loan balances actually exceed “Super Prime.”

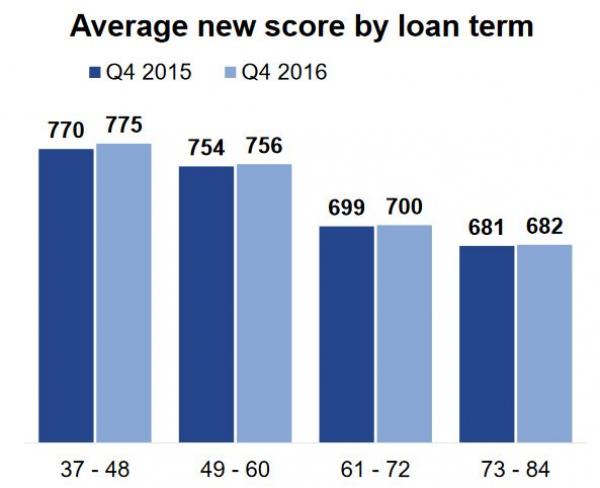

But don’t worry, those subprime borrowers can “afford” those loans because they simply offset higher interest costs with stretched out terms…

…which keeps there average monthly payments low.

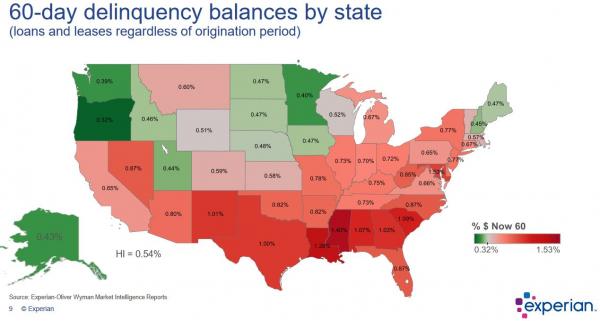

But, despite all the financial engineering, a look at 60-day auto delinquencies around the country may imply that the auto party is slowly coming to an end.

But sure, auto sales should be perfectly sustainable around 18mm per year…

Leave A Comment