Yes, once in a while Apple (AAPL – Analyst Report) falls into the cellar of the Zacks Rank. Of the over 4,000 stocks we collect and analyze earnings estimates for, it is inevitable that even a company with monster sales, profits, and cash can end up at the bottom of the pile.

I won’t regurgitate the changing projections for iPhone sales this year which you can read in a thousand other places. Instead, we just want to focus on why AAPL shares became a Zacks #5 Rank Strong Sell last week.

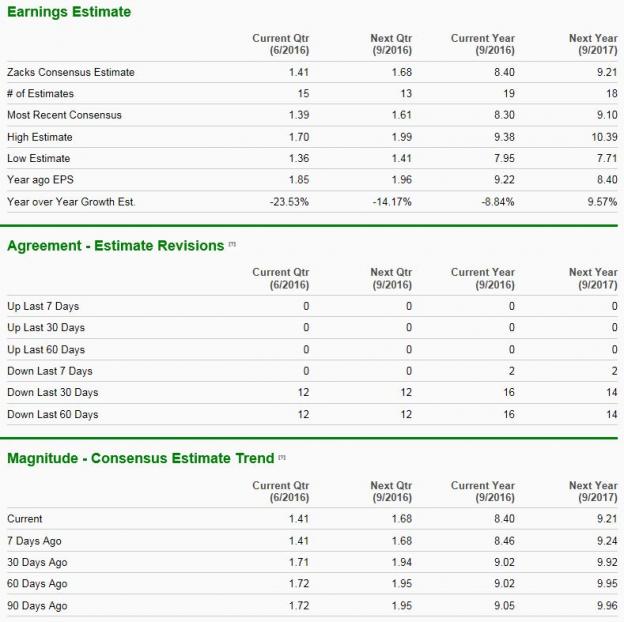

For this fiscal year ending in September, the consensus EPS projection fell from $9.02 to $8.40 as 14 analysts lowered estimates in the past few weeks. That represents -9% EPS growth vs. last year.

For next fiscal year, estimates were knocked down from $9.92 to $9.21, for +8.6% EPS growth relative to this year.

Here are the Zacks Detailed EPS Tables which show the agreement and magnitude of the downward revisions from analysts…

While many investors might believe that the company is experiencing “peak iPhone” demand, others think this is just a normal ebb and flow in product cycles.

The iPhone 7 will revive record-breaking sales and profits once again, say the bulls.

Where ever you stand, in the short run the stock is probably headed lower until analysts and investors get more visibility on the next cycle and potential global demand.

Leave A Comment