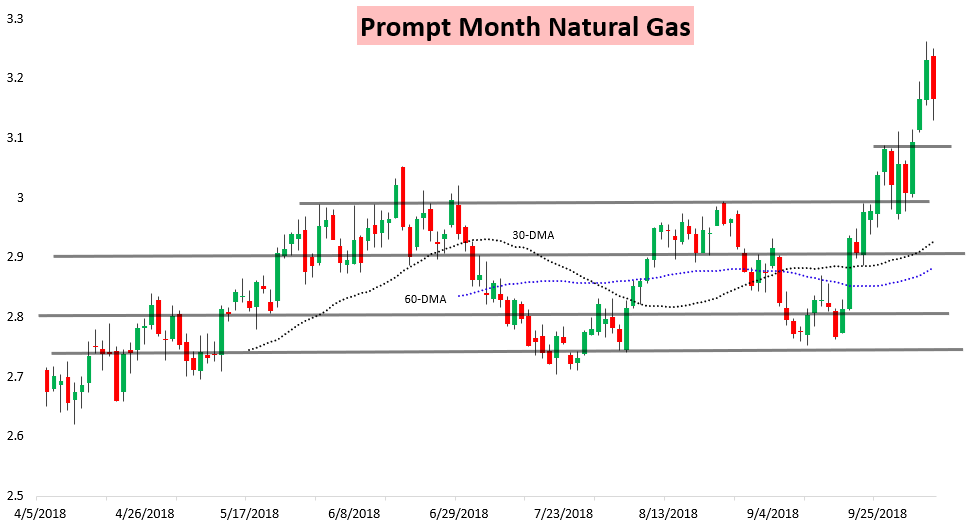

It was another volatile day for the November natural gas contract, as after a cash-led rally each of the first three days of the week we saw the combination of pipeline approvals and a larger storage build as announced by the EIA hit prices back 2% lower.

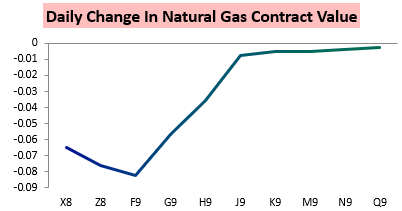

The January contract logged the largest loss on the day, with weakness along the front of the strip and later contracts far more stable.

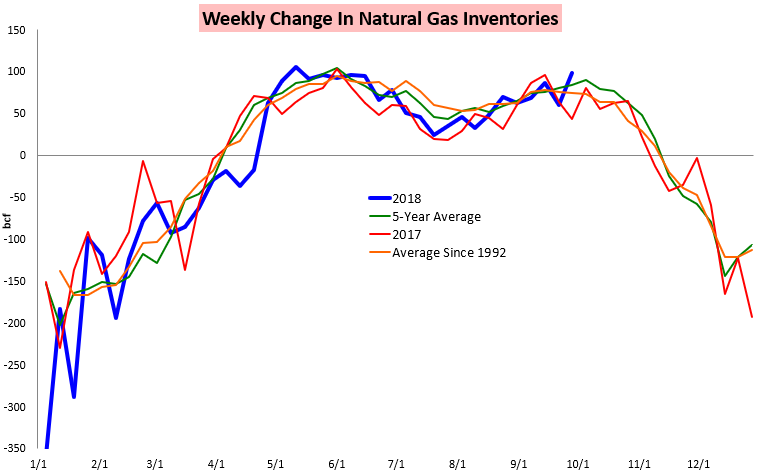

At 10:30 AM Eastern the EIA announced that 98 bcf of natural gas was injected into storage this past week, besting our estimate of 88 bcf by a solid 10 bcf.

The result was a very loose print on a weather-adjusted basis following a very tight weather-adjusted print this past week. As expected, prices sold off after the number was announced, and we outlined this was likely in our Morning Update where we said, “…if anything see risk for the print to miss higher, which would indicate a far looser market than last week and lower some of the storage concerns…”

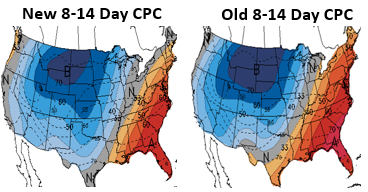

Prices plummeted all the way down to the $3.13 area after the print, though immediately after it we warned subscribers that “cash prices…keep us skeptical prices move down in a straight line” as we looked for “bounces above $3.2.” After the print prices got back up to $3.198, not quite there, but justifying our analysis that it would take more than a loose storage build to send prices lower, especially with some Week 2 cold risks lingering.

Meanwhile, we continue to track daily supply/demand dynamics as we attempt to forecast next week’s EIA print. We see very impressive natural gas power burns, thanks in part to widespread heat across the South as well as structural demand growth and nuclear outages that need to be replaced by gas.

Every day in our Note of the Day we break down the latest weather-adjusted demand and supply dynamics, as well as the Week 2-4 weather forecast and spread action along the natural gas curve. Today we looked at the potential impact of the Atlantic Sunrise pipeline approval and how that combined with our weather forecasts and balance reading would likely impact natural gas prices moving forward.

Leave A Comment