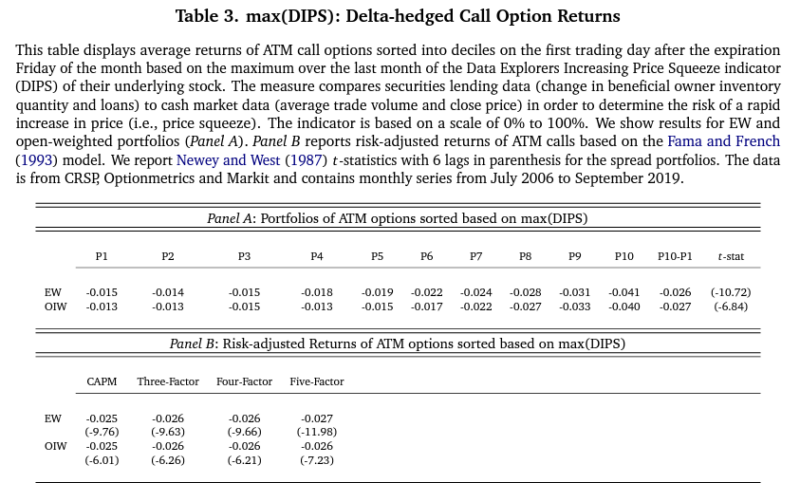

Academic research, including the studies “Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks,” “Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks” and “Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks,” has found that there are investors who have a “taste,” or preference, for lottery-like investments – those that exhibit positive (right tail) skewness and excess kurtosis. This leads them to irrationally (from a traditional finance perspective) invest in high-volatility stocks (which have lottery-like distributions), driving their prices higher, and resulting in poor returns. PixabayShort squeezes, with their resulting price surges, are of interest to investors with a preference for lottery-like distributions. A short squeeze occurs when many investors bet against a stock by selling it short (hoping to buy it back later at a lower price), and its price shoots up instead. Short selling is risky because losses are unlimited (unlike going long, where losses are limited to your investment). Thus, if a shorted stock unexpectedly rises in price, short sellers may have to act fast to limit their losses. They may be forced to act to meet margin calls. Because short sellers exit their positions with buy orders, their exit can push prices higher, which leads to more covering of short positions, creating a vicious circle. The rapid rise in price can attract buyers looking to “jump on the bandwagon” to exploit the short squeeze. The combination of new buyers and panicked short sellers can lead to stunning and unprecedented increases in valuation, to levels well above anything that could be justified by a stock’s fundamentals – such as occurred with GameStop. This opportunity, along with the excitement created on social media investment sites such as Robinhood and Reddit that short squeezes can generate, presents an attractive target to lottery skewness-seeking investors. The evidenceIlias Filippou, Pedro Garcia-Ares, and Fernando Zapatero contribute to the literature on the preference for lottery-like distributions with their November 2022 study, “Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks,” in which they examined if retail investors were attracted by stocks with a relatively high likelihood of a short squeeze occurring and the profitability of trading on that likelihood. They identified securities that could attract the attention of skewness-seeking investors because of a potential short squeeze using IHS Markit’s proprietary measure and the Data Explorers Increasing Price Squeeze indicator (DIPS). DIPS compares securities lending data (change in beneficial owner inventory quantity and loans) to cash market data (average trade volume and close price) to determine the likelihood of a rapid price increase: “[It] provides an objective measure that mitigates conceivable data mining concerns.”Their analysis focused on call options written on the stocks susceptible to a short squeeze rather than on the stocks themselves because Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks has shown that in the case of optionable stocks, skewness-seeking investors favor call options over the underlying stocks; the implicit leverage of options magnifies the effect of positive jumps. Their analysis used delta-hedged returns, as it has become customary in the options literature; delta-hedged returns isolate the option-specific part of the return from that due to changes in the stock price.Sorting stocks based on their Max(DIPS), their proxy for skewness, on the first trading day following the expiration of the options, they computed the average percentage of stocks in each bin that experienced one daily price increase of more than 15% during the following month (until the next month’s expiration day).Considering only options that expired in the next month and choosing options closest to at-the-money, their data sample covered stocks on the NYSE, AMEX, and Nasdaq over the period July 2006-September 2019. Following is a summary of their key findings:

PixabayShort squeezes, with their resulting price surges, are of interest to investors with a preference for lottery-like distributions. A short squeeze occurs when many investors bet against a stock by selling it short (hoping to buy it back later at a lower price), and its price shoots up instead. Short selling is risky because losses are unlimited (unlike going long, where losses are limited to your investment). Thus, if a shorted stock unexpectedly rises in price, short sellers may have to act fast to limit their losses. They may be forced to act to meet margin calls. Because short sellers exit their positions with buy orders, their exit can push prices higher, which leads to more covering of short positions, creating a vicious circle. The rapid rise in price can attract buyers looking to “jump on the bandwagon” to exploit the short squeeze. The combination of new buyers and panicked short sellers can lead to stunning and unprecedented increases in valuation, to levels well above anything that could be justified by a stock’s fundamentals – such as occurred with GameStop. This opportunity, along with the excitement created on social media investment sites such as Robinhood and Reddit that short squeezes can generate, presents an attractive target to lottery skewness-seeking investors. The evidenceIlias Filippou, Pedro Garcia-Ares, and Fernando Zapatero contribute to the literature on the preference for lottery-like distributions with their November 2022 study, “Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks,” in which they examined if retail investors were attracted by stocks with a relatively high likelihood of a short squeeze occurring and the profitability of trading on that likelihood. They identified securities that could attract the attention of skewness-seeking investors because of a potential short squeeze using IHS Markit’s proprietary measure and the Data Explorers Increasing Price Squeeze indicator (DIPS). DIPS compares securities lending data (change in beneficial owner inventory quantity and loans) to cash market data (average trade volume and close price) to determine the likelihood of a rapid price increase: “[It] provides an objective measure that mitigates conceivable data mining concerns.”Their analysis focused on call options written on the stocks susceptible to a short squeeze rather than on the stocks themselves because Do Investors Overpay for Stocks with Lottery-like Payoffs? An Examination of the Returns on OTC Stocks has shown that in the case of optionable stocks, skewness-seeking investors favor call options over the underlying stocks; the implicit leverage of options magnifies the effect of positive jumps. Their analysis used delta-hedged returns, as it has become customary in the options literature; delta-hedged returns isolate the option-specific part of the return from that due to changes in the stock price.Sorting stocks based on their Max(DIPS), their proxy for skewness, on the first trading day following the expiration of the options, they computed the average percentage of stocks in each bin that experienced one daily price increase of more than 15% during the following month (until the next month’s expiration day).Considering only options that expired in the next month and choosing options closest to at-the-money, their data sample covered stocks on the NYSE, AMEX, and Nasdaq over the period July 2006-September 2019. Following is a summary of their key findings:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged and do not reflect management or trading fees, and one cannot invest directly in an index.

Investor takeawaysShort squeezes are often associated with a large positive jump in the price of a stock. Filippou, Garcia-Ares, and Zapatero demonstrated that skewness-seeking investors try to identify securities that could experience a short squeeze in the near future and are willing to pay a premium for them. That results in an overvaluation of the options and, on average, negative returns. Investors are best served to avoid investments with lottery-like distributions. One way to do that is to turn a blind eye to social media sites like Robinhood and Reddit so you don’t get caught up in the hype and excitement. That’s another example of why retail investors are called “dumb money.” Forewarned is forearmed.Fund families whose investment strategies are based on academic research, such as Alpha Architect, AQR, Bridgeway, and Dimensional Fund Advisors, have long excluded from their eligible universe stocks with lottery characteristics because the historical evidence has demonstrated that limits to arbitrage allow securities with these characteristics to become overvalued.More By This Author:Lottery Preference And Biotech Stocks: Trust The Financials, Not The Science Financial Literacy In The US…Doesn’t Look Great!Outperforming Cap- (Value-) Weighted and Equal-Weighted Portfolios

Leave A Comment